Wheat stock projections add to market nerves: Grain market daily

Thursday, 16 May 2024

Market commentary

- Nov-24 UK feed wheat futures saw minimal price movement yesterday, down £0.05/t to close at £217.95/t.

- Global wheat markets were mixed but moved relatively sideways yesterday. US wheat markets were slightly pressured after improved weather across the US plains saw strong yield potential during the annual US wheat tour. However, Paris wheat was supported slightly as concerns remain over the Russian crop. Sovecon revised down its wheat crop estimate yesterday to 85.7 Mt, from 89.6 Mt (LSEG).

- Paris rapeseed futures (Nov-24) ended yesterday’s session at €483.50/t, down €1.50/t from Tuesday’s close.

- European rapeseed markets followed US soyabean prices down yesterday. US soyabeans were pressured after the National Oilseed Processors Association (NOPA) reported that soyabean crushing fell to a seven-month low in April.

Wheat stock projections add to market nerves

The initial projections from the USDA show global wheat demand exceeding production by over 4 Mt. Wheat production is forecast to rise 10.5 Mt year-on-year due to recoveries in output for Australia and Kazakhstan, plus rises for the US and Canada. However, this would still not be enough to meet demand, which is up 2.0 Mt to 802.3 Mt.

This includes a Russian wheat crop of 88.0 Mt. This is down 3.5 Mt year on year but in the same ball park as the latest IKAR and SovEcon estimates.

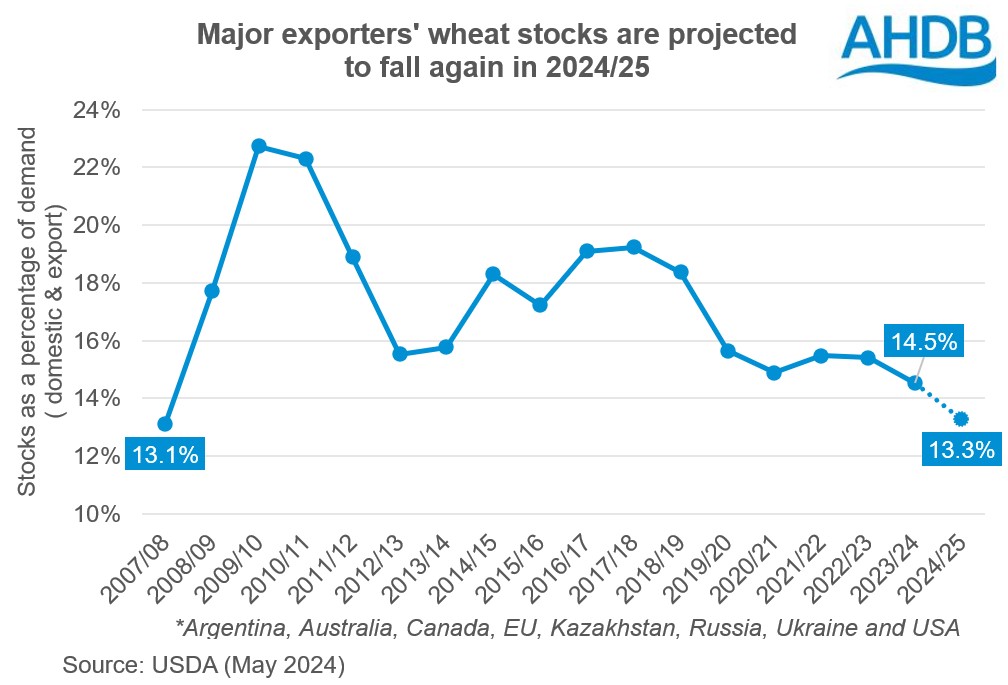

The USDA predicts stocks held by major exporting countries (Argentina, Australia, Canada, European Union, Russia, and Ukraine) to fall over 2024/25 by 6.9 Mt to 31.7Mt. But with global demand rising, it’s important to look at stocks relative to demand. Stocks in these countries at the end of 2024/25 in are predicted to equate to just 13.3% of combined domestic and export demand. This is down from an estimated 14.5% at the end of 2023/24 and would be the lowest since 2007/08 (13.1%).

However, similar predictions have been made in recent years, the situation has evolved and the market has reacted. So, it’s still early days for the 2024/25 season. Jack Watts and I discuss what the USDA forecasts means in the context of recent market trends in the video below.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.