UK pig meat exports remain weak

Thursday, 16 December 2021

By Bethan Wilkins

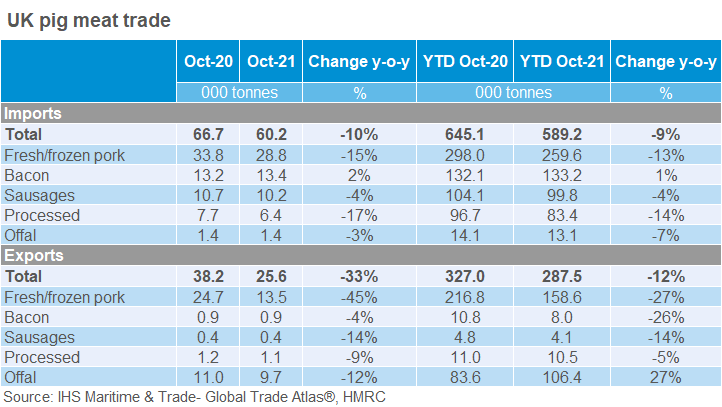

The UK’s export performance continued to falter in October. Fresh/frozen pork shipments were down compared to both September (-5%) and October the previous year (-45%), at 13,500 tonnes.

Pork shipments to China were barely over 4,000 tonnes, just a third of last year’s level, and the lowest volume since December 2018.

Exports to the EU were also down 35% to under 7,000 tonnes. Falling Chinese demand has led to oversupply within the EU and low prices, meaning UK product is uncompetitive. Ongoing effects of Brexit are also probably still playing a role.

Shipments of bacon, ham and sausages also recorded declines. Offal exports weakened too, with October’s total of 9,700 tonnes 12% lower than last year, although this was still higher than the September volume. The decrease was largely down to lower shipments to China (-35%). All in all, it is clear that the weaker Chinese market has significantly depressed our export prospects, alongside those of other global pork exporters.

As has been the case throughout 2021, UK fresh/frozen pork imports during October were down on a year earlier (-15%), at 28,800 tonnes. Ham imports were also 17% lower than in 2020 and sausage volumes were 4% lower, continuing trends seen throughout the year so far. Bacon continued to be the exception to the generally falling picture, with volumes up by 2%.

Despite pork imports overall being lower, volumes of boneless product held steady, as some processors attempt to dedicate their own butchery staff to dealing with British pigs.

With imports remaining low in October, overall pig meat imports (incl. offal) remain depressed in the year to date, totalling 589,000 tonnes, which is 9% below the already low level shipped in 2020.

Low prices for pork in the EU are likely still having a negative effect on our domestic pork prices, as long as the potential remains for this pork to be imported if its price competitiveness is strong. Nonetheless, so far it seems that the volume of EU pork that has actually arrived in the UK is relatively low.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.