What impacts will the malting barley sector see from stricter lockdown measures?

Thursday, 5 November 2020

Market Commentary

- Both the UK old and new crop wheat contracts increased yesterday. The May-21 contract increased £1.05/t to close at £188.60/t. Gains in Nov-21 UK wheat contract were less at £0.80/t to close at £158.20/t.

- The FAO world food price index rose for the fifth consecutive month, averaging 100.9 points in October, up from 97.9 for September. The food price index tracks monthly changes in price for a basket of cereals, oilseeds, dairy, meat and sugar.

- With South American weather forecasts, detailing unfavourable dryness, potentially affecting planting pace for the Brazilian soyabean crop, CBOT soyabean markets felt incentives to rise.

What impacts will the malting barley sector see from stricter lockdown measures?

The imposing of stricter lockdown measures that came into effect today will see the English hospitality sector limit the sale of alcohol to a takeaway only basis, with ‘eat-in’ meal occasions restricted until 2 December. The implications of which will be seen across the agricultural sector. This article will focus on the demand impact for malting barley.

This impact will primarily be the loss of alcohol sales from pubs, bars and restaurants (on-trade). An uptick in retail sales (off-trade) of alcohol could help ease some losses though not to the extent required. Over the course of September, an additional £261 million was spent on retail alcohol sales compared to the same period last year, perhaps indicating a change in consumer trends during the pandemic. Brewing demand is likely more to be affected by this current lockdown, owing to the shorter lead time compared to liquor production, with whisky as an example. Distillers could see longer-term impacts from lockdown measures, in the twelve months to 31 March 2020, 16% of spirit alcohol servings took place after 10pm in the UK on-trade, compared to 7% for beer, according to Kantar.

Should separate lockdown measures be eased in Northern Ireland, Scotland and Wales earlier than the English proposed end, then UK demand could see increases. Though it is uncertain at this point on further lockdown measures in these countries.

The government move to permit the takeaway sale of alcohol from on-trade providers will likely help to reduce stock levels with some levels of demand created. The created levels of footfall to on-trade is uncertain at this point but should help to provide demand for the sector nonetheless.

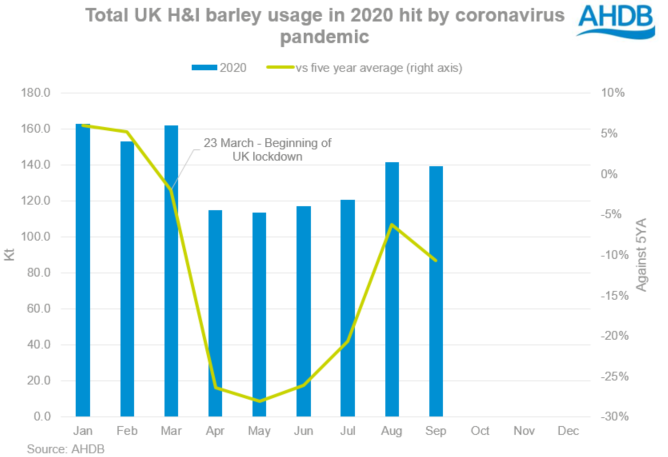

In the season to date, barley usage by Brewers, Maltsters and Distillers (July – Sep) has begun to show signs of recovery against the five year average from March to June levels. September total barley usage was at an 11% decline against the five year average, compared to a 6% decline for August. The increase in demand following the government ‘Eat Out to Help Out’ voucher scheme could help to explain August increases in usage figures. September total barley usage figures were 2.1Kt below August levels, though it is the five-year average that is higher for September. The overarching pressure on demand from the pandemic has continued to weigh on figures. According to AHDB, season to date (Jul – Sep) total barley usage levels were at 401.2Kt, 15% below 2019/20 season to date levels.

Over the course of the previous lockdown from April to June, total barley usage by BMD, was at an average decline of 27% against the same period last year. Taking this into account, we could expect a somewhat similar decrease over November. One difference to note however, is that maltsters, brewers and distillers all intend to remain open throughout the lockdown, though some slowing production levels, according to reports from industry. For November, a 20% decline from the five year average would equate to a ‘loss’ of 30.3Kt, with total barley usage then estimated at 121.10Kt.

Have tonnages moving off farm been affected?

An estimated 60% of total required malting barley tonnages for the season are bought before the new calendar year. For the 2020/21 season, we forecast a total barley human and industrial (H&I) usage figure of 1.70Mt. Taking a look at brewing markets, approximately 31% of H&I barley usage is for brewing, representing a figure of 528.9Kt of barley required for brewing markets this season.

Corn return volumes for malting barley (premium + other) dated for 2020/21 delivery indicate 143.1Kt has or will be moved off farm pre-Jan as of 29 Oct. This is a 38% decline against the same period last year. This figure is likely understated due to ‘Other purchases’ not included in this figure, as a result of the inability to distinguish valid delivery dates.

Why has this happened?

This decline could be attributed to supply and demand factors.

On-trade demand has seen pressures from the ongoing coronavirus pandemic. Despite the pick-up in demand from the government voucher in August, there is still a significant portion of licensed premises that remain closed. By the end of September, 80.4% of total licensed premises were trading, up only slightly from 76.3% in August, according to CGA.

We know from the AHDB cereal quality survey second provisional release, that high protein levels in barley samples have been a more frequent feature this season. As such, a greater volume of samples missing malting specifications will reduce the availability of malting barley.

If indeed total barley usage for BMD is affected by the November lockdown and an estimated 30.3Kt of barley is ‘unused’ then it is important to discuss where this additional supply may go.

Should lockdown measures be eased in December and further in 2021 then we could see demand start to return and usages increase to approach historical averages for the months ahead, similar to August where total barley usage was just 6% below 5YA levels. The November ‘losses’ could be rolled into the coming months though the short to mid-term future remains very uncertain at this point.

Exports are an additional option. Increased barley availability this season has again meant exports are key to reduce the surplus. Though the UK has exported 134.46Kt of barley over Jul - Aug, 59% below total tonnage for the same point last year. Some of this decline could be attributed to both the later harvest and a slow start to farmer selling. Trade data for September should be released in the coming days. Uncertainty is also present in trade markets given the upcoming Brexit deadline and a lack of trade agreements with the EU currently.

Conclusion

The full extent of the impact this second lockdown will have on the malting barley sector is uncertain at this point. Usage statistics for November will be released in January, enabling a better concrete review. An easing of lockdown measures in Wales, Scotland and Northern Ireland before the end of the English lockdown could cushion some of the impact too.

The impact felt by sectors will be exacerbated further should the lockdown be extended past its current 2 December ‘ending’. Though Christmas will certainly be different this year, the period will still be a focal point for demand, and the closure of the hospitality sector during the period could have lasting ramifications for the domestic malting barley picture.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.