What will happen with dairy markets in 2019?

Wednesday, 9 January 2019

By Chris Gooderham

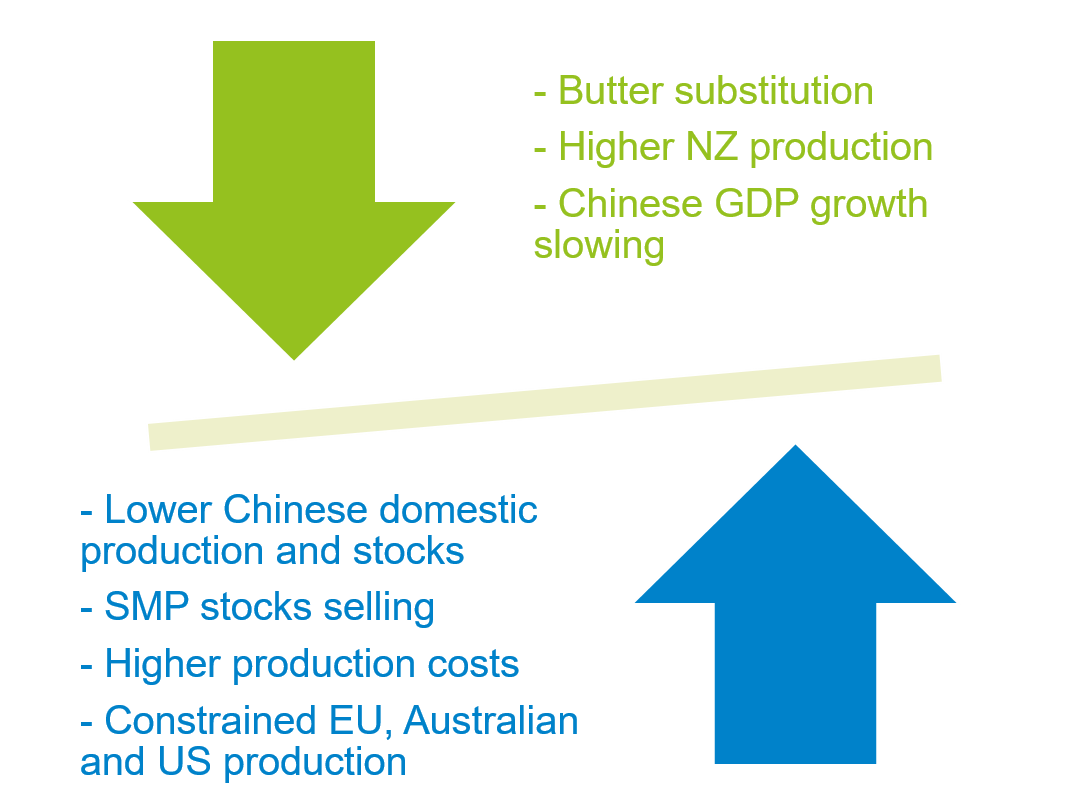

There are a number of conflicting dynamics playing out in the dairy markets at the moment. The key to which direction the markets move will be decided by the relative strength of each force. Let’s take a look at them:

Globally

- EU and Australian milk production have both been impacted by the weather and depleted feed stocks, while tight margins have slowed the growth in US production. Although New Zealand is showing strong growth, overall milk production from the key exporting regions is likely to rise only modestly through 2019.

- Demand for SMP is more in line with supplies as the EU intervention stocks reduce. The Commission expect all the intervention product will have been sold by the end of 2019. Under this scenario, we’d expect SMP prices to continue to recover from the lows they’ve been at over recent years.

- Butter demand has been dampened by food manufacturers re-engineering their products to remove butter. The high prices of late 2017 and early 2018 coupled with the extreme volatility in the markets proved too much for many butter buyers, and they have looked to de-risk their businesses against future issues. Consumers continue to have a preference for butter, but the high prices have dampened their enthusiasm. All of this has slowed the growth in dairy fat demand.

- The rise in SMP prices is likely to take some pressure off butter prices. In order for the combined value of butter-powder to provide a competitive return relative to other dairy products, butter prices won’t need to be as high as they’ve been over the last couple of years.

- We would expect those two dynamics to keep butter prices below the extreme highs we saw in 2017, but still at historically high levels.

- Chinese imports of dairy products have historically been closely aligned to their GDP growth, and imports in 2018 are in line with that relationship. While GDP growth has slowed, lack of domestic production and low stocks mean import demand from China is expected to continue to grow in 2019.

- With global dairy demand expected to continue rising by 1.7% - 2.1% per annum, the more modest growth in milk supplies means global commodity prices would be expected to rise. However, the reaction from food manufacturers and consumers to the high butter prices may well limit the amount fat prices can increase.

Domestically

- Production costs have been rising and further increases are expected off the back of the summer weather, and as a result of Brexit uncertainty.

- The increase in costs is expected to stall GB milk production somewhat in early 2019, with the Milk to Feed Price Ratio dropping below the long-term average.

- Cheddar stocks are a mixed bag. UK-made cheddar stocks are low, but Irish-made cheddar stocks in the UK are high. However, the Irish cheddar is likely to be maturing in UK stores rather than maturing in Irish stores, so the volume of Irish cheese ready for sale is probably no different to if this was being stored in Ireland. It is just been imported early to avoid any post-Brexit risks. The impact on cheddar prices is therefore likely to be minimal.

- Brexit continues to dominate people’s minds. While we don’t know the final outcome, the expectation is for further exchange rate volatility and companies throughout the supply chain doing their best to mitigate the Brexit risks through domestic sourcing and building stocks.

As last year, the recent drop in dairy product values is expected to put downward pressure on farmgate prices in the early part of 2019. However, if milk production growth slows, we would expect the markets to start to recover. The forward curves for dairy commodity prices are already showing this trend, with settled prices for SMP and butter contracts maturing in the April/May period, gradually rising throughout December.

Any recovery in market prices would be expected to flow through into farmgate prices 3 months later. Market dynamics can change quickly however, and the exit from the EU could make markets more unpredictable than usual. As always, the best advice is to operate the production system that is right for you, and ensure your costs are as competitive as you can make them to provide the resilience needed to deal with the changing conditions

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.