UK barley market prospects: Grain market daily

Tuesday, 10 December 2024

Market commentary

- UK feed wheat futures (May-25) ended yesterday’s session at £188.60/t, up £1.25/t from Friday’s close. The Nov-25 contract was up £0.95/t over the same period, to close at £189.40/t.

- Domestic wheat futures closed higher following Paris maize futures. Paris milling wheat futures (Mar-25) closed lower and maize futures (Mar-25) closed higher yesterday. The global wheat market is trying to find a direction for price movement amid a flurry of weather risk information. China, one of the largest maize importers, cut its 2024/25 production forecast to 293.8 Mt from 297 Mt (LSEG).

- May-25 Paris rapeseed futures closed at €527.25/t yesterday, up €6.75/t from Friday’s close.

- As well as Paris rapeseed futures gaining yesterday, Winnipeg canola futures (May-25) also closed 1.6% higher yesterday. However, favourable weather and a huge soyabean crop in South America weighed on the soyabean market. We are awaiting the USDA’s December WASDE report today.

UK barley market prospects

The domestic barley market is somewhat subdued this season. While usage in animal feed is expected to be higher (due to its relative price to wheat), bringing total barley usage up on the year, demand by brewers, maltsters and distillers (BMD) is lower. From July to October 2024, usage of barley by the BMD sector is 9.7% lower than the same period in 2023. UK barley exports are also slower this season, with July to September 2024 exports totalling 98.5 Kt, compared with 225.4 Kt by this point last season. Exports have been slower this year, due to several reasons; firstly, the tightness in the domestic wheat market has hampered barleys competitiveness on the export market. Secondly, Spain’s barley production rebounded in 2024, one of the UK’s largest barley export destinations. Lastly, with EU malting barley markets having higher nitrogen requirements than the UK, this year’s crop offers less opportunities, given the lower nitrogen levels recorded.

Globally, the 2024/25 barley area was the lowest for the last 20 years, according to November USDA data. World barley ending stocks in 2024/25 marketing year could also be at their lowest level for the last 20 years. However, the EU barley market is operating as if its more comfortably supplied than it suggests on paper.

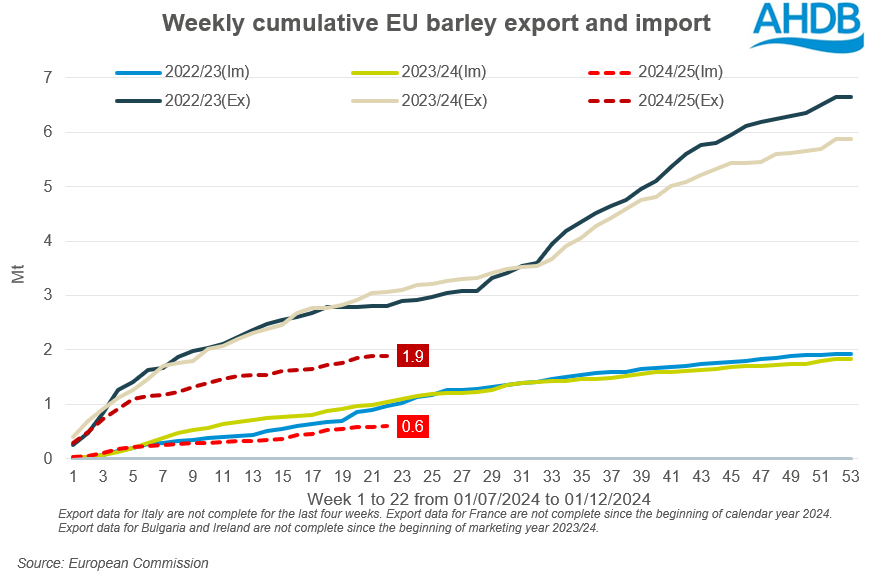

The European Commission (EC) currently have full season EU barley exports forecast at 10 Mt for 2024/25, which is relatively in line with 2023/24 levels (9.95 Mt). However, as of 1 December 2024, from the start of current season in July EU barley exports have totalled 1.89 Mt, down 38% from the same period in 2023, when 3.06 Mt had been exported, according to latest data from the EC. EU barley imports are also lacklustre, with the bloc importing just 601 Kt to date, down 42% from the pace last season.

Looking ahead

The provisional results of the Early Bird Survey for harvest 2025 suggest a drop in the total UK barley area for harvest 2025, driven by a reduction in spring and winter barley plantings. If realised, at 1,084Kha, this would be the smallest UK barley area since 2014. One of the reasons for the reduction in intended planted area is thought to be the squeeze in malting barley premiums.

EU barley trade is quite steady at the moment, with the pace of exports needing to accelerate during the second half of the season to meet the current projection for full season exports. Firm maize prices are somewhat supporting barley prices in the EU and globally. The Australian barley harvest is in its final stages, adding competition to the market.

Looking ahead to next season, if a smaller barley area is planted in the UK, then it’s likely we will again have a smaller exportable surplus.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.