What might today’s WASDE bring? Grain market daily

Friday, 8 April 2022

Market commentary

- UK feed wheat (May-22) prices softened yesterday, falling £2.40/t to close at £302.10/t. New crop prices felt support though, rising £0.75/t over the same period, closing at £270.25/t.

- Both old and new crop Chicago wheat prices weakened yesterday, awaiting today’s WASDE release. The May-22 contract was back $6.70/t, to close at $374.75/t, while Dec-22 prices ended the day at $375.12/t, down $4.04/t on the day.

- Paris rapeseed prices felt support across the board, old crop (May-22) increasing €7.50/t, to close at €961.00/t and new crop (Nov-22) contract closed up €1.00/t at €793.00/t.

- FranceAgriMer have rated 92% of French soft wheat crops in good/excellent condition, in the assessment they released today. This is unchanged on the week, but 5 percentage points up on scores a year earlier.

What might today’s WASDE bring?

Global grain prices softened slightly yesterday, as markets took a pause prior to the release of the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) report, which will be published at 17:00 today. However, underlying support still remains over supply concerns due to the war in Ukraine.

Yesterday, the Ukrainian Prime Minister stated that the Ukrainian grain harvest would be 20% less than last year, following reduced sowing area after the invasion. This follows news from UkrAgroConsult earlier in the week estimating wheat production would be 38% back on the year, and maize 55% down over the same period.

Today’s WASDE report follows a flurry of USDA information released over the past couple of weeks, including the quarterly stocks, prospective plantings and crop progress reports. But what might we expect from today’s issue?

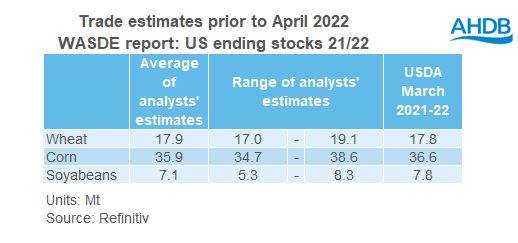

The largest downward revisions for US stocks are expected in maize and soyabeans. US maize export pace has accelerated since the beginning of February.

To meet the export forecast for this marketing year of 63.5Mt, weekly export pace would need to average 1.35Mt for the rest of the season, well below the 1.6Mt average rate observed since the outbreak of the war in Ukraine. So, we may see the USDA revise US maize exports upward and trim ending stocks accordingly.

The Argentinian maize harvest is now pegged at 17% complete (BAGE, 7 April), but production is forecast to be 3.5Mt down on the previous season, at 49Mt. In addition, with Argentinian grain transporters threatening strike action from next week, further bottlenecks could appear to global supply if they carry out their actions.

US soyabean stocks are also expected to be trimmed. Last Friday, I wrote about how extra demand could be felt on these for the remainder of the season. Should there be any changes in this demand, we may see the prices react accordingly.

The general sentiment is that much of what is expected in today’s WASDE report has already been factored into markets. The May report is the next “big one”, which will give us the first look at USDA projections for new crop ending stocks.

The UK impact?

With so much riding in supply availability from the key global exporters, and the US crop moving into the key growing window, US weather looks likely to set the tone for the coming months. Any threats to the already challenged US winter wheat crop will support markets further. This in turn will feed through into domestic prices, as the UK follows the global direction.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.