UK beef self-sufficiency and impacts of Brexit

Friday, 6 November 2020

By Charlie Reeve

Self-sufficiency

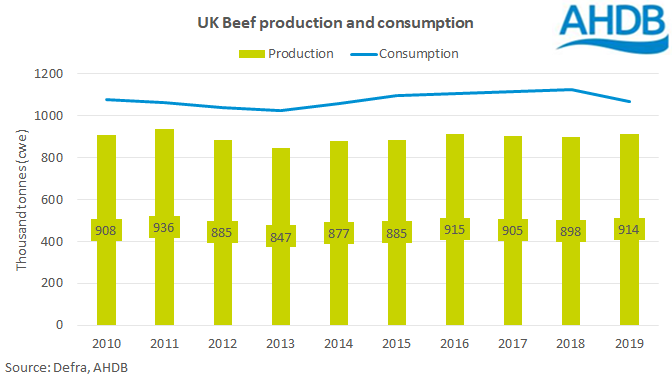

In 2019, the UK was 86% self-sufficient for Beef. This was an increase of 6% on the previous year due to a combination of increased production and reduced consumption. More beef needed to be exported to balance the market.

With self-sufficiency at this level, the UK is of course a net importer of beef year after year.

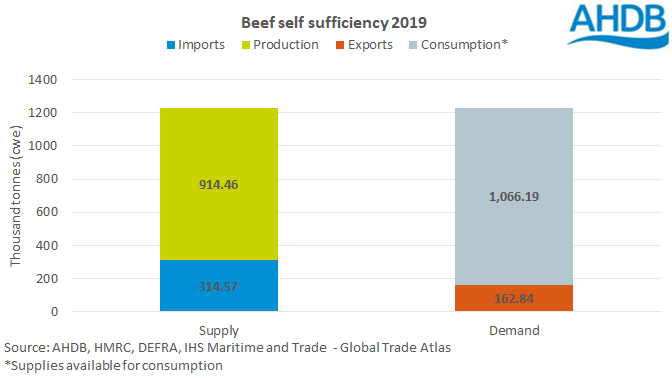

In 2019, the gap between UK beef production and domestic consumption was 152,000 tonnes. In order to fill this deficit 315,000 tonnes of beef were imported, as 163,000 tonnes were exported.

Total beef production in 2019 reached 914,500 tonnes, consumption during the same period was estimated at 1.1 million tonnes. International trade is important not only to meet demand, but also balance the carcase, and demand for the different cuts of beef that are purchased by consumers in the UK. Most of the beef that is imported comes in the form of fresh boneless beef, and the EU market is an important destination for cow beef for example. Exports tend to be at a lower price than imports.

Imports and exports

The major exporter of beef to the UK is Ireland. In 2019, Irish beef accounted for 78% of imports entering the UK. Ireland is also the largest export destination for UK beef exports with a large amount of trade taking place between the two countries, with further processing taking place on both sides of the Irish Sea.

The UK’s main other export destinations are also currently in the EU, in particular the Netherlands and France. However, the UK does export elsewhere and recent trade deals with Japan and the U.S. have opened wider market access.

Brexit

In the event of no deal being reached between the UK and the EU, UK exports to the EU would face tariffs. The UK government has published the tariffs it intends to impose on imported beef. These tariffs could be subject to revision at a later date. These import tariffs, combined with the UK’s position as a net importer, imply that beef prices here can be expected to rise.

However, even if a deal is agreed, it is not necessarily all plain sailing across the channel for UK beef exports. The UK will become a third country, and so there would be some impacts on trade regardless of tariffs. These might include increases in the time taken for transportation due to checks at borders, and are expected to increase the cost of doing business in any case. It is reasonable to expect some disruption to trade in particular in the early days.

Leaving the EU allows the UK to strike its own trade deals, which could offer both opportunities and risks for the UK beef industry. The UK is not the most competitive country in terms of the cost of production, although UK beef may be able to fetch premium prices in specific markets around the world. On the other hand, after time, there is a chance of competitively priced beef imports entering the UK from countries where costs of production are much lower, such as Brazil and Argentina.

What’s happened in 2020 so far

Consumer demand so far in 2020 has been on a bit of a rollercoaster. During the initial lockdown, retail sales were strong especially for low value offerings such as mince. The initial closing of the foodservice sector resulted in less demand for premium cuts such as steak, although action taken in supermarkets and the supply chain, along with AHDB’s Make it Steak campaign, helped address these carcase balance issues.

UK farm gate prices have been stronger in recent months, well above last year’s prices for the time of year. Although of course they do follow a prolonged period of low prices, and feed costs are increasing again as the winter housing period begins. As the UK now enters a second lockdown it will be an interesting time for markets especially as demand normally increases in the run up to the Christmas period.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.