Barley sector outlook: Grain market daily

Thursday, 15 October 2020

Market commentary

- UK feed wheat futures slipped back slightly yesterday after sterling hit its highest level since 7 September (£1 = €1.1077, Refinitiv). The Nov-20 contract was down £0.55/t to £181.50, with the Nov-21 contract back £0.20/t to £156.30/t.

- This is in contrast to Paris and Chicago maize and maize futures, which all made small gains. Meanwhile, Chicago soyabean futures made larger gains.

- Global grain and oilseed prices were both supported by US export sales to China, continuing dryness in Brazil and reported buying activity by speculative traders.

- Earlier this week, Algeria’s state buyer (OAIC) bought an estimated 600Kt of milling wheat from optional origins (Refinitiv). This was the first tender where some grades of Black Sea milling wheat could be supplied. However, reports yesterday indicate that Russian wheat was not competitive after recent price rises – the wheat will likely come from the EU. This also supported Paris milling wheat prices yesterday.

Barley sector outlook

This marks the second of the three sector round-ups that are to be released this week following our Grain Market Outlook conference held virtually on Tuesday. We hope you found the content useful and informative.

Below, we examine three key sections including fundamentals that will affect future price direction for domestic barley markets.

A La Niña weather phenomena is now underway causing increased rainfall in Australia, but drier weather in Argentina, Brazil and the Black Sea region. The production in these countries will impact global price direction for barley relative to other grains; higher than expected production would increase barley’s discount to wheat, while lower than expected production would reduce it. In addition, the size of the Australian crop will affect the competition UK barley faces in export markets this season.

Australian production is expected to rise 17% year on year to 10.5Mt, supported by greater rainfall. There are some questions about whether quality could be impacted if the rainfall continues during harvest. Harvest is now underway and we’ll watch the results with interest.

Argentinian barley area has been reduced by the dry conditions and production is expected to be down 9% from 2019/20. Regular rainfall will be needed over the coming months to maintain yield potential.

Low soil moisture following dry weather in southern regions of Russia and much of Ukraine is disrupting winter barley planting for harvest 2021. While plantings in Ukraine are currently disrupted to a lesser extent than Russia, the potential impacts are greater as 40% of barley in Ukraine is winter sown (2015-2019). In Russia, just 12% of the crop is winter sown (2015-2019).

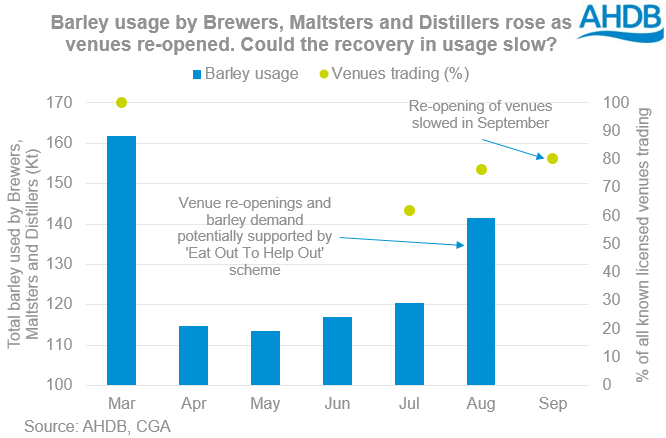

Globally, industrial usage of barley is forecast at 30.6Mt in 2020/21 by the International Grains Council, slightly (0.1Mt) below last season’s level. This shows the continuing impact of the measures to combat the coronavirus pandemic on demand.

However, all forecasts can only take account of what is reasonably expected to happen. There are no recent points of reference for how the pandemic may evolve, so forecasts will evolve with the situation. With rising case levels in many Western countries, there’s a cloud of uncertainty hanging over global demand forecasts.

A similar situation is occurring in the UK. Last week, I looked at continuing impact of the pandemic on malting barley demand, despite some recovery in July and August. Over the past two weeks, we’ve had more restrictions re-introduced, especially affecting the hospitality sector.

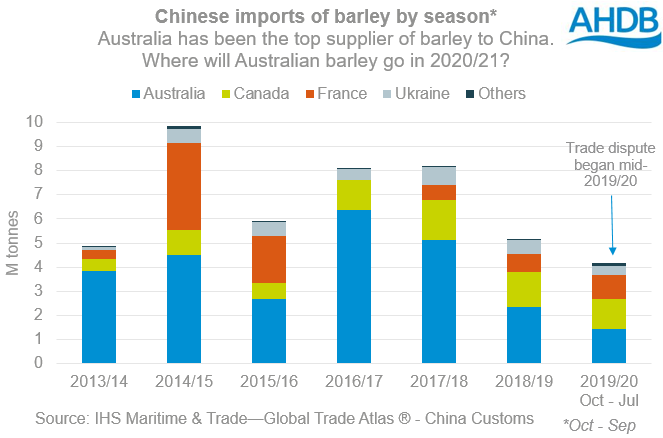

China’s trade dispute with Australia impacting barley trade flows

Earlier this year, China introduced large tariffs on imports of Australian barley. In recent seasons (2014/15-2018/19), 70% of Australian barley exports were shipped to China (IHS Maritime & Trade – Global Trade Atlas® - Australian Customs). This leaves large volumes of Australian barley looking for new homes.

While Australia’s large 2020/21 barley crop has yet to be harvested, it is already pricing competitively for New Year delivery. As a result, UK barley faces tough competition into the Middle East and North African markets and will keep UK prices at a huge discount to wheat. This competition could be further exacerbated if rain damages the quality of the Australian harvest, further increasing its supply of feed barley.

Meanwhile, China is still expected to import 5.3Mt of barley this season (USDA) and is buying from other origins, reportedly including Argentina and France. This was one of the factors behind the rise in global barley prices in recent months.

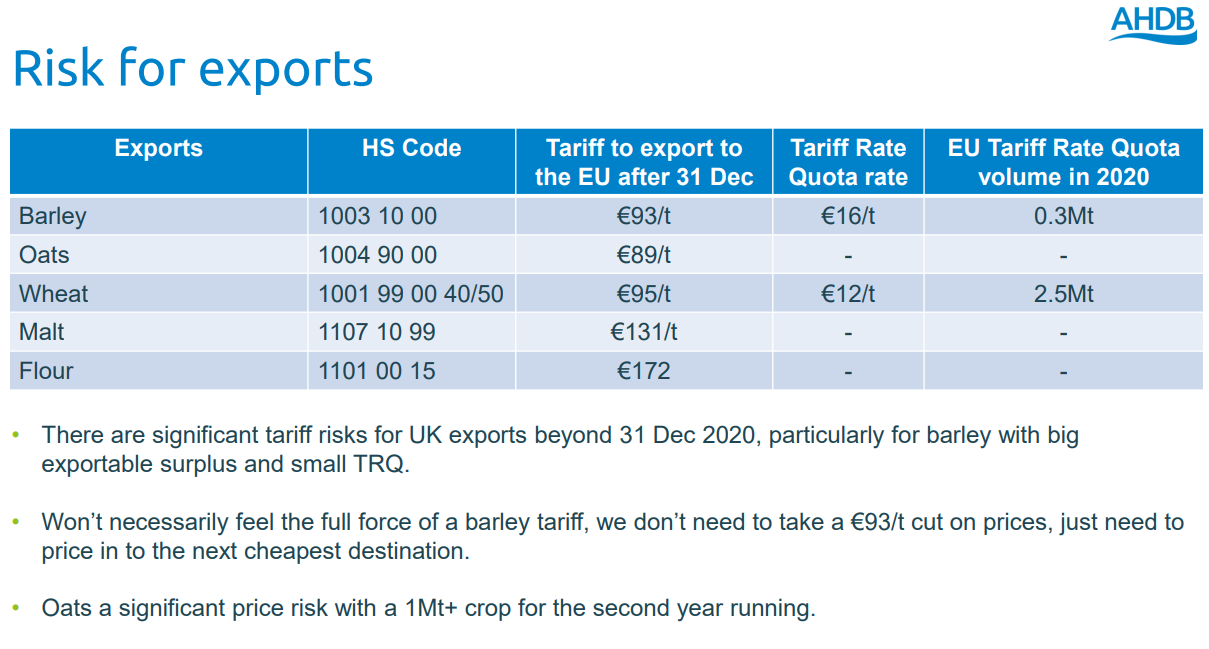

End of the UK’s transition period for leaving the EU

If the UK and EU don’t agree a trade deal in the coming weeks, UK barley will face tariffs into the EU from 1 January, where 82% of our exports currently go (2015/16-2019/20). This means the price of UK barley will have to fall to either:

- Continue shipping to the EU if there is still space in the TRQ (max. 307Kt) available. In this case the price would need to fall by €16/t to cover the cost of the tariff.

- Compete for demand in other major barley importing nations including North Africa or the Middle East. There would be other costs involved here e.g. extra drying costs, but would still offer better returns than paying the €93/t EU tariff.

Pressure on feed barley prices from this threat and the global supply situation is actually helping to mitigate part of its impact on the domestic market this season at least. The low price is encouraging more barley to be used in animal feed in the UK, thereby reducing the amount of barley will we need export in 2020/21. Longer term, the risk remains as we’ll more than likely need to export in future seasons.

In addition, the main export markets outside the EU require predominately feed rather than malting barley. Malting barley would need to be prioritised for export to the EU, with the options in other destinations more limited.

The tariff on malt going into the EU from the UK equates to 29% of trade value over the past five seasons, representing a sizeable penalty. Far less of our malt exports (12%) than barley go to the EU reducing its impact. However, unless new business can be won elsewhere, it could still have a knock on impact on the volume of malting barley required in the UK and so potentially its’ value.

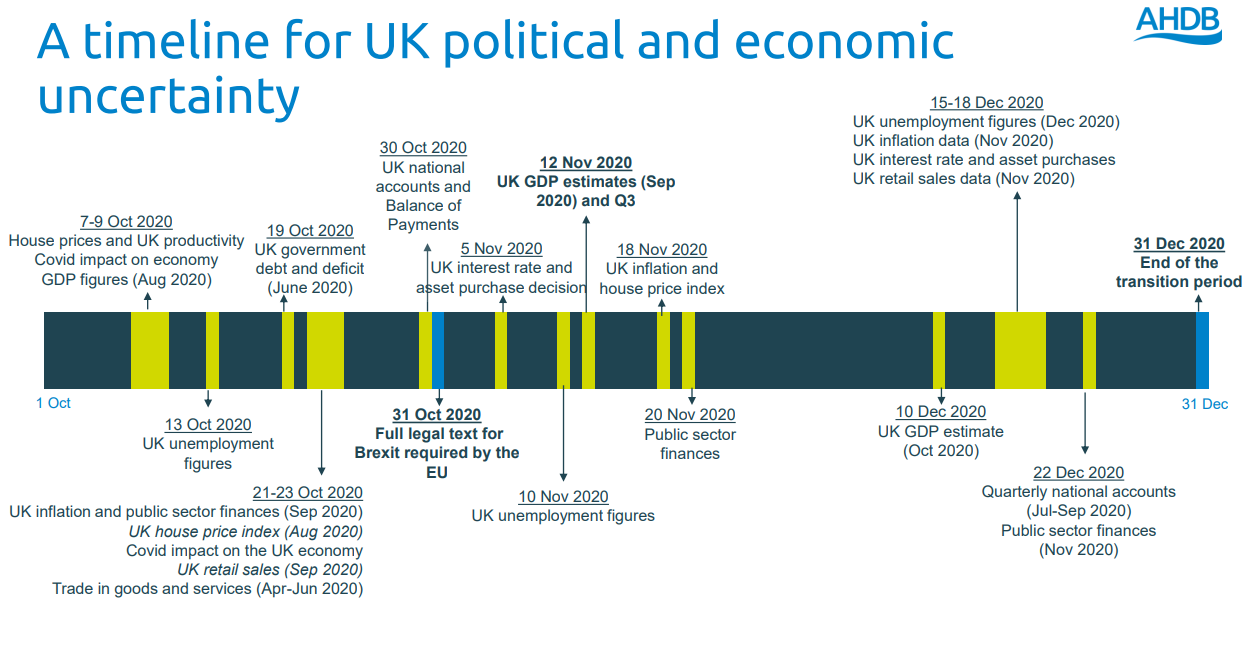

Currency risk

Finally currency is another key risk and driver of market volatility going forward. Sterling will react to Brexit developments and the publication of economic data. Between now and the 31 December, there are a number of key economic releases for the UK, including interest rate decisions and economic growth forecasts. Adding Brexit and a US election into the mix, sterling volatility has the potential to significantly impact the value of UK barley.

If the value of sterling rose, all other things being equal, the price of UK barley will fall in order to maintain or exceed export competitiveness. If sterling falls in relation to the data, going forward UK markets will be supported. With the deadline for a Brexit deal looming, and progress seemingly lacking, it feels as though sterling has more downward potential than upward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.