Wheat premium over maize incentivising imports: Grain Market Daily

Friday, 28 February 2020

Market Commentary

- Sterling has dropped 2% against the euro from Tuesday, to close yesterday at £1=€1.1713. This drop follows the UK setting out its stance for negotiating a trade deal with the EU.

- The latest International Grains Council (IGC) report estimates record high global wheat production of 769Mt, on the back of a significant rise in Indian production. A rise in in Indian production would reduce the global import demand level.

- The strengthening euro has pressured rapeseed prices down, closing yesterday at €387.25/t, down €4.75/t from the previous close.

- The UK balance sheet was released yesterday, highlighting the increased likelihood of a large carry of old crop wheat into the 2020/21 season.

Wheat premium over maize incentivising imports

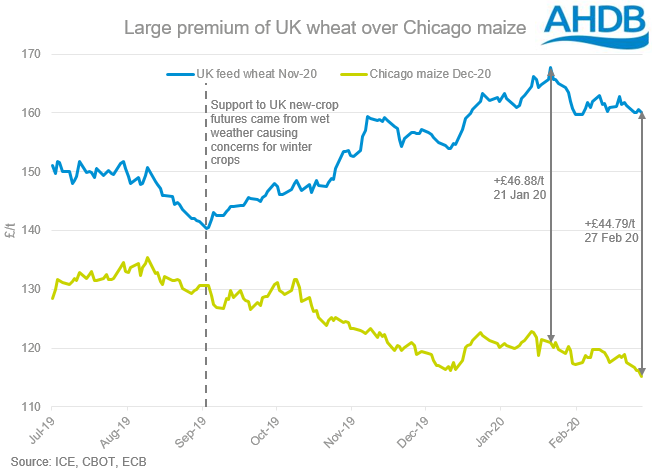

New-crop UK feed wheat (Nov-20) remains at a large premium to Chicago maize (Dec-20), reaching £44.79/t on 27 February which could incentivise consumption of imported maize over domestic grains.

Weak sterling does make imports more expensive but at such a significant spread this is unlikely to affect the sentiment at this stage.

UK new-crop (Nov-20) feed wheat futures have gained 14% since September, on the back of unprecedented and relentless wet weather hampering autumn/winter drilling. The rerun of the Early Bird Survey (EBS) pegs harvest 2020 wheat area intentions at 1.5Mha, down 17% from last year. These figures may have been further cut since then, following Storm Dennis.

The rising UK feed wheat contract (Nov-20) has been met by a falling global maize market, widening the premium and moving the wheat price floor lower.

From experience, in this situation imports of maize spike. This was prevalent in 2013/14 and repeated again last year (2018/19).

Last season saw maize imports of 1.3Mt, up 40% from the previous season. The 2013/14 marketing year saw a spike in maize imports of 45% year-on-year. The 2013/14 season followed a very wet autumn causing downgrades to winter cropping. Wheat production that year (2013 harvest) was just 11.8Mt which sits above our mid-range estimate of 10.74Mt, based on the current EBS estimates (see Alex’ GMD last week).

We saw a drop in wheat usage in animal feed (including integrated poultry units) in 2013/14 and a rise of 67% in maize. With the prospects of tight supply in 2020/21 we could also expect to see this shift. There is also some optimism around European maize supply with the struggles surrounding wheat planting, particularly in France leading to increased maize forecasts. Alongside a relatively large European crop outlook there is also a large Brazilian crop from the current harvest.

Despite the rise in new-crop UK feed wheat futures since September the support could be somewhat eroded by a number of factors:

- A larger global wheat crop.

- The potential for a large carry-out of old crop domestic cereals, highlighted in yesterday’s release of the UK balance sheet.

- Increased maize imports.

- The expectation of a large barley crop for 2020 harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.