UK barley hoping for rises? Grain market daily

Thursday, 19 November 2020

Market Commentary

- Both the UK old and new crop wheat contracts have increased this week. The May-21 contract has increased £1.50/t from Friday, to close at £192.30/t yesterday. Gains in Nov-21 UK wheat contract were less, at £1.30/t, to close at £160.15/t.

- The Chicago soyabean futures contract (nearby) eased after closing above a four-year high this week. The recent high follows dry weather in South America and continued demand from China. The contract closed at $432.01/t (£325.58/t). Paris rapeseed futures (nearby) also rose, reaching €414.50/t (£370.23/t) at close yesterday.

- The latest and final update to GB 2020/21 cereal quality figures (CQS) is available now and can be found here.

UK barley hoping for rises?

A second 8Mt+ barley crop in two seasons, has again meant that exports are going to be key for the UK barley market. However, exporting this season is not straight forward, with a challenging global market, and strong export competition. This article will examine global barley prices to gain insight on future domestic price direction.

Alongside the large barley crop, we know from the cereal quality survey, that malting barley targets have been missed by many GB samples, resulting in an increase in tonnages for feed markets. Add to that, the ongoing pandemic and resulting pressure on malting and it leaves domestic prices with an uphill climb to gain value.

Ex-farm feed barley (UK, nearby) was quoted at £138.50/t in the week ending 12 November, a £46.80/t discount to feed wheat. The gap to wheat has grown since the start of the season, and gains in the value of barley have mostly been on the back of gains in wheat. There are a number of factors preventing this spread narrowing and these can be seen if we examine the end markets for domestic barley.

Barley inclusion rates in animal feed production are reportedly at their limits, with barley usage already up 28.5% year-on-year (Jul-Sept). From a brewing, malting and distilling perspective, barley usage has declined 14.7% over the same period. Insight into the impact on the malting barley sector from the current lockdown can be found here.

Though increases to feed usage this season are seen (+14%), the domestic barley surplus for free stock or export is estimated at 2.28Mt, according to the AHDB balance sheet released last month. As a result, exports will be pivotal and UK barley prices will need to remain competitive.

With this in mind, how competitive are we?

Uncertainty still remains over the trading relationship we will have with the EU come January. With the risk of tariffs, the UK could increasingly have to compete with Australian, Black Sea and French barley for non-EU export business. A no-deal scenario would result in tariffs for UK barley going into the EU although we would still be able to access the EU third country tariff rate quota (TRQ’s). The EU TRQ for barley stands at 307Kt of imports at €16/t, after which a €93/t tariff is imposed on further tonnages above this quota.

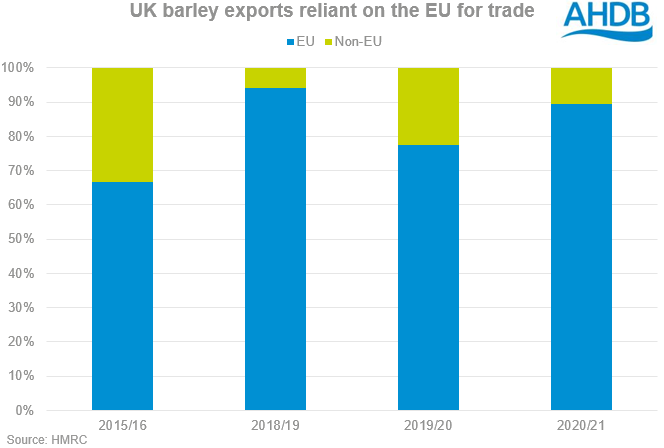

Last season, 23% of UK barley exports were to non-EU homes, the largest share since 2015/16. This season, to September, the share exports to non-EU homes stands at 11%, with exports to Algeria and Morocco totalling 28.8Kt.

Though this figure is an estimate, it gives a rough idea as to the situation facing barley markets for the second half of the season.

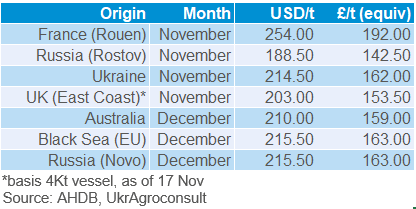

If we look at export (FOB) prices, we can see how competitive UK barley is. These prices were as at 19 November.

The UK sits around the middle of the pack and is pricing competitively against global origins. This is to be expected given the need for exports, especially before the upcoming Brexit deadline.

There has been plenty of activity in global barley tenders this week. The latest Saudi Arabian (SAGO) tender for 730Kt of feed barley was met with accepted Cost, Insurance & Freight (CIF) offers ranging between $229.83/t and $237.82/t. Though origins are yet to be disclosed, the majority are thought to be from Australia and Black Sea regions. This week, Jordan too has bought 60Kt of feed barley for delivery next year, with the accepted CIF price at $238.99/t.

Could feed barley then move higher?

The ability for feed barley to rise looks to be subject to a trade deal with the EU. The large surplus this season that is weighing on markets is cleared most efficiently through exports to the EU. In the last five years, the trade bloc has accounted for an average of 85% of UK barley exports; having this route subject to a €93/t tariff, after the TRQ of 307Kt had been filled, would effectively cease fresh purchases. At the moment, the uncertainty and risk of losing this market has acted as a cap on large price gains in barley.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.