What does the high price differential between Irish and GB beef mean for the GB market?

Friday, 25 October 2024

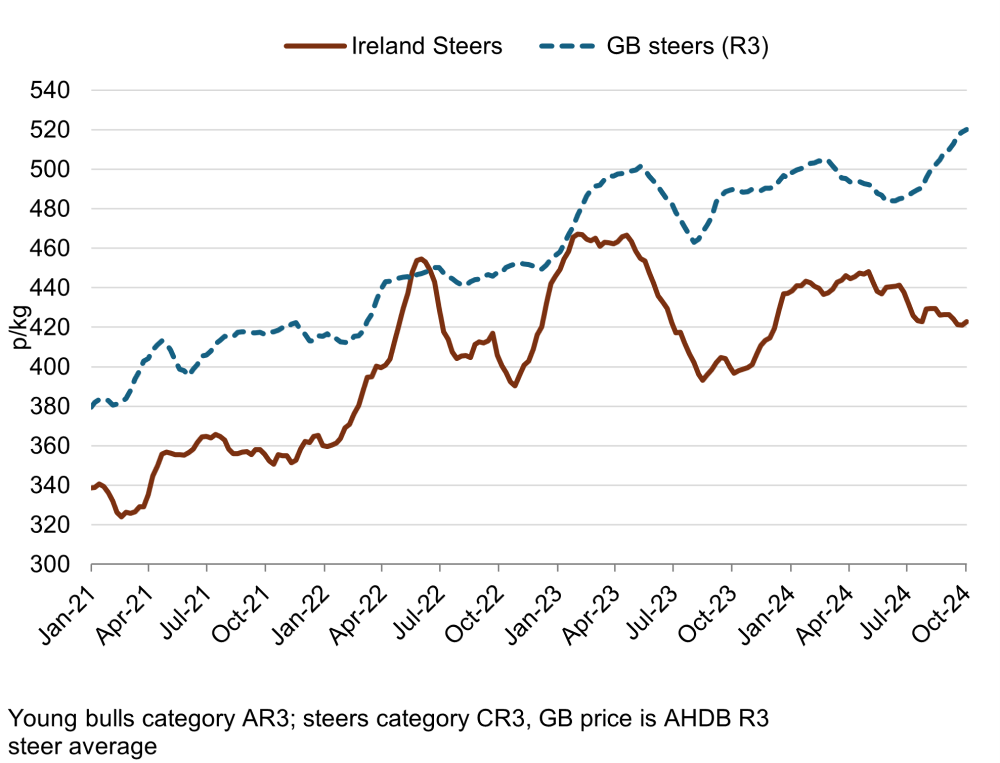

Over the past few weeks, we have seen GB deadweight cattle prices climbing to record highs. On the contrary, Irish deadweight prices have witnessed greater stability, meaning a widening price differential between the two products. What’s driving this divergence, and how might it affect the market going forward?

Key points

- In the week ending 12 October, the price differential between GB and Irish prime beef was 97.1p/kg on R3 steers.

- Higher throughputs and lower carcase weights are likely restricting growth in the Irish prime price.

- The wider price differential between GB and Irish prime beef presents some risk of increased imports, however any tightness in supply in Ireland may also support the GB cattle price.

Situation in Ireland

Prime cattle prices in Ireland have seen relative stability over the past few weeks, with some minor increases. In contrast, GB prices have been climbing up and we have seen the widest recorded (since 2014) price differential between the two in recent weeks. What is driving this trend?

Throughput numbers in Ireland have grown in the past few weeks, with data from w/c 14 October showing total beef kill at DAFM plants up 1.7% for the year to date, compared to the same period of 2023. This increase has been driven by higher numbers of cows, up 10% on the same period of last year. Heifer kill numbers are up 4% for the year to date, whilst steers are back 1%, compared to the same period of last year. This available supply will put some downwards pressure on prices, although market commentary suggests an expectation for numbers to tighten over the coming weeks, particularly in prime.

Furthermore, data shows that the average carcase weight for steers was back 10kg year on year in the week ending 12 October, whilst heifers were back 5kg in the same week. Irish reports suggest that these lower weights may be a result of later turnout and challenging grass growing conditions through the summer months. This could have impacted growth and finishing quality of cattle, with reduced weights and poorer quality likely to weigh on prices.

GB and Ireland deadweight prime cattle prices (p/kg)

Source: European Commission, AHDB

Looking forward

Bord Bia are predicting a tightening in Irish prime cattle availability in the final quarter of 2024 and into next year. This is driven by both a long-term decline in cattle numbers, and firm export trade across both live exports and beef products. Forecasts suggest that numbers could remain tight throughout 2025.

Irish cattle population data from DAFM, shows a 1.7% year on year decline in the number of cattle for beef production aged 12-30m as at 1 September 2024 (includes dairy males, beef males and beef females). This was driven by a 5% reduction in the number of cattle for beef aged 12-18 months, compared to 2023, pointing towards a tighter supply in the short term.

What could this mean for the GB beef market?

With the price differential as it is, there is a risk of increased imports from Ireland into the UK, which may put downwards pressure on the GB price.

On the flipside, with a tightening Irish cattle supply, any increase in Irish prices is likely to support GB prices, as we traditionally see them moving in a similar direction due to the strength of the relationship between the two markets. We may also see buyers looking to secure greater cattle supplies in GB to bolster their pipeline.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.