The UK-Ukrainian continuity agreement and what this means: Grain market daily

Friday, 13 November 2020

Market Commentary

- May-21 London wheat futures eased back yesterday, closing at £190.60/t a fall of £0.35/t from the previous day’s close. With exchange rates easing back against the euro and dollar, this counteracted any gains made this week from a strengthening pound.

- Argentina’s wheat harvest estimate has been revised from 17Mt to 16.7Mt by the Rosario Grain Exchange (BCR); this figure will be the lowest in five years.

- Despite some falls in wheat and maize futures this week, tenders continued to provide some market support with Algeria purchasing 600Kt wheat, Pakistan purchasing 400Kt wheat and South Korea purchasing 130Kt maize.

- CBOT soyabean futures are up 8% in the past 2 weeks from strong Chinese demand. NOPA soyabean crushing’s in October were also up 9.7% from September due to strong processing margins; NOPA handle 95% of processed US soyabeans.

The UK-Ukraine deal, what does this look like for grains?

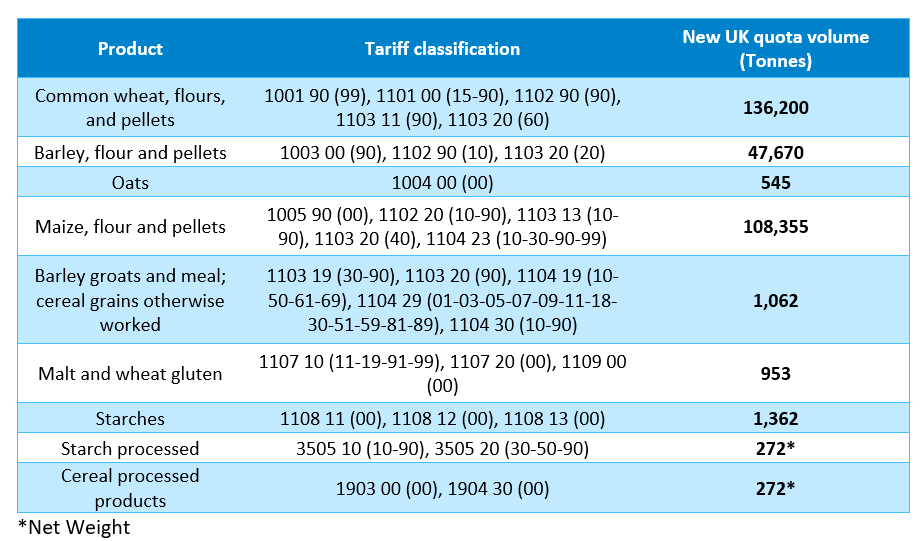

As one of the first outlined by the Department for International Trade (DIT), the UK-Ukraine continuity agreement facilitates trade after the 31 December 2020. Following on from the EU-Ukraine Agreement, the agreement looks to replicate technical outlines, but with some adjustments in Tariff Rate Quotas (TRQs) to cereals outlined below.

The new TRQs work on two rules of origin:

- Wholly obtained or produced in Ukraine

- Substantial transformation through added value, change in tariff classification or specific processing or manufacturing.

For a full list of TRQs, follow this link.

Sanitary and phytosanitary regulations are to remain in a similar format, but with ‘EU protected Zones’ replaced with ‘Pest-Free Areas’ and the requirement to notify any disease outbreaks.

What this could mean for the UK

Wheat

With the AHDB Early Balance Sheet forecasting a wheat import requirement of 2.15Mt this season, Ukraine could be one place we look towards to help fulfil this requirement. On average over the last five seasons, 2% of wheat imports have been from a Ukrainian origin.

The TRQ of 136Kt of low and medium wheat surpasses total wheat imports for recent marketing years and potentially facilitates further future trade on leaving the EU at the end of December. Above this TRQ though, low and medium quality wheat would incur a tariff of £79/t on the MFN basis.

Tariffs for high quality wheat are currently set at £0/t under the UK General Tariff Schedule. However, there is currently little information around what tolerances there would be on the specification of imported wheat. The EU states a 0.7% protein tolerance at a 12% moisture, but it remains to be decided as to whether this would be transcribed to the UK. As Alex pointed out on Tuesday, the small domestic crop this season has seen the use of imported wheat soar already this season.

Maize

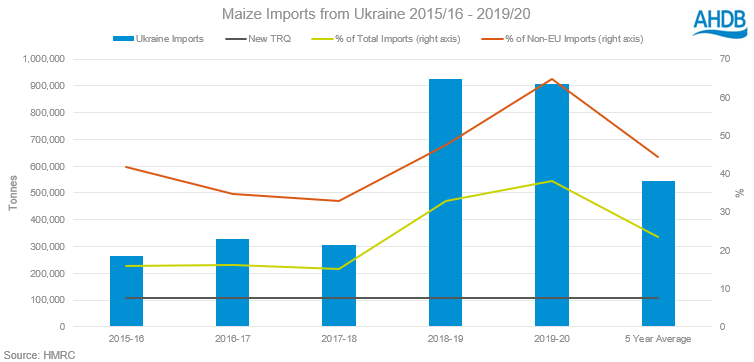

Ukrainian maize shipments of 906Kt accounted for 65% of non-EU imports in 2019/20. The new TRQ outlines a limit of 108Kt. While this falls short of the previous year’s imports, above this quota, the UK General Tariff is set at £0/t for maize. Given the uncertainties the UK currently has around access to lower quality wheat imports, we could well see considerable maize imports after 01 January 2021, with Ukraine potentially able to fulfil some of this requirement.

The latest WASDE report pegged back Ukrainian maize production this season to 28.5Mt, from 36.5Mt in October following dry conditions in the region. They also projected that exports would decrease 8Mt, to 22.5Mt. With this, and forecasts of other global exporters pegging back their production levels, we may not have quite the surfeit of maize globally as anticipated earlier in the season, and therefore prices could see some support. Anthony talked about the drivers of this maize support on Wednesday.

The introduction of this continuity agreement is positive in terms of facilitating trade on departure of the EU and provides some reassurance to continue imports of both low and medium quality and maize.

However, how much it will assist and fundamentally change how the nations have been trading may be minimal, given the previous season trade levels, and the zero-rated tariff for maize under the UK General Tariff schedule.

This agreement must first be laid before Parliament under the Constitutional Reform and Governance Act 2019 before ratification. If accepted, either party can request a review of the agreement after 2 years from entry into force on a product-by-product basis.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.