UK pig meat self-sufficiency: coronavirus and Brexit

Thursday, 5 November 2020

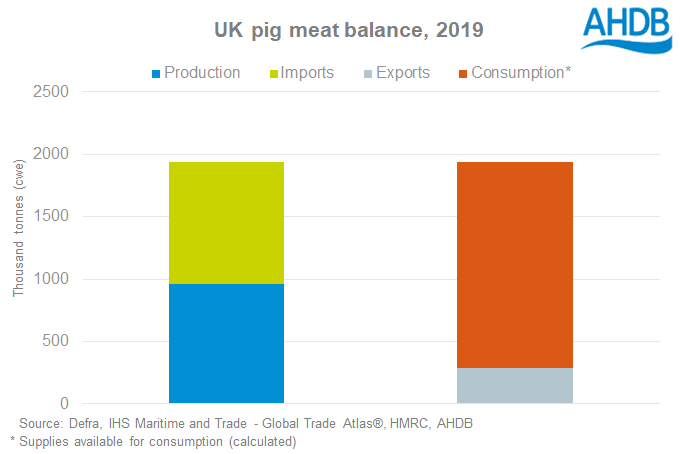

The UK is far from self-sufficient in pig meat. In 2019, a little under 60% of the pig meat available for consumption in the UK was imported, almost all from the EU. About 30% of our domestic pig meat production was exported. However, even if we didn’t export anything, the total volume we produced was still only equal to about 58% of what we consumed. This balance has implications for both how the market responds to coronavirus related national lockdowns and the upcoming end of the Brexit transition period.

It’s not quite as simple as saying we produce 58% of what we consume. A crucial role played by trade is in balancing the carcase. UK consumers prefer cuts from the leg and loin, and there are not enough pigs in the UK to satisfy that demand. As a nation, we have a penchant for back bacon compared to belly bacon for example.

In China, an important export destination, very different parts of the pig are prized. Although, the current reduction in Chinese domestic pig meat production, due to African Swine Fever, arguably means that Chinese import demand covers a wider range of cuts than perhaps is typical.

It is this need to balance the carcase, as much as encouraging demand overall, that motivates AHDB marketing campaigns like pulled pork.

So what does all this mean for lockdown and Brexit?

Imported pig meat tends to feature more heavily in the foodservice sector. Any disruption to that market, such as state of national lockdown that closes restaurants, affects imports more than it does demand for British pork. During the first lockdown data from Kantar indicated a rise in pork demand driven by retail, and so British product would also have been in high demand. This is also expected to be the case in the second lockdown this month.

When it comes to Brexit, the UK government has published the external tariffs it intends to apply to imports outside of any free trade agreements. These would apply to EU product in the event that no deal can be reached with the EU. However, note that upon leaving the customs union, the UK will be free to revise these external tariffs if it wishes. Nonetheless, the tariffs currently set to be in place are high for pig meat products, in the region of 30-40%. As the UK is a significant net importer of pig meat, this would increase the value of domestic pork.

The UK also exports pig meat to the EU, which would also face similarly high tariffs if no trade deal is agreed. However, an increasing share of exports now go to China instead of the EU (45% in the year to date, including offal). While additional tariffs on shipments to the EU would of course be disruptive, the impact of the increased cost of importing pork would likely dominate in a no deal situation.

Despite this, one area where UK exports to the EU are particularly important is sow meat trade. Sow carcases are overwhelmingly exported to the EU, and the additional tariffs faced in a no deal situation would have some negative impact on returns to UK producers.

Overall, the impact of no-deal by itself would be expected to be supportive of UK pig prices. The supply chain as a whole, however, would likely face significant challenges without a supply of low or tariff-free pork. Ultimately, a rise in consumer prices could be the result.

In any case, deal or no deal, the administrative burden of importing from, or exporting to, the EU as a third country will add to the cost of doing business. Even if a deal with the EU is achieved, analysis suggests our reliance on imports means this could offer some support to UK pork prices. Prices are currently on a downward trend, and in the current climate, this may simply translate into a slower decline than would otherwise have occurred.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.