Time to think new, new crop prices? Grain market daily

Wednesday, 29 May 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £223.55/t yesterday, up £3.55/t from Friday’s close. The market was closed on Monday for the Spring Bank Holiday.

- Global wheat markets were supported as IKAR and Sovecon both revised their Russian wheat crop estimates downwards to 81.5 Mt and 82.1 Mt respectively following the pressure from dry weather and frost. In addition, the USDA’s winter wheat rating dropped one percentage point to 48% good-to-excellent as at 26 May, contrasting the average analyst expectation of no change on the week. Also, in the latest EU MARS report, the EU’s soft wheat yield was lowered on the month from 5.93 t/Ha to 5.92 t/Ha.

- Paris rapeseed futures (Nov-24) closed at €496.50/t yesterday, down €1.25/t from Monday’s close.

- A slide in soyabean futures weighed on the oilseed complex as soyabean meal futures fell due to competitively priced South American meal exports. Furthermore, soyabean planting progress in the US exceeded the average analyst expectation by two percentage points, reaching 68% complete as at 26 May, above the five-year average of 63%.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Time to think new, new crop prices?

Although planting of spring crops for harvest 2024 has not long finished, the time to confirm planting plans for harvest 2025 is approaching. There will likely be challenges around getting back into desired rotations and repairing soils after last year’s wet autumn, but could also give opportunities to make changes. Many of AHDB’s summer events include discussions around cropping choices and soils; check out what’s happening in your area here.

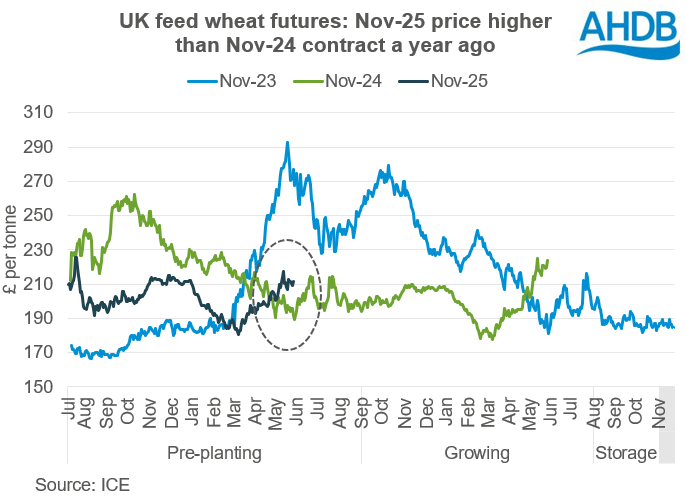

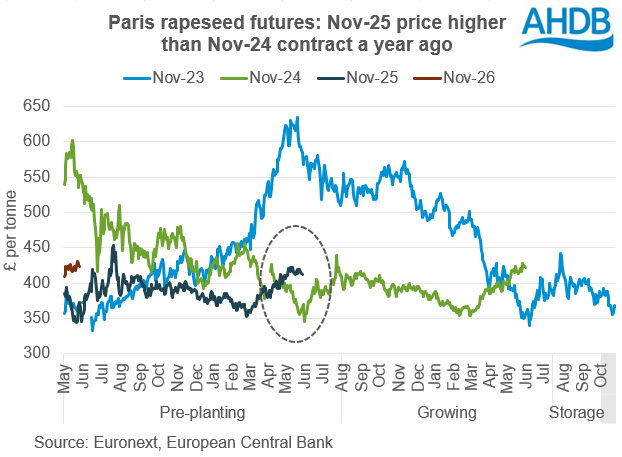

As people start to think about finalising plans and booking inputs, it’s worth keeping an eye on prices for the 2025 crops. For both wheat and rapeseed, Nov-25 futures are currently higher than where the Nov-24 futures were a year ago (see below).

This far ahead of the season, there’s much less trade on the UK feed wheat and Paris rapeseed futures than for nearer contract months. This means it might be harder to make physical sales. However, it’s always worth monitoring prices and staying in touch with your merchant(s) as you commit to growing the crop.

Nov-25 UK wheat futures pulled up

Nov-25 UK feed wheat futures closed at £211.55/t yesterday. While up £2.20/t compared to Friday, it’s also over £30.00/t above the level in early March. The worries about the global 2024/25 harvest have also pulled up harvest 2025 prices too. As a result, Nov-25 futures are around £15.50/t (8%) above the Nov-24 price a year ago (26 May 2023, i.e. ahead of planting).

The current Nov-25 price does sit £12.00/t below the current Nov-24 futures price. This reflects that typically wheat areas lift the year following a wet autumn. There is also still some uncertainty about what crops are in the ground for harvest 2024. AHDB’s Planting and variety survey will give the next insights into the areas. The survey is open until 21 June and if you’re able to contribute, you can help everyone understand the full impact of the wet weather on the cropped area.

OSR prices up too

Nov-25 Paris oilseed rape futures have also lifted too since late-February. Concerns about EU rapeseed production, along with spillover support from the grain market and buying activity by speculative traders all contributing.

In Euro terms, the Nov-25 contract closed at €484.00/t yesterday, up over €70/t (17%) since late-February. Also, the Nov-25 Paris rapeseed price is €58.75/t or 14% higher than the Nov-24 price was a year ago (i.e. ahead of planting).

There’s a very similar pattern when the values are converted into pounds, though the percentage gains are slightly less due to shifts in the exchange rate. Yesterday, Nov-25 futures equated to approx. £412/t. A year ago, the price for Nov-24 (the 2024 crop) was approx. £369/t.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.