UK wheat imports rise with crops looking poor: Analyst Insight

Thursday, 28 March 2024

Market commentary

- UK feed wheat futures (May-24) closed at £170.50/t yesterday, up £0.50/t from Tuesday’s close. New crop futures (Nov-24) closed at £193.10/t, up £1.60/t over the same period.

- Prices rose yesterday following the European Commission forecasting wheat production in the EU-27 will fall 4% to a four year low for the 2024/25 season of 120.8 Mt, due to a reduction in planted area. Planting continues to be disrupted by heavy rain in top producing regions. Additionally, markets have also been supported this morning, following news of Saudi Arabia’s tender for the purchase of 595 Kt of wheat. However, sizable Russian wheat supplies continue to limit gains in wheat futures.

- Paris rapeseed futures (May-24) closed yesterday at €441.50/t, down €10.50/t from Tuesday’s close. The Nov-24 contract ended the session at €451.50/t, down €6.50/t over the same period.

- Paris rapeseed futures continued to follow Chicago soyabeans, which are still down amidst continued pressure from technical trading after Tuesday’s lower closing price. Continued concern about the potential for another large US supply in 2024 also weighed, along with poor export demand in the US.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK wheat imports rise with crops looking poor

The poor condition of UK winter crops for harvest 2024 is shown clearly in the latest AHDB crop report, out today, and this concern about production is one of the factors driving imports this season.

Higher wheat imports predicted in 2023/24

Wheat imports in 2023/24 could reach 2.00 Mt according AHDB’s latest UK Supply and Demand estimates, out this morning. The UK import pace has remained firm so far this season, a reflection of both the poor quality of the 2023 harvest and the understandable worries about the 2024 harvest. As a result, AHDB has increased its forecast of total season imports from the 1.75 Mt predicted in January to 2.00 Mt. This would be the highest level of wheat imports since 2020/21.

The total demand forecast for wheat is also slightly higher than in January, up 33 Kt to 14.86 Mt, now 287 Kt higher than last season. A slight dip in expected human and industrial (H&I) usage, down 36 Kt from what was predicted in January, is offset by increased animal feed demand. The dip in H&I usage is linked slightly lower lower-than-forecast actual data in recent months for brewing, malting, and distilling, plus the fall in ethanol prices over winter. The increasing competitiveness of maize for some uses is also a factor.

Meanwhile, animal feed is supported by slightly more on-farm feeding of barley and wheat, expected due the falls in grain prices, plus some recovery in demand by Integrated Poultry Units and for compound cattle feed.

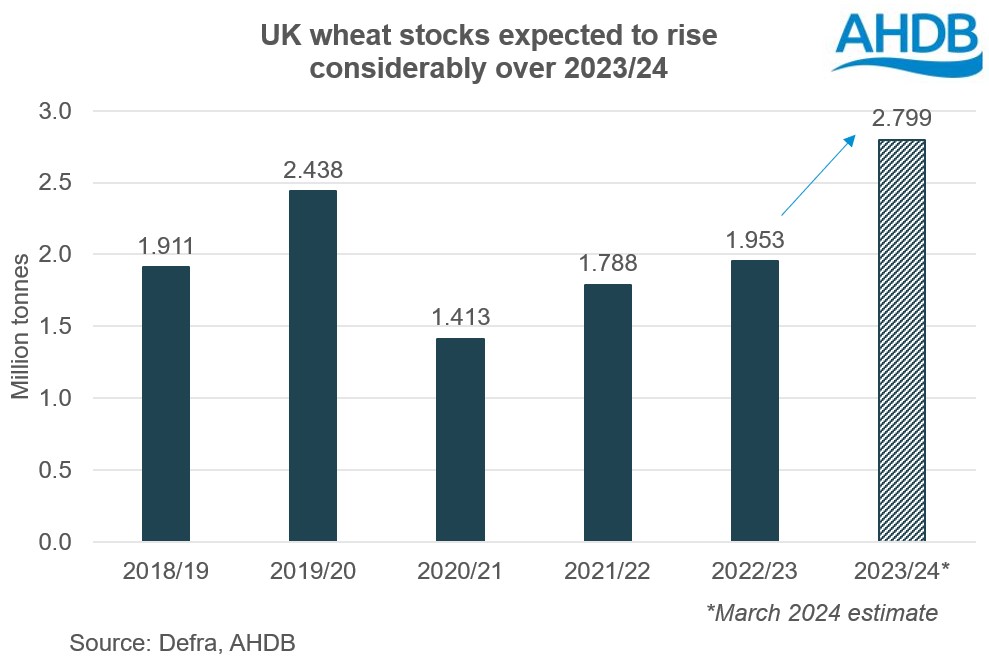

The forecast rise in imports more than offsets the small uptick in demand meaning end of season stocks are pegged 247 Kt higher than in January at just under 2.80 Mt. Larger stocks look likely to be needed though, with sharply lower crop areas for harvest 2024 and crop conditions looking poor.

Poor crop conditions for harvest 2024

AHDB has also released its first crop development report of 2024 today. The report shows crop conditions based on information up to 26 March 2024 and confirms the wide-spread poor condition of all winter crops.

The high rainfall levels over winter have continued to take their toll on winter crops in all parts of the UK. The worst conditions have been in the East Midlands and neighbouring regions of the West Midlands, East, and Yorkshire and the Humber.

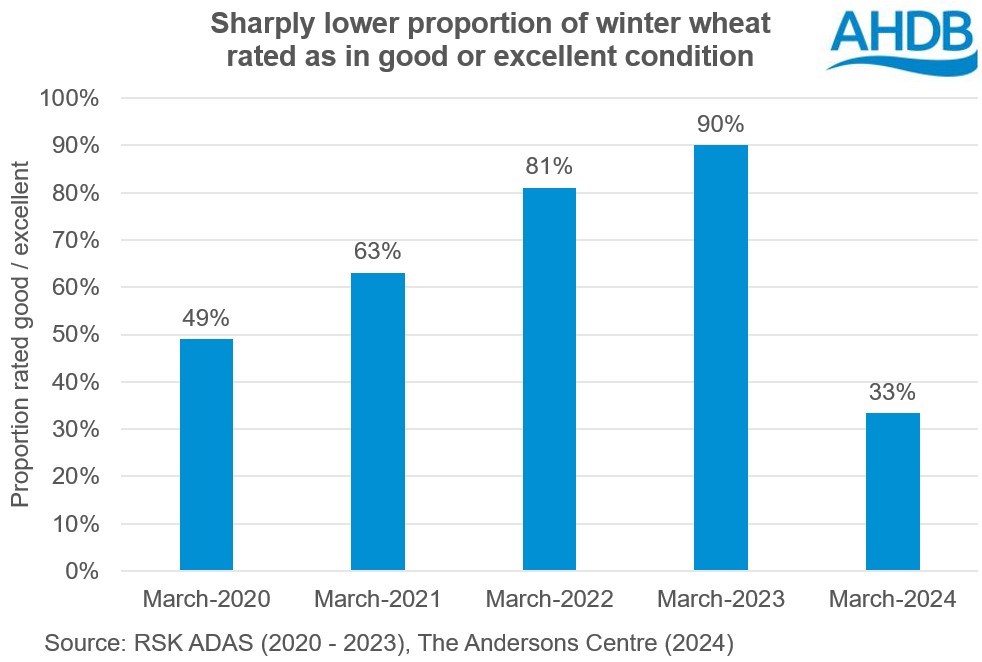

As a result, crop condition ratings are sharply lower year-on-year. Just 34% of GB winter wheat is rated as in a good or excellent condition as of late-March (data collected for AHDB by The Andersons Centre). This is a marked drop from last year, when 90% of the crop was rated good or excellent and even below March 2020’s 49% (RSK ADAS). While wheat regularly astounds on its ability to recover from poor winters; this year will be a major test of this ability and the next month is key.

Despite establishing better than most wheat, the stress over winter has badly impacted GB winter barley crops and now only 38% is in a good or excellent condition. A year ago, 92% of the GB winter barley crop was rated good or excellent. Many plants tillered less than usual leaving a lower yield potential and the crop is very dependent on a warm dryish spring.

While GB winter oat conditions are better than other winter crops, still only 37% of the UK crop is rated as good or excellent. This is much lower than the 83% at the end of March 2023.

After sitting in water for so long over winter, many winter oilseed rape plants died and there are some very bare patches in the Midlands particularly. Overall, only 31% of the GB winter oilseed rape crop is rated as in good or excellent condition (The Andersons Centre). This is well below the 70% rated good-excellent at the end of March 2023 but slightly above March 2020’s 26% (RSK ADAS).

Spring crop planting remains heavily delayed, and little insight can be offered at this stage. More coverage is due in the next report, which will show the situation as at the end of April.

While there’s still time to plant spring barley and spring oats, understandably there’s questions about if all the planned spring crop areas get planted. AHDB’s Planting and Variety Survey will give the first post-planting insight into the cropped area. Look out for the survey forms landing on your doorstops and in your inboxes next month to help us all understand what the final cropped areas for harvest 2024.

The March 2024 crop development report can be found in full here.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.