Wildfires in Australia – a beef and lamb perspective

Wednesday, 8 January 2020

Australia is currently facing extensive and severe wildfires. While most sheep are further inland than many of the fires, there are still significant numbers in the areas affected. Early estimates suggest that over a quarter of sheep in Australia are kept in areas that have either been significantly or partially impacted. Similarly, around a fifth of the national cattle population is in areas that have had some fires. These areas with significant fires could account for over 10 million cattle and sheep, although that is not to say at all, that this many animals have been lost. It will take some time, and potentially months, for the full impact to become clear.

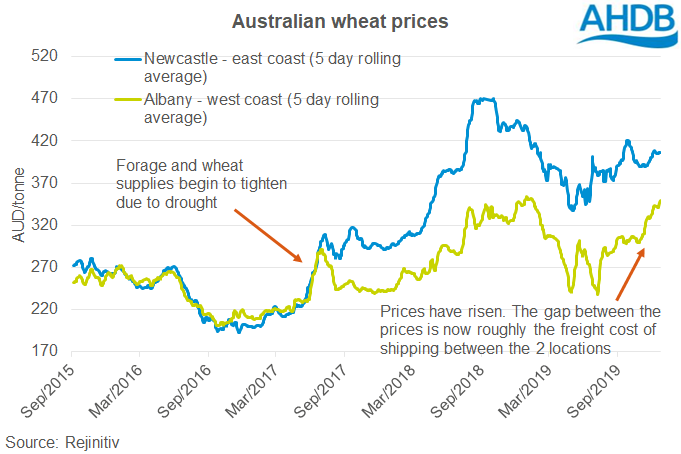

Many of the fires are in key wheat producing areas, and with forage also lost during the fires farmers may have limited feed alternatives. Helpfully, much the south east coast harvest was completed early this season. Australia is already importing wheat, and there is some option to ship wheat from the west coast round to the east coast and into Newcastle port. Transportation from Newcastle to the livestock is potentially a larger logistical issue – as many roads and freight routes are affected.

From a meat export point of view, abattoirs still appear to be largely operational, bar some transport issues, and all the major ports have also remained operational. Although the ability to process animals is still there, there will be some impact on production volumes, how much of course remains to be seen.

Could it affect the UK sheep market?

Any drop in production would further affect an already tight global sheep meat market. We are now on the cusp of the time when European production is at its lowest, and demand is at its seasonal peak. Protein demand in China continues to be elevated with wholesale meat prices already at high levels.

Australia has limited direct access to the EU, however, if Australia has less product available to ship to China → then China is likely to look to increase its purchases from New Zealand → and New Zealand does ship significant volumes into the EU, especially leg cuts for Easter.

It is at the end of this chain where the UK would feel any pinch in supply.

Due to the nature of how the EU beef market functions, any impact is likely to be much more limited and cushioned by global beef production which is growing.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.