Wheat exports up but barley exports down in 2021/22: Grain market daily

Wednesday, 17 August 2022

Market commentary

- Global grain and oilseed markets are experiencing downwards pressure as ships continue to leave Ukrainian ports, and from improved weather conditions in the US.

- UK feed wheat futures (Nov-22) closed at £264.00/t yesterday, down £3.50/t from Monday’s close. The May-23 contract closed at £269.05/t down the same amount over the session.

- According to reports this morning, four more ships carrying sunflower oil, sunflower meal and maize have left Ukrainian ports (Refinitiv).

- Dec-22 Chicago maize futures drop $7.08/t yesterday, closing at $240.26/t.

- Chicago soybeans (Nov-22) also saw a loss, closing at $507.38/t, down $11.48/t from Monday’s session.

- Following suit, Nov-22 Paris rapeseed lost €7.75/t from Monday’s close, to settle at €624.50/t yesterday.

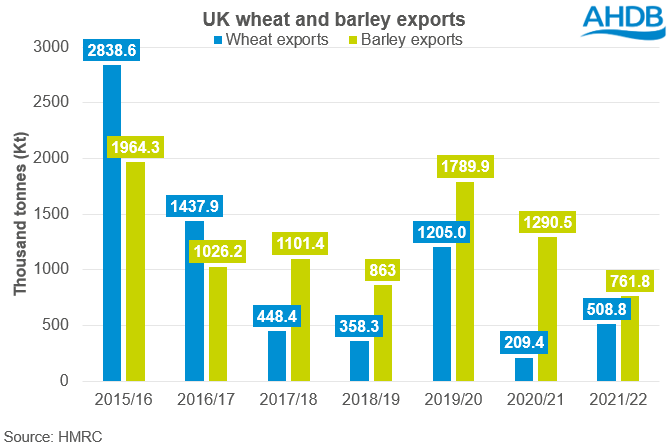

Wheat exports up but barley exports down in 2021/22

On Friday, the latest HMRC UK trade data was published, giving us a clear outlook on last season’s grain imports and exports. With tight global grain supply and demand, how does the domestic market compare?

Wheat

The UK exported 508.78Kt of wheat (including durum) in 2021/22, with the majority going to Ireland, Spain, and the Netherlands. This is 21Kt less than what was forecast for the season in the last balance sheet update. Full season exports are 30% less than the five-year average, but more than double 2020/21 volumes (209.40Kt). The increase on the previous season is due to UK wheat production being 45% higher on the year in 2021. While production last season was above the five-year average, concerns over tight supply capped exports for much of the season. However, with high wheat prices globally, with the war in the black sea, UK wheat priced competitively into the European market in the spring. 103.64Kt of wheat was shipped from the UK in May alone.

In 2021/22 the UK imported 1.992Mt of wheat, exceeding the May balance sheet forecast for the season by over 240Kt. With full season usage broadly in line with what was estimated in May, and exports coming in slightly lower than forecast, 2021/22 end-season stocks will likely be higher than originally forecast. This means opening stocks for 2022/23 will also be higher.

Turning our attention to this season, and with an ample domestic wheat crop expected this harvest, as well as generous carry-in stocks, and a downturn in animal feed demand as discussed in the recent cereals market outlook, it is likely the UK will have a larger exportable surplus in 2022/23. In terms of imports, the UK may look to import more higher protein wheat this season, if the domestic crop does not meet specifications. Early indications suggest that UK wheat proteins are coming in lower this season. However, this is based off the earliest harvested crops, with more information needed to build a full UK picture.

Barley

Barley exports were down 41% on the previous season and 37% lower than the five-year average in 2021/22 at 761.82Kt. Domestic demand returning to near pre-pandemic levels last season, combined with a 14% year-on-year drop in production led to a tighter barley balance sheet and therefore less exports.

As mentioned in a recent analyst insight, domestic demand is expected to stay strong in 2022/23 and with the UK barley crop this year also expected to be smaller than average, it’s likely exports will remain at this level going into this new season.

Oats

A record high UK oat crop of 1.12Mt in 2021, combined with robust global demand, made way for strong exports last season. At 123.05Kt, UK oat exports were just under three times the amount they were the previous season and 149% higher than the five-year average. This is only slightly under the 125Kt estimated in the May supply and demand estimates, and is the highest volume exported in 19 years.

This season the domestic oat crop is expected to be smaller than last year, but still relatively large. Increased domestic demand is anticipated this season, with the ‘Oatly’ plant expected to open in Peterborough in 2023. Usage of oats in animal feed is also expected to remain relatively strong due to its relative price to other cereals, although not as high as last season’s levels. Therefore, exports this season will likely be back to more ‘normal’ levels.

Maize

UK maize imports last season were down 23% from 2020/21 at 2.201Mt, and down 9% from the five-year average. Imports were just marginally above the 2.184Mt estimated in May’s supply and demand estimates. High global prices last season, due to the ongoing volatility in grain markets, meant that maize imports were down on the year, as cheaper alternatives were sought after. This trend can be expected to continue into the new season as maize prices remain high on the back of weather concerns in the US and EU.

The 2021/22 final balance sheet is due to be published in September, and will take into account full season trade, usage and stocks data.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.