UK January beef outlook review

Thursday, 5 May 2022

In January we published an outlook for the UK cattle sector. Let’s now take another look at it, to see how it’s fairing against more recently available information.

Main points from the beef outlook:

-

More prime cattle available to kill in 2022, focused in the second half of the year. Slightly fewer cows available to kill. Overall production forecast up 1%.

-

Overall beef demand expected to fall by 1%, as retail sales lose some share to foodservice, but foodservice not recovering to pre-pandemic levels.

-

Beef imports forecast to grow by 1%, as foodservice demand increases, and increased cattle supplies in Ireland.

-

Beef exports to increase by over 10% in 2022, driven by lower overall domestic consumption, higher production, and increased foodservice demand on the continent.

Production

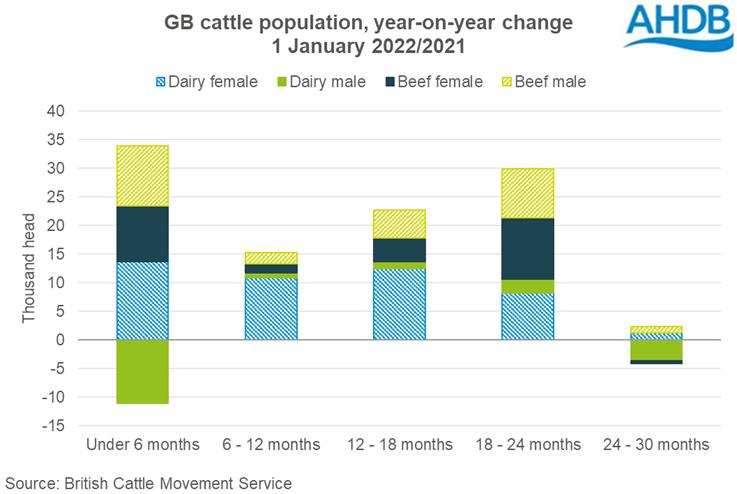

In January, we forecast that prime cattle kill would increase by 2% in 2022 compared to 2021, but with supplies likely to remain tight in the first half of the year. Cow kill was expected to remain slightly below 2021 levels, due to longer-term contraction in the suckler and dairy herds. Overall, this was forecast to lead to a 1% increase in beef production for the year.

So far in 2022, prime cattle kill has reached 485,400 head, 4% lower than the same period a year ago. Lower slaughter at this point in the year was to be expected, judging by cattle population figures available at the time.

Cow kill reached 161,000 head, up 2% versus a year ago. This is slightly ahead of where we were forecasting cow kill to be by this point. Cull prices have hit record highs so far in 2022, and coupled with the rise in input costs, these factors could well be motivating slaughter decisions.

As a result, total beef production during the first quarter of 2022, although down 2% year-on-year at 223,400 tonnes, is slightly ahead of expectations for the first quarter of the year.

Trade

HMRC’s trade figures for the first two months of 2022 showed that the UK exported 17,700 tonnes of beef, up 55% compared to the same period a year ago. Imports totalled 55,800 tonnes, which is double the volume imported over the same period in 2021. Much of the annual increases will be attributed to recovery from last year’s post-Brexit lows. The uplift in imports came predominantly from Ireland and look unusually high. These figures will be watched closely with future releases for any potential revisions.

Demand

As with the other proteins, some consumer demand is shifting out of the retail channel and into foodservice, as pubs and restaurants continue to reopen and increase offerings. Retail data for the 12 weeks to 17 April compares with a year ago, when more restrictions were in place. As such, primary beef retail volumes declined by 18% year-on-year during this period.

For foodservice, growth is coming from traditional meals in pubs and restaurants, with burgers also showing strong increases. Despite this growth, if we take foodservice and retail volumes together, total beef sales were estimated to be down 5.5% compared to 2021 (52 weeks to 20 March).

Inputs

The biggest difference in the market compared to when the forecast was made in January, is the price of inputs, already high then, and further pushed up in price by Russia’s invasion of Ukraine. The impact on beef production is likely to be more pronounced than on sheep meat, but less so than pork, due to the nature of feed usage. Perhaps the most immediate factor to watch will be prime carcase weights, especially bulls, which rely more heavily on cereals-based rations.

Another area to monitor will be cow slaughter and population figures, (an indication of producer retention decisions) considering current cull prices and feed costs (and indeed future grain pricing, thinking ahead for winter feeding requirements). Much will depend on the quantity and quality of the homegrown harvest, both for cereals and forage.

AHDB has produced a calculator to help graziers decide if the inflated price of fertilizer is worth paying, given the inflated price of bought feed.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.