Why should I contribute to the AHDB Planting & Variety Survey? Grain market daily

Tuesday, 13 June 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £200.50/t, gaining £5.00/t on Friday’s close. Nov-24 futures closed at £203.50/t, gaining £3.50/t over the same period.

- Our domestic market followed both the Paris and Chicago market up yesterday. Wheat markets rose yesterday from spillover strength in maize markets with some scattered dryness concerns for US maize. Also, rising tensions in the Black Sea region added to market strength, with UN Secretary-General Antonio Guterres voicing concerns that Russia will quit the Black Sea Grain Initiative, which is currently set to expire on 17 July (Refinitiv).

- Paris rapeseed futures (Nov-23) closed €444.75/t yesterday, gaining €6.25/t on Friday’s close. The market gained yesterday with some dryness concerns in parts of the Canadian Prairies. There was also strength for new-crop Chicago soyabean futures on worries about dry weather in the US Midwest.

Why should I contribute to the AHDB Planting & Variety Survey?

We are coming to the end of the data collection for the AHDB Planting & Variety Survey (PVS), which is set to close this coming Friday 16 June.

There is still time to contribute to the survey, the form is located here.

This survey provides an estimate of the area and variety breakdown of cereals and oilseed rape to be harvested in the UK. This year’s survey will provide results for what we can expect from the 2023 harvest, ahead of harvest starting. It is the only pre-harvest set of results published formally, with national coverage.

So, you might be thinking: why should I submit my planting and variety data to this survey, how is this information useful to me?

Quantifying the UK crop

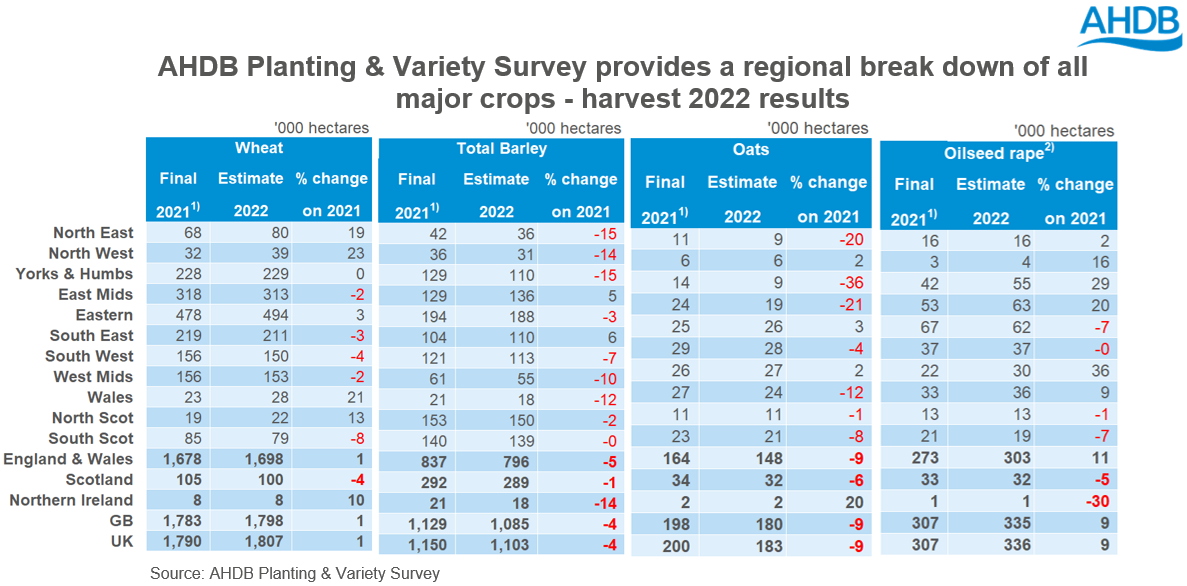

The PVS survey provides both a national and regional breakdown of all major crops sown in the UK.

From this information, we can use the latest crop development report to give an indicative production estimate of all major crops.

The survey can also provide insight into the regional breakdown of major crops, to distinguish any regional deficits. This could influence the delivered premium in that location. It can also be a tool for decision making for marketing campaigns for the new season.

Furthermore, the latest AHDB UK supply and demand estimates show that the beginning stocks of wheat are looking historically high for the 2023/24 marketing year. With a large wheat crop expected this coming harvest, weather dependant, UK domestic total availability looks to increase next season. The information from the PVS could influence our domestic grain prices to the continent. For example, will UK wheat be competitive on the export market if we are in surplus? Or will we export a significant amount of barley to the EU? The PVS results can help formulate the production outlooks which will influence our trading relationship to the continent, feeding into ex-farm prices.

Variety breakdown

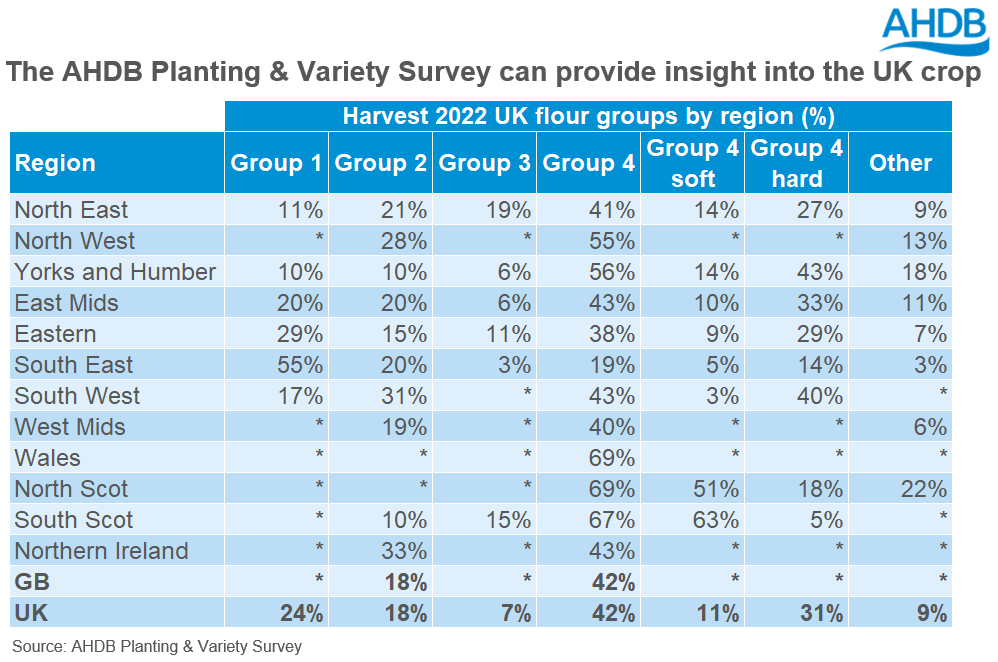

The survey provides insight into the varietal breakdown of all major crops, including (where publishable) the regional breakdown by UK flour group.

This provides insight into the make up of the domestic crop, i.e., how much milling wheat is being grown? Again, this is information that can feed into influencing delivered premium prices of bread wheat going forward.

Help us to help you make informed decisions

There is further information on the PVS webpage with a historical dataset.

Five minutes of your time on this survey is invaluable, and the information the AHDB produces can help inform you on market insight, which can aid the marketing decisions of your arable crops.

Data accuracy and transparency are key to functioning markets. As such, accuracy in data collection is vital. Therefore it is critical that the AHDB produces accurate, unbiased data which the industry can trust.

A full set of results will be published at the beginning of July here. There will also be further analysis on the Cereals & Oilseeds webpage.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.