UK January pork outlook – review

Wednesday, 11 May 2022

In January we published an outlook for the UK pork sector. Let’s now take another look at it, to see how it’s faring against more recently available information.

Main points from the pork outlook

- A contraction in the breeding herd is expected, leading to a 2% fall in UK pig meat production, weighted towards the second half of 2022

- Export markets remain challenging, with Chinese demand slowing and a weak EU market. However, trade may increase again year-on-year as new trading conditions with the EU become the norm for UK exporters

- UK demand is expected to weaken slightly, although falling production, recovering foodservice demand, and increased exports could all support import levels, particularly in the second half of 2022

Production

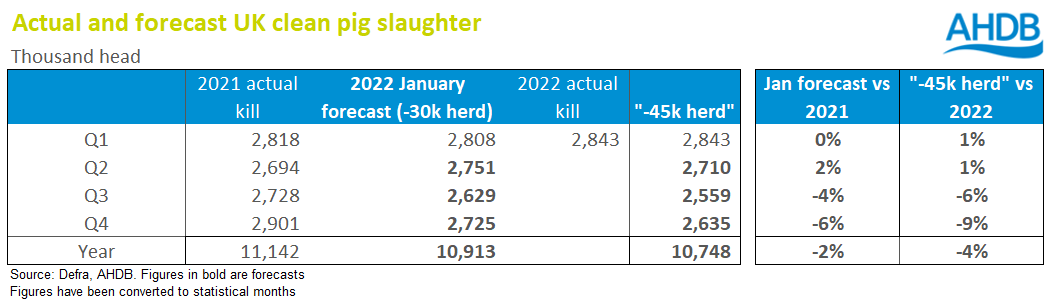

In January, we forecast that pig production would fall by 2% for the year as a whole, based on a 30,000 head contraction in the sow herd, and allowing for the size of the backlog on farms at that time. This would imply very little change in year-on-year clean pig slaughter in the first five or six months of the year.

In the first three months of the year, production has been 6% higher than year earlier levels. An increase in clean pig slaughter accounts for 1% of this, with the rest due to heavier carcase weights. Clean pigs were on average 4.3 kg heavier in the first quarter of 2022 than the same period in 2021, and also heavier than forecast. Clean slaughter itself was about 40,000 head more than forecast.

In the January forecast, clean pig slaughter was expected to fall only in the second half of the year, after the backlog had cleared. Other paths the backlog might take were considered here. Based on weekly slaughter rates alone so far, it could be expected that the backlog is being cleared more quickly than was the base case in the forecast. However, there is plenty of anecdotal evidence that there are still large numbers of pigs backed up on farms and this is supported by carcase weight data.

As mentioned, the January outlook was based on a view that the sow herd would shrink by around 30,000 head. However, input costs have continued to rise sharply, and negative margins have only worsened; the risk of this was identified in the outlook in January.

So, what might happen to numbers of available pigs, if the sow herd contracts by more, say 45,000 head by the summer? This is not to say that it could not contract by more than that amount, but this figure is consistent with survey data collected by the National Pig Association. If the UK sow herd were to contract by 45,000 head (to 370,000 head) by the summer, then clearly the clean pig slaughter falls further than forecast in January as supplies tighten. This is shown in the table below.

It is worth noting that if the backlog takes a very long time to clear, this may indicate that either the Defra December survey underestimated the size of the backlog at the beginning of the year, or that contraction in the sow herd is happening at a slower pace. Data on the size of the pig population in June is not typically available until late autumn.

Trade

Trade data is only available for the first two months of the year. HMRC’s trade figures show that the UK exported 38,000 tonnes of pig meat, up 30% compared to the same period a year ago, which is slightly more than expected. Imports totalled 153,000 tonnes, 61% more than a year ago and also more than expected. Much of the annual increases will be attributed to recovery from last year’s post-Brexit lows, but also higher production, and the speed of recovery in the foodservice sector following coronavirus disruption. As forecast, Chinese import demand has remained weak, and this is expected to continue.

Demand

As with beef and lamb, some consumer demand is shifting out of the retail channel and into foodservice, as pubs and restaurants continue to reopen and increase offerings. Retail data for the 12 weeks to 17 April compares with a year ago, when more restrictions were in place. As such, total pork retail volumes declined by 10% year-on-year during this period.

If we take foodservice and retail volumes together, total pig meat sales were estimated to be down only 1.6% compared to 2021 (52 weeks to 20 March).

Inputs

Although pig prices have improved, the biggest difference in the market compared to when the forecast was made in January, is the price of inputs, already high then, and further pushed up significantly by Russia’s invasion of Ukraine. The impact on the pork sector is likely to be more pronounced than for other red meats, due to the nature of its production system.

Other areas to monitor in the coming weeks and months will be carcase weights, the backlog, and of course feed and other input costs (and indeed future grain pricing, thinking ahead for future feeding requirements). Much will depend on the quantity and quality of the homegrown cereals harvest, but also global market developments.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.