UK pig meat export volumes relatively stable in May

Tuesday, 13 July 2021

By Bethan Wilkins

Exports

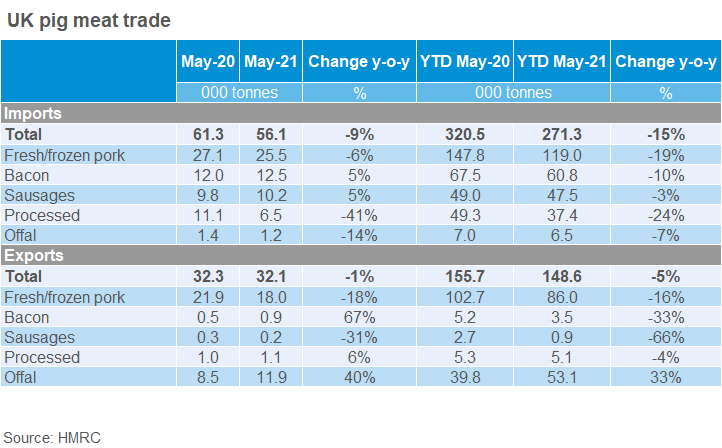

UK exports of pig meat and offal were lower than last year once again in May, at 32,100 tonnes. However, this was only 1% down on the same month in 2020.

For fresh/frozen pork, volumes totalled 18,000 tonnes, an 18% decrease on May last year. Falling export volumes to China were a key factor behind this decline, with shipments down 30% year-on-year at 7,200 tonnes. Exports to the EU also declined by a third, particularly driven by lower shipments to Germany, the Netherlands and Denmark. Meanwhile, shipments to the Philippines continued to see strong growth, with volumes increasing over fifteen times compared to May 2020, totalling 1,900 tonnes.

The value of UK exports of fresh/frozen pork only decreased by 4% in May, compared to the month last year, to £33.4 million. Despite falling wholesale prices within China, it seems prices for our exports to China were still stronger than last year, which mitigated the effect of the decline in volume.

Conversely, offal exports remained above year earlier levels in May, increasing by 40% to 11,900 tonnes. Offal shipments to China were up by a quarter to 6,500 tonnes and trade with the Philippines was nearly ten times higher than last year at 1,100 tonnes. There was an even stronger increase in the value of offal shipments, which reached £16.2 million, about two-thirds more than last year.

In total, the value of UK pig meat exports totalled £55.8 million in May, which was 10% higher than last year.

Imports

Total pig meat imports were down by 9% on May 2020, to 56,100 tonnes. Value totalled £168.8 million, 5% lower than last year.

For fresh/frozen pork specifically, volumes fell by 6% to 25,500 tonnes. The decrease was driven by lower shipments from Ireland (-53%) Germany (-11%) and Poland (-59%), with these declines totalling 2,700 tonnes altogether.

The average price of fresh/frozen pork imported into the UK was £2.23/kg, 6% behind May last year. European farmgate pig prices increased significantly throughout May and were above year earlier levels by the end of the month, but this does not seem to have fed through to pork import prices at the time. The value of pork shipments was £57.0 million, 11% lower than last year.

The large decrease in processed ham imports is particularly influenced by a drop in volumes from Poland, which approximately halved year-on-year. However, at the same time, the value of this trade reportedly more than doubled. This is a rather unusual set of trends, and suggests the processed ham import figures should be treated with some caution at this time.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.