Black Sea deal update: Grain market daily

Tuesday, 14 March 2023

Market commentary

- UK feed wheat futures (May-23) closed at £217.00/t yesterday, up £2.00/t from Friday’s close. New-crop futures (Nov-23) closed at £221.70/t yesterday, up £2.20/t over the same period.

- Domestic wheat futures followed global markets higher yesterday, with gains seen for Chicago and Paris contracts. Dryness concerns for US winter wheat supported prices, alongside spill over of the ongoing market volatility concerns in the US financial sector.

- Yesterday, the USDA released the latest crop condition report (week ending 12 March) for Kansas who account for c.27% of the US winter wheat crop. Their winter wheat crop ‘good’ to ‘excellent’ ratings remained at 17%, unchanged from the previous week.

- Paris rapeseed (May-23) futures closed yesterday at €485.25/t, down €7.75/t from Friday’s close. Pressure continues to be felt, from wider vegetable oils as well as falling Chicago soyabean prices.

- Chicago soyabean futures (May-23) closed yesterday at $547.89/t, down $5.78/t from Friday’s close. Brazil’s large crop coming to the market pressures prices.

- HMRC UK trade data for January has now been released, available here. Season to date total wheat exports (Jul – Jan) inc. durum are up 178% from last season, at 736Kt. Oat exports are up 324% from last season over the same period, at 118Kt.

Black Sea deal update

The Black Sea Initiative, the Ukrainian grain export corridor, continues to keep uncertainty in grain markets short and longer term.

The deal, established back in July 2022, allows the safe navigation of grain, related foodstuffs, and fertiliser from three Ukrainian ports (Odesa, Chernomorsk and Yuzhny).

With the deadline for the last extension due on the 19 March, talks took place yesterday (and are ongoing) between Ukraine, Russia, Turkey, and the United Nations (UN). The deal has previously been extended for 120 days, twice.

It looks as though talks are progressing to secure a renewal, though how long the renewal period is for remains unclear.

Russian Deputy Foreign Minister Alexander Grushko told Russian news agency TASS today, that the grain deal has been extended for 60 days only. Half of the previous renewal period. Russia agreeing to a 60-day extension has also been confirmed by the Turkish Defence Ministry (Refinitiv).

According to Refinitiv, a Russian source earlier in the day said that a 60-day extension meant that after 60 days, one of the parties may raise the issue surrounding the termination of the deal. Russia has consistently pushed to reduce the impact of sanctions on the export of their own grains and fertilisers.

Whereas, Ukraine says it will keep to the 120-day extension and indicated that the original agreement states extensions are possible for a minimum of 120 days and should be amended if this period is shorter. Turkey states that talks are ongoing. Watch this space for more news on this.

What does this mean for grain markets?

This deal has facilitated movement of grain and oilseed from Ukraine, albeit with slow inspections causing some difficulties.

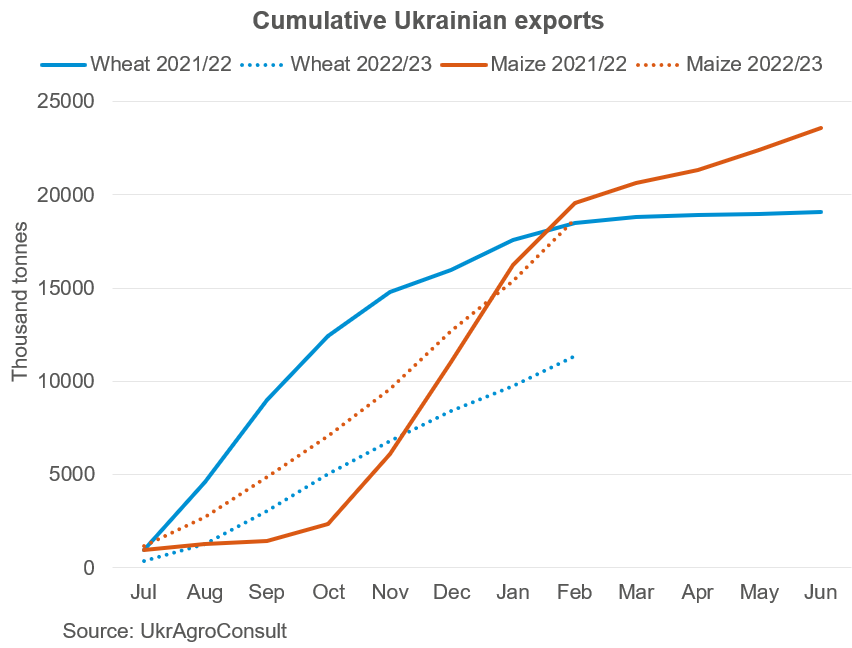

Maize and wheat especially, accounting for 49% and 27% respectively of the foodstuff tonnage shipped through the deal since establishment, continues to leave Ukraine.

Using UkrAgroConsult data, which includes road and rail movement, we can see how much has been leaving Ukraine this season compared to last.

What does this mean for price direction?

Crucially, global wheat markets have been feeling pressure over recent weeks and months. Pressured by cheap ample Russian supplies on the global market, coupled with slow demand, we have seen old crop wheat futures prices move lower than new-crop wheat futures prices in the UK. This looks set to continue.

Uncertainty over the corridor extension does add volatility to markets, short and long term due to how this impacts global supply. However, the market has been expecting an extension to this deal and therefore has been priced into markets accordingly. Today, price reaction we can see prices trading down for UK feed wheat futures (May-23) at £215.50/t and Nov-23 futures at £218.00/t (13:15). I would be inclined to see the renewal of the deal as a watchpoint in the context of new season at this stage in particular, with price direction looking to new crop availability.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.