What’s behind the strength in cow prices?

Thursday, 30 July 2020

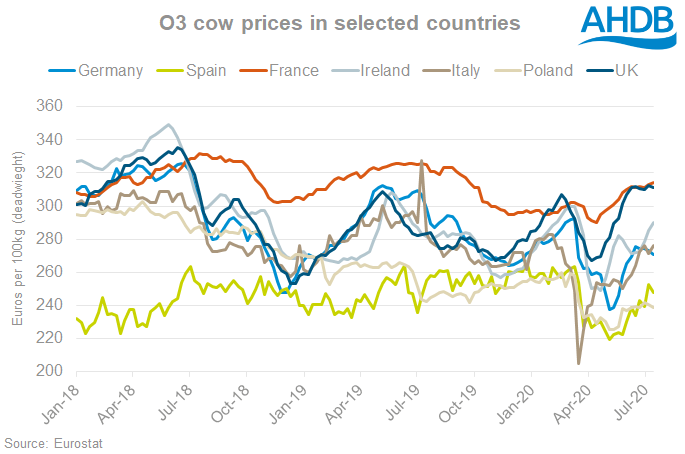

Cow prices have been rallying across Europe in recent weeks. However, unlike the UK, most major countries are still pricing cows below year-earlier levels.

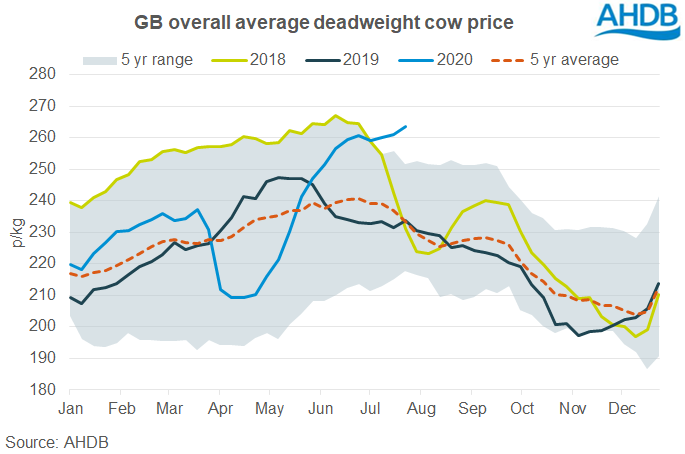

Despite initial problems caused by the closure of the foodservice market, an important channel for manufacturing beef, cow prices here have recovered well and remain buoyant.

Burger sales are expected to increase over the coming months as fast food outlets reopen, which may be fuelling processor demand as factories get ahead of orders. Although recently steak sales at retail have been strong, mince has continued to be popular in supermarkets, long after shoppers stocked their freezers immediately following lockdown. Together these factors point to strong demand for manufacturing beef, at a time when the cow price typically starts to weaken.

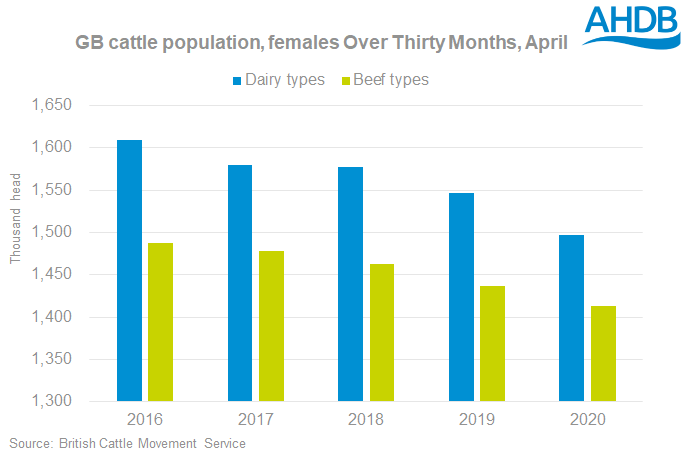

Reports suggest supplies of cows are on the tight side. It may also be that some processors see value in cows, against a strong prime price at the moment. AHDB has been expecting prime numbers to be a little tighter this year than last. Good prices for clean cattle might encourage some farmers to send forward heifers that might otherwise have been replacements, instead retaining some cows for another year. This would support prime production and limit the number of cull cows available. There were 72,500 fewer female cattle over thirty months of age on GB farms on 1 April 2020, compared with the same point in 2019.

UK cow throughput during the first six months of 2020 is now on par with 2019, at 311,000 head. In June however, rallying prices and some farmers perhaps needing to reduce numbers drew out a good number of animals; 19% more cows were killed last month than a year ago. Since then estimated slaughter figures have returned to closer to last year’s levels, despite continued strong demand, which also might indicate a shortage at the moment.

To put things in a wider context, cow prices are showing strength across the seven European countries that slaughter the most cows (see chart). In all but the UK, they remain below year-earlier levels. Cow slaughter across the EU-27 bloc of countries (not including UK) in the year to April was 2% lower year on year, and 12% lower in April alone, as demand for beef across Europe fell as eating out markets closed. Countries across Europe are opening up again now, although the threat of isolated second outbreaks of coronavirus remains.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.