What does the world market have in store for rapeseed prices? Analyst's Insight

Thursday, 17 December 2020

Market commentary

- There were small declines to global wheat futures prices yesterday, after Chicago futures failed to cross a psychological level ($6/bushel). May-21 and Nov-21 UK feed wheat futures both fell by £1/t and closed at £193.25/t and £158.25/t, respectively.

- Paris rapeseed futures (May-21) rose €4.25/t yesterday to €404.75/t.

- In Ukraine, 12% less winter rapeseed has been sown for harvest 2021 than 2020, according to the Economy Ministry. The winter wheat and barley areas are also down 5% each after dry weather hampered planting.

- Australia will appeal to the World Trade Organisation about the tariffs imposed on Australian barley imports by China. The appeal could take years to resolve. The Chinese tariffs are impacting global barley trade and prices.

What does the world market have in store for rapeseed prices?

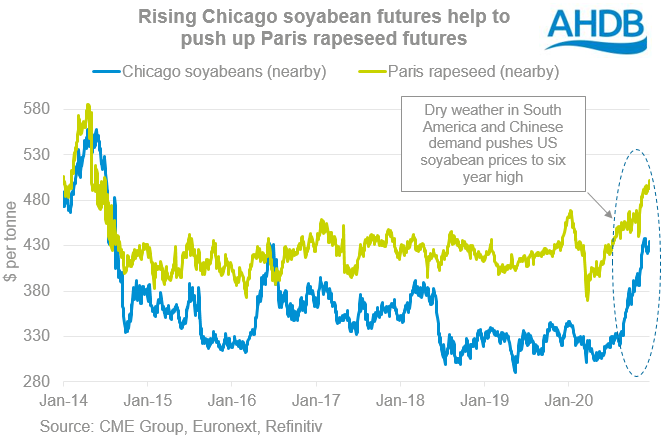

US soyabean futures recently hit the highest level since August 2014 due to worries about the 2020/21 South American crops and high demand from China. This rise has helped to push up European, and so UK, rapeseed prices.

The rise is slightly less in euro or sterling terms. This is because both the euro and the pound are at their highest levels against the US dollar since spring 2018.

Global oilseed supply this season (2020/21) is currently forecast to be less than demand, with stocks falling as a result. These forecasts include historically large crops for Brazil and Argentina. Unless these current forecasts for South America are confirmed, the deficit will be even larger. Which will likely further support prices.

Regular rain is needed to support crops, after very dry conditions earlier in autumn so South American weather will be key to oilseed prices for the next 2-3 months.

Is there a New Year risk to soy prices?

However, in the New Year soyabean prices, and so rapeseed prices, will also be increasingly affected by the potential US areas for harvest 2021.

The USDA’s outlook to 2030, released in November, suggests the area of soyabeans will increase by 2.4Mha for harvest 2021 to 36.0Mha. The area of maize is forecast to fall by 0.4Mha to 36.4Mha. These forecasts are based on information from early October.

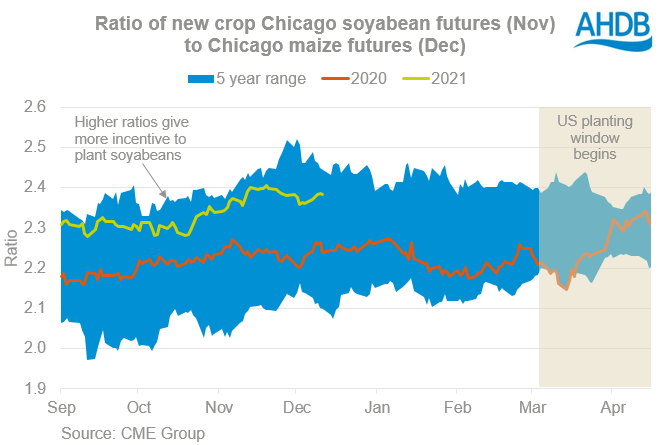

There’s a strong link between how new crop soyabean and maize prices compare to each other, and the area planted to the two crops.

The two crops are grown in the same areas of the US, and often compete for land. Soyabeans cost approaching twice the amount per tonne as maize to grow (USDA) due to lower yields. So when soyabean prices are more than double those for maize, it incentivises farmers to grow more soyabeans.

Since October, soyabean prices have risen more than maize – pushing the ratio higher. This could make it more likely still that a large area of soyabeans will happen, assuming the weather in spring is favourable.

Maize planting can start in early March if conditions are right, but soyabean planting usually starts later in April. If there’s a warm and dry March, more maize may still be planted than the prices suggest. In contrast, a wet spring can mean more soyabeans are planted, such as happened in 2019.

Price impact

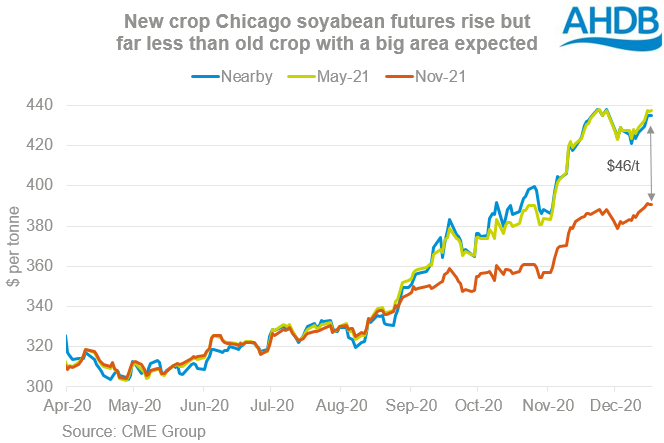

Nov-21 soybean prices are at a large discount to old crop prices, reflecting the potential increase in supplies next season.

Private forecaster estimates will give some indication of market expectations for the area. But they will also feed market sentiment and could result in some late changes to planting intentions. The USDA will release the results of its survey of US farmers’ planting intentions on 31 March and confirm the actual areas on 30 June.

However, the bottom line is if a much larger US area continues to look likely, this could cap new season and potentially old season price rises. This will also impact rapeseed prices.

So the weather in South America is key in the short to medium term. However, from the spring, US area expectations will become more important, especially if South American crops continue to receive regular rainfall.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.