UK usage of imported wheat soars in 2020/21: Grain market daily

Tuesday, 10 November 2020

Market Commentary

- UK old and new-crop futures closed up yesterday continuing gains from last week. The May-21 contract increased £0.30/t to close at £191.10/t. Smaller gains were seen for the Nov-21 UK wheat contract, up £0.15/t to close at £159.35/t.

- Agricultural markets await the release of the November world supply and demand estimates (WASDE) by the USDA. In particular, updates to Chinese 2020/21 maize import estimates are a watch point, given US export sales to China already exceed current season-long forecasts.

- The US maize harvest was at 91% complete in the latest US crop report yesterday. This is 11% ahead of the five-year average for this point. The US winter wheat crop was rated at 45% good to excellent, up 2% from last week’s report.

UK usage of imported wheat soars in 2020/21

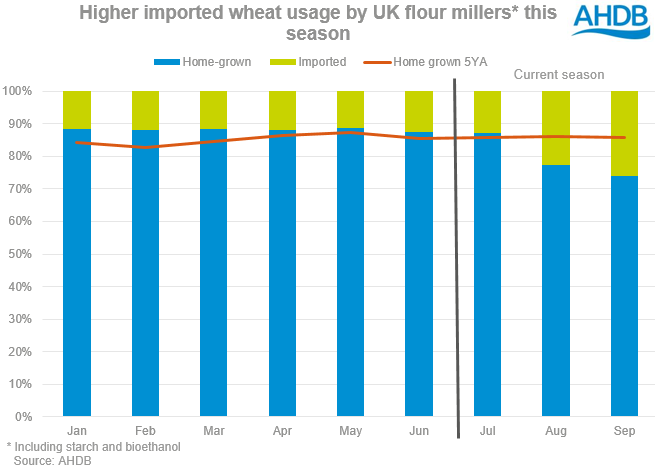

With the release of our cereal usage statistics up to September last week, it is worth now examining how the UK milling industry has fared in the first three months of the season with increased support from imported supply anticipated.

Both a reduced domestic supply and demand picture have impacted wheat usage this season, with greater reliance on imported supply. Total wheat usage by UK flour millers (including starch and bioethanol) from July to September stands at 1.47Mt, up 2.1% year-on-year.

The impact from the reduced availability of domestic wheat is already evident. In the season to date (Jul-Sep), the milling of home grown wheat was 17% below the five-year average (5YA), and the lowest figure since the 2013/14 season. In that season, an 11.8Mt wheat crop had quality significantly impacted by the wet harvest.

Home grown wheat quality too has been an issue this season, with 31% of samples meeting UK high quality bread milling specifications based on data up to early October. The final cereal quality survey results are to be released later this week.

An increase in imported wheat milled was evident in August usage figures at 23% above the five-year average. This trend has continued with September figures at 40% above the five-year average. With September at 133.7Kt, this represents the highest monthly total since September 2018, and before that September 2013.

With imported tonnages holding greater importance in the UK market this season, movements in global and especially European grain markets will have greater meaning for domestic prices. With domestic wheat prices capped by the cost of importing grain, knowing current and future trends for grain markets is imperative to recognise price direction. Uncertainty over potential trade tariffs come January means more incentive to import before then but millers could also increase their usage of home grown tonnages, if tariffs are imposed.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.