USDA crop conditions – more woes for wheat? Grain market daily

Tuesday, 5 April 2022

Market commentary

- UK feed wheat futures bounced up again yesterday, supported by threats of further sanctions from the West on Russia. The May-22 contract closed at £303.40/t, up £0.20/t. New crop (Nov-22) futures rose further following US crop condition news (see below), up £3.70/t to close at £262.25/t.

- Paris rapeseed (May-22) prices softened slightly. to €944.25/t, down €2.50/t from Friday’s close. The Nov-22 contract saw the reverse, up €20.50/t over the same period, to close at €789.50/t.

- Argentine grain transporters are calling for strike action, demanding an increase in grain freight rates as the higher fuel costs begin to bite. With 86% of soyabean transportation to ports by truck, and the bulk of the soyabean harvest in the second quarter of the year, strike action could come moving into a key period.

USDA crop conditions – more woes for wheat?

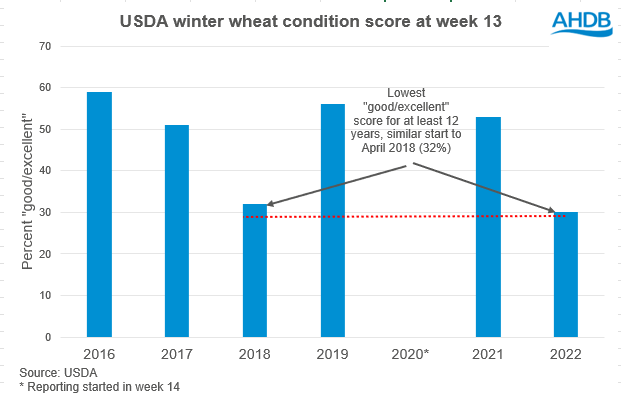

Yesterday, the USDA released their first crop progress report for 2022. Crop conditions failed to impress, falling below the lowest trade estimates. Just 30% of US winter wheat was rated in good-excellent condition. Last year, at the same point, 53% of the crop was good-excellent. We have to look back to April 2018 to see similar crop condition ratings, one of the lowest starts to the spring this century.

We have talked over the past weeks about drought concerns in much of the Plains, the main region for hard red winter wheat (the largest US class). Seemingly, these conditions are playing out in the condition of the crop as it enters the key growing period.

However, with the crop not due to be harvested until June/July, there is still plenty of growing time left until harvest. Weather conditions will be key in setting market direction. We already know, from the USDA prospective planting report (released 31 March), that the total US wheat area is up 1% at 19.16Mha. While more than last year, this still represents the fifth lowest US wheat area since 1919.

What could this mean for the UK

With concerns around global supply for the new season, any news that could further add to global tightness will lend support to UK new crop prices. Fulfilling the US crop potential will be key to meeting global demand, especially as concerns still flare surrounding potential availability next season from the Black Sea.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.