UK trade surplus for all dairy falls in 2020

Thursday, 11 March 2021

By Bronwyn Magee

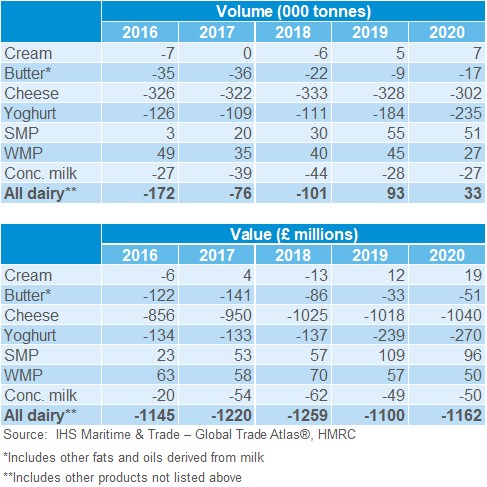

The UK trade balance for all dairy products** was positive in volume terms in 2020 for the second year running. Including shipments of unprocessed milk, there was a surplus of 33k tonnes, which compares to a surplus of 93k tonnes in 2019.

The main reason for the reduced surplus was an increase in the trade deficit for yoghurt. Fewer exports of butter and whole milk powder (WMP) were other factors behind the drop in the trade surplus.

Higher imports of yoghurt, combined with a drop in exports resulted in the trade deficit increasing by 51k tonnes to reach 235k tonnes. This compares to a deficit of 184k tonnes in 2019.

The cheese trade balance, while remaining in deficit, saw the largest improvement compared to 2019. While exports of cheese were 15k tonnes lower (7%), this was more than offset by the 8% drop in imports, equal to 41k tonnes. This is a result of fewer shipments from Ireland, which were down 12% on the year. The reduced foodservice demand resulting from COVID-19 likely reduced import demand.

Meanwhile, the cream surplus improved, lifting marginally year-on-year, while the trade surplus in milk powders dropped back compared to 2019 levels, with WMP falling most notably (18k tonnes).

In value terms, the trade deficit increased by 6% to £1.16bn for 2020, amounting to a drop of £62m from last year. While the value of imports across all categories fell by 5%, the total value of exports dropped back 11%.

All key product categories, with the exception of cream and powders, recorded a value trade deficit in 2020. Cheese, butter, yoghurt and concentrated milk were already running trade deficits, which worsened in 2020. For milk powders, the value trade surplus was reduced.

For yoghurt, the higher value deficit was partly because we exported less, but also because the value and volume of yoghurt imports greatly increased. While the value of yoghurt exports did lift, this was not enough to outweigh the increase seen in imports.

For cheese, butter and concentrated milk, the value of imports declined, but larger decreases in our export values offset this.

Cream was the only product to show an improved position in value terms, with the reduced import value far outweighing lower export returns.

*Butter here includes both butter and other fats and oils derived from milk.

**HS codes 0401-0406. Includes shipments of unprocessed milk/raw milk crossing the border for processing.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.