Balance sheet shows small surplus before exports: Grain market daily

Wednesday, 24 February 2021

Market commentary

- UK feed wheat futures (May-21) fell back £1.00/t, closing at £205.00/t. The May contract still remains in a long-term upward channel. New crop (Nov-21) futures fell by just £0.10/t, ending yesterday at £169.65/t.

- UK markets moved against the grain of global wheat markets, with sterling continuing to make gains against both the euro and the dollar. Sterling closed at £1=€1.1616 and £=$1.4113, yesterday. Sterling is now at the highest point against the dollar since April 2018.

- Rapeseed values were supported yesterday. The May-21 Paris rapeseed contract closed at €472.00/t, a jump of €11.00/t. Support came from a mix of soyabeans (up 1.5%) and vegetable oils.

Balance sheet shows small surplus before exports

The latest AHDB UK Cereal Supply and Demand Estimates have been published today. The estimates are based on data through to December and industry discussions. The balance sheet shows the deficit from November removed, with a surplus of 73Kt before exports are taken into account.

Through to December the UK had exported 116.7Kt of wheat; adding this figure into the balance sheet leaves a 43.7Kt deficit.

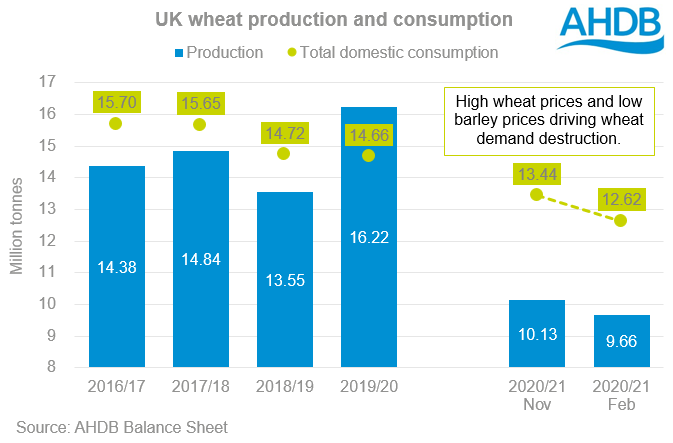

The reduced deficit is driven by a large reduction in the volume of wheat being consumed, which more than offsets the cut to production.

Production is cut by 475Kt, to 9.66Mt in line with the latest Defra data, published in December. Imports are also seen reduced, taking total availability to 14.20Mt, down 26% on last year. The tight picture for UK wheat this season has driven ex-farm feed wheat prices to a maximum premium over feed barley of £53.50/t, in the week ending 7 January*.

As a result of the increased premium of wheat over other feed grains, we have seen a large reduction in the consumption of wheat. Consumption of wheat in animal feed, including integrated poultry units, is seen 711Kt lower, at just 5.92Mt. The total reduction in demand is 814Kt, leaving wheat consumption in 2020/21 at just 12.62Mt.

Where has the deficit gone?

While the deficit still exists, owing to the volume of exports already carried out, it is significantly reduced. Furthermore, with exports not included in the balance sheet until the third release is published, the balance sheet now shows a surplus.

The reduction in the deficit is a sign of market forces acting to clear the deficit in wheat. The discount of other feed grains to wheat appears to have destroyed demand. While wheat consumption is down, total consumption of wheat, barley, maize and oats is just 73Kt less than in the November balance sheet, showing the shift from wheat into other grains.

Further to this, the loss of some uncertainty in the market has also cleared some of the fog around domestic supply and demand. When the November balance sheet was produced, we were contending with a looming EU Exit deadline.

Old crop feed wheat is now trading below market parity, which further highlights the reduced need to import this season, as a result of rational market forces working to balance the market.

Barley

The fall in consumption of wheat is partly offset by a sharp increase in barley usage. The large discount of barley to wheat has seen usage of barley in animal feed increase 423Kt on November’s forecast.

Usage by brewers, maltsters and distillers is seen fractionally up on the previous forecast. The increase in usage combined with a fall in production (Defra), leaves the balance of supply and demand 674Kt lower than in November’s balance sheet.

Balance sheet questions

Over the course of the season, the accuracy of the balance sheet and what it represents have been questioned. This is not just an external question, and AHDB continues to question the accuracy of the stocks and production figures.

The end-June stocks figure, which had an exceedingly large standard error, and the disputed production figure from 2019/20 led to a large residual last year. This residual, combined with low output this season, has led to the situation we find ourselves in now.

What are AHDB going to do about it?

AHDB is currently working with Defra to review the data that goes into the balance sheet. This includes supporting Defra with the 2021 Census and on-farm stocks surveys. In addition, AHDB are also involved in discussions with Defra and HMR&C surrounding the provision of more timely trade data.

AHDB remains committed to helping Defra with the provision of accurate and timely data. Alongside the work mentioned above, AHDB and Defra are currently exploring alternative methods of measuring cropping area.

More information on the ongoing work between AHDB and Defra is available here.

*Excluding week ending 31 December, due to low volume.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.