US soyabean stocks could feel extra demand: Grain market daily

Wednesday, 30 March 2022

Market commentary

- UK feed wheat futures prices fell yesterday; the May-22 contract dropped £6.00/t to close at £303.25/t, while Nov-22 was back £8.50/t, to close at £254.00/t. More positive tones coming from Russia/Ukraine peace talks are bringing a backwards step from recent price gains.

- Price softening was also felt in the oilseed complex, with Paris rapeseed (May-22) down €34.25/t, closing at €937.75/t. The Nov-22 contract was also back (€10.50/t), to close at €746.75/t. Chicago soyabeans also moved down. The May-22 contract dropped $7.81/t and Nov-22 dropped $7.44/t, to finish the session at $603.64/t and $532.18/t respectively.

- There is news today that Ukraine is in talks to ship grains via Romanian ports. If realised, this could bring further pressure to global prices.

US soyabean stocks could feel extra demand

Global grain markets have recovered some of their position this morning. Yesterday they fell to four-week lows, following more positive tones from Russia-Ukraine peace talks. However, markets are still nervous, causing grain prices to edge up again this morning.

Trading volumes are generally quiet, as markets await tomorrow’s USDA reports. But what might the quarterly stocks report show for soyabeans?

Trade estimates are ranging between 43.6Mt and 53.5Mt, the average pegging March stock levels at 51.8Mt. This volume would place stock levels above this point last year.

However, the first half of last years export season recorded a particularly strong start, with record export volumes recorded for the whole season.

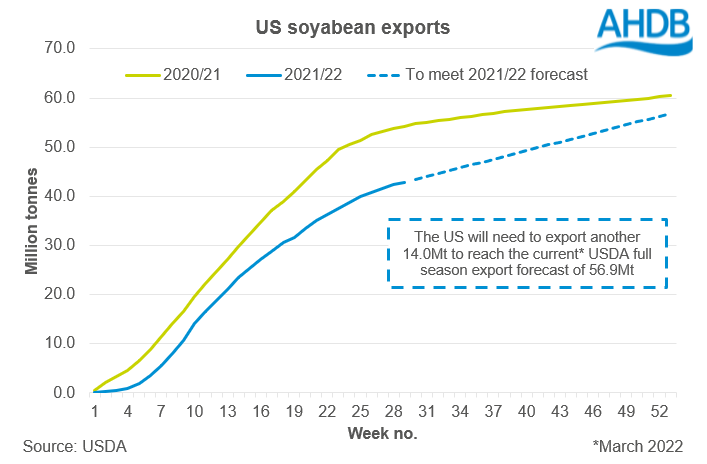

To meet this year’s export forecast (56.9Mt), 14Mt still needs to be shipped (with data to 17-Mar). However, the US may see extra pressure on this if demand shifts from Brazil to the US. Since the beginning of March, export pace has been at a greater rate than last season.

The Brazilian crop has been downgraded by several bodies over recent weeks. Conab (Brazil’s official forecaster) reduced their production estimates earlier this month, to 122.8Mt, down 2.7Mt from their February estimate. The latest USDA world agricultural supply and demand report pegged production at 127.0Mt, down 7.0Mt from a month before. These downward revisions might result in customers looking elsewhere to shore up supply.

How tight US stocks become, as the Northern Hemisphere draws towards harvest, could lend even further support for global oilseed prices. In turn, UK rapeseed prices could find support too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.