New crop wheat pricing to limit exports: Grain market daily

Friday, 26 February 2021

Market commentary

- May-21 UK feed wheat futures closed at £206.50/t yesterday, down £0.25/t from Wednesday’s close. However, Nov-21 futures rose £1.00/t to £171.10/t and the Nov-22 contract gained £1.25/t to £160.10/t.

- Some profit-taking was reported in the Chicago wheat and maize futures, which pushed prices down. The trigger was relatively low new export sales by the US for wheat, maize and soyabeans in the week ending 25 February.

- French winter wheat and barley crop conditions have slipped over winter but remain much better than last year (FranceAgriMer). As at 22 February, 87% of winter wheat was rated ‘good’ or ‘very good’. This is down from 96% at the end of November but well above the 64% at this time last year. This shows French production remains on track to rebound this year.

- The International Grains Council (IGC) raised its estimates of global wheat production for this season (2020/21) yesterday. There were increase from Australia, Kazakhstan and Russia. But, the IGC kept its forecast for end of season stocks unchanged, partly due to higher demand.

New crop wheat pricing to limit exports

New crop UK feed wheat futures are now pricing to limit exports in the 2021/22 season. This is because UK supply and demand could be tight again next season unless we get bumper yields.

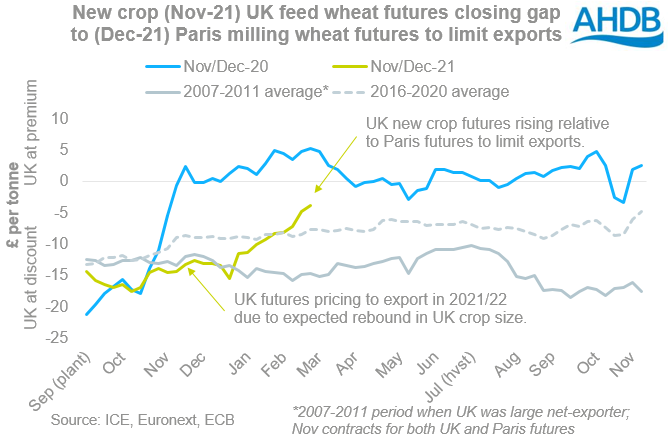

At present, UK feed wheat (Nov-21) is currently pricing at a much narrower discount to Paris milling wheat (Dec-21) than normal. Before 2012, when the UK routinely exported larger volumes of wheat, a discount of around £15/t was ‘normal’. This is because the UK futures are based on a feed wheat specification, but Paris futures are based on a milling wheat specification.

Last autumn, the Nov-21 contract was pricing around £12-18/t below new crop (Dec-21) Paris futures. This reflected expectations of a rebound in wheat planting in the UK, plus uncertainty about the UK’s ability to export to the EU after 1 January 2021.

Since January, the discount has narrowed. Yesterday, Nov-21 UK feed wheat futures closed at £171.10/t, approximately £3.55/t below the Dec-21 Paris milling wheat futures contract (Refinitiv). Several reasons are behind this:

- Carry-over stocks from this season are likely to be very thin, increasing reliance on the 2021 crop.

- Meanwhile, ethanol demand seems set to return in 2021/22. If animal feed demand also rebounds, UK wheat demand will be higher next season.

- There’s still uncertainty about the 2021 crop size. AHDB’s Early Bird Survey showed that the area may rise by 28% from 2020 to 1.78Mha for harvest 2021. This is in line with the 2016-2020 average. The area includes spring planting. But, the range in yields is 7.0t/ha (2020) to 8.9t/ha (2019) over the past five years. So, even if this area is realised, we can’t be certain what the crop size will be.

Unless we get a high yield, it seems more likely that supply and demand will again be tight next season, as Megan discussed yesterday. As a result, new crop prices have risen relative to those in the rest of Europe to limit new season exports for now.

Nov-21 UK feed wheat futures will likely remain at a narrow discount (or small premium) to new crop Paris futures until we know about the UK crop. Our next report on UK crop conditions will be released in early April.

If the UK has a bumper crop next season, the UK discount may need to widen again to incentivise exports. But, if UK yields are average or lower, UK prices will likely need to rise to a premium to Paris futures to attract imports. This is the case regardless of if the global market rises or falls.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.