Where is the ceiling for new crop wheat prices? Grain market daily

Wednesday, 3 March 2021

Market commentary

- UK feed wheat values (Nov-21) continued to move up yesterday, closing at £171.95/t. Old crop, May-21 feed wheat futures, gained £0.55/t, to close at £207.45/t.

- New crop UK feed wheat futures are now at just a £1.98/t discount to new crop (Dec-21) Paris milling wheat futures, a further signal of the UK moving towards import parity for new crop pricing. Helen discussed the historic trends in this relationship last week.

- Global grain markets moved higher yesterday, alongside delays to Safrinha maize crops in Brazil, markets are still awaiting confirmation of damage to wheat crops following the cold weather in North America.

Where is the ceiling for new crop wheat prices?

As we look to 2021/22, we are set for a year of tight supply and demand in the UK. As we flagged with the release of the Balance Sheet, we are still set for a small deficit once 2020/21 exports are taken into account.

The area planted to wheat in the UK is shown in the Early Bird Survey at 1.78Mha, close to average. Applying an average yield (exc. 2020), 8.4t/ha, to this area would peg output at 14.9Mt. If we use a five-year trim average (exc. 2020 and 2019) of 8.0t/ha, output would reach 14.2Mt.

With the introduction of E10, we will likely be in a position where we need to import next season to balance the market. This means that the value of imports will play a large part in setting UK grain prices, as it has done this season.

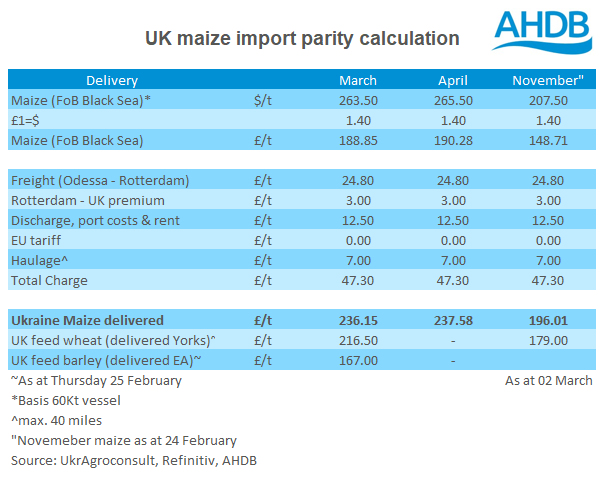

UK feed wheat delivered into North Humberside (Nov-21), was quoted on Friday at £179.00/t. We can look at global FoB values, applying freight, port charges and haulage to give an idea of the ceiling for domestic prices.

As ever, Black Sea grain is likely to be key. In a recent report by Refinitiv, Ukrainian maize was quoted at $206.00/t - $209.00/t for Oct/Nov shipment. Applying the charges mentioned above, gives a price of £196.01/t for Ukrainian maize delivered into North Humberside. As things currently stand, this is the ceiling for domestic grain values as we move to import parity on new crop.

Even if the ethanol plants use UK wheat, the tightness in the market would mean that feed compounders would likely look to cheaper origin imports to satisfy their demand. With this in mind we need to watch the progress of maize planting in Brazil, the US and Black Sea closely.

New crop maize drivers

Brazilian maize planting (Safrinha crop) was 31.6% complete as at 26 February, 31.2 percentage points behind the same time last year. Meanwhile the US is set to plant 37.2Mha of maize, the highest since 2016. Planting of the US crop will begin in April.

Ukrainian maize planting is also set to start in April. Margin data from UkrAgroConsult suggests the attractiveness of corn has declined in favour of soyabeans. Black Sea weather will remain a key watch point, particularly given the current cold conditions in Ukraine.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.