What are the key market drivers this week? Grain market daily

Thursday, 16 March 2023

Market commentary

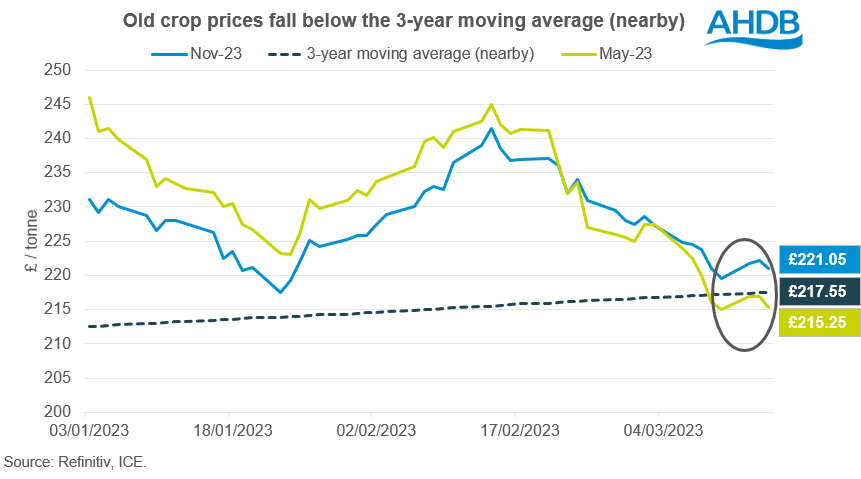

- UK feed wheat futures (May-23) closed at £215.25/t yesterday, down £1.75/t from Tuesday’s close. New crop futures (Nov-23) fell £1.15/t over the same period, to close at £221.05/t at the end of the session.

- Global grain markets remain volatile as they react to any news surrounding talks on the extended Ukraine grain corridor deal – more information on this below.

- Paris rapeseed (May-23) closed at €481.50/t yesterday, losing €1.25/t over yesterday’s session. Rapeseed prices have come under pressure as recent rains across Europe have benefited EU and UK production prospects.

What are the key market drivers this week?

UK feed wheat futures (May-23) based on yesterday’s close (£215.25/t) are only marginally supported in comparison to last Friday’s close, and new crop futures are still trading at a premium to old crop. At the end of last week, old crop prices started to fall below the nearby 3-year moving average showing the pressure that prices have been under as of late. This continues this afternoon with the May-23 contract currently trading at £214.00/t (12:00).

So far this week, news on the grain corridor deal extension is keeping prices volatile. Argentinian weather remains a watchpoint as well this week as the country continues to feel the impact of severe drought. Finally, Chinese demand has seen some support in US maize markets this week, read more on this below.

Ukraine grain deal to be extended for 60 days?

The Ukrainian export deal that allows ships to carry food supplies from three main ports in the country looks as though it will be extended, though following talks on Monday it could only be for 60 days. While it was thought that a 120-day extension would be on the cards, Russia have argued that the initial agreement had not been adhered to, and that Western sanctions had impacted its fertiliser and food exports. This is something to monitor over the next week as it will be a main market driver. Read more about what the extension could mean for global grain markets in Tuesday’s Grain market daily.

Ongoing drought in Argentina

The severe drought in Argentina has impacted both the country’s soyabean and maize crop. Yesterday, the country’s top processing chamber reported that Argentina’s soyabean crushing plants are now operating at the lowest capacity in history due to impact of the climate. According to Refinitiv, in February, farmers in the country sold 622.3Kt of soyabeans to the processing sector, nearing just a third of the 1.7Mt sold during the same month a year earlier. While farmers haven’t yet began harvesting soyabeans in Argentina, it’s thought farmers are reluctant to sell their stored crops, due to fears that a poor harvest will lead them to run out of reserves.

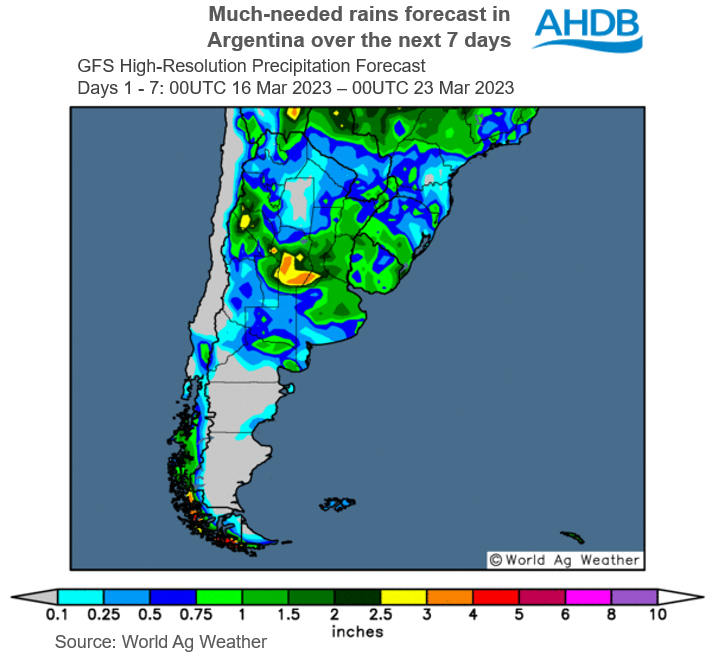

While at the beginning of the week, there were some welcomed rains forecast in key producing regions of Argentina, the country hasn’t received the rain it was initially forecast. However, looking over the next seven days, up to 4 inches of rain is forecast across certain areas, something to monitor moving forward.

While the Argentinian weather continues to limit any major losses, so far this week Chicago soyabean futures (May-23) are down $6.52/t, closing at $547.15/t yesterday. Losses in soyabean markets are largely due to pressure in crude oil markets, with Brent crude oil futures (nearby) down $9.09/barrel from Friday’s close, at $73.69/barrel yesterday. Losses in crude oil markets are due to higher US stockpiles as well as concerns that a crisis of confidence in the banking sector could lead to a recession and sluggish demand.

Uptick in Chinese demand?

Chicago maize futures (May-23) have felt some support this week, gaining $3.64/t from Friday’s close, to end yesterday’s session at $246.65/t. With China coming out of nearly three years of lockdowns, there is still a big question mark over how much demand we’ll see from the country for the rest of the season. The USDA confirmed sales of 667Kt of US maize to China for 2022/23 delivery yesterday, indicating demand for maize could be picking up.

Chinese demand prospects for soyabeans are also thought to be on the rise. Expectations of a climb in domestic crushing in Brazil, will help make up for the drop in Argentina. According to the chief of Brazil’s oilseed lobby Abiove, Brazil’s record soyabean crop (currently estimated at 151.4Mt by Conab) will enable the nation to boost exports to China, while also increasing domestic soyabean processing. Last year (2021/22), China’s total soyabean imports fell for the second consecutive year, sitting at around 91Mt (Refinitiv), with Brazil accounting for 54.4Mt. However, the first two months of 2023 have seen record soyabean imports by China, indicating good demand prospects for the remainder of the season, something to watch out for over the next few months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.