Why have markets rallied while US crop estimates grow? Grain Market Daily

Friday, 14 August 2020

Market commentary

- UK wheat futures (Nov-20) closed yesterday at £162.95/t, up £1.25/t on Wednesday’s close.

- Chicago maize futures (Dec-20) closed yesterday at $133.36/t, gaining $4.53/t in one trading session. A mixture of short coverings from anticipated large maize crop announced by the USDA and the recent derecho storm across the Mid-West has caused this rally, continue reading to find out more.

- On Wednesday, the UK official entered a recession, with two successive quarterly declines in GDP. Currency hasn’t fluctuated too much to this news as the global economy takes a slump. Since Friday sterling has strengthened (+0.09%) against the dollar to close yesterday at £1 = 1.3063. However, since Friday as weakened (-0.13%) against the Euro to close yesterday at £1 = €1.1059.

- The second AHDB harvest report details harvest data up to the week ending 11 Aug. In the fortnight since the first report, harvest progress has been rapid.

- Wheat – 43% complete. GB national yield estimated at 7.3 – 7.8t/ha.

- Winter barley – 98% complete. GB national yield estimated at 6.3 – 6.6t/ha.

- Spring Barley – 12% complete.

- Oats – 14% complete.

- Winter oilseed rape – 89% complete. GB national yield estimated at 2.6 – 3.0t/ha.

Why have markets rallied while US crop estimates grow?

A large derecho storm swept across the Midwest of the US on Monday, there are reports that this has adversely affected over 4Mha of arable land in Iowa, as the powerful inland hurricane tore across several states, reporting to have flattened a significant proportion of the much anticipated maize crop.

On Wednesday the release of the latest WASDE and crop production report posed significant optimism for both the US’ maize and soyabean crop, which hadn’t taken into account the possible adverse effects of this storm.

Chicago maize has been significantly supported this week closing on Thursday at $133.36/t, up $7.09/t on last Friday’s close.

This support could be from a mixture of information, such as support for maize as there could be driven by perceived yield/crop damage, and also increased short covering in the Chicago futures market.

Why does this matter to the domestic grower?

Although we do not know the extent of the storm damage, large production of maize and soyabeans in the US will put a medium-term bearish sentiment on the global market which in-turn will affect your domestic prices. Events such as the recent storm offer short-term support.

Bumper crops for the US

During July, the US experience widespread warmth, this bolstered crop development, which has led to large a production outlook.

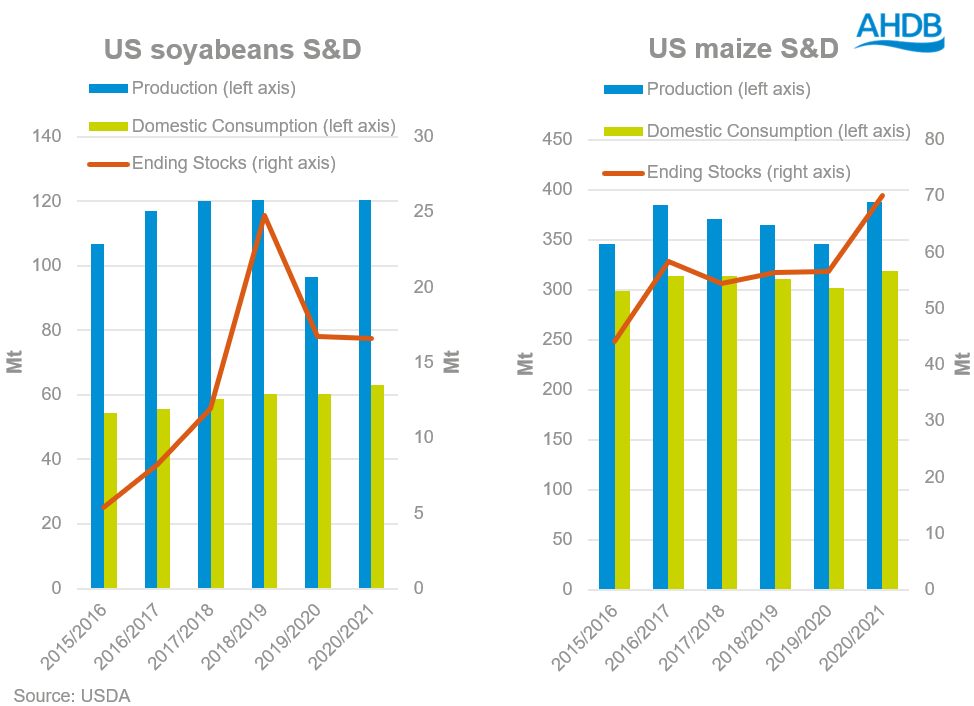

US maize crop is now predicted at 388Mt. Despite a reduction to planting intentions of maize (37Mha, down from 39Mha in the March prospective plantings report), most drought conditions remained consolidated across the western half of the US. Maize yield is forecast at 11.41 t/ha, this is the largest on record.

The soyabean crop now stands at 120.4Mt, up from 112.5Mt in July’s report, and up 25% on 2019. Ideal growing conditions predict yields at a record 3.58 t/ha, up from 3.19t/ha last year.

If conditions remain ideal and yields come into fruition this could be the second largest US soyabean crop on record.

Conclusion

In the short term, storm damage and the perceived impact on crops could offer support for prices. The degree to which this impacts US production will have a bearing on longer term price trends. However, at present expectations of large US crops will bear weight on global markets.

As discussed by the team, click here to see how maize is more than important than ever in 2020/21 and how it could dominate our cash prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.