The only Brexit certainty is uncertainty: Grain Market Daily

Wednesday, 4 September 2019

Market Commentary

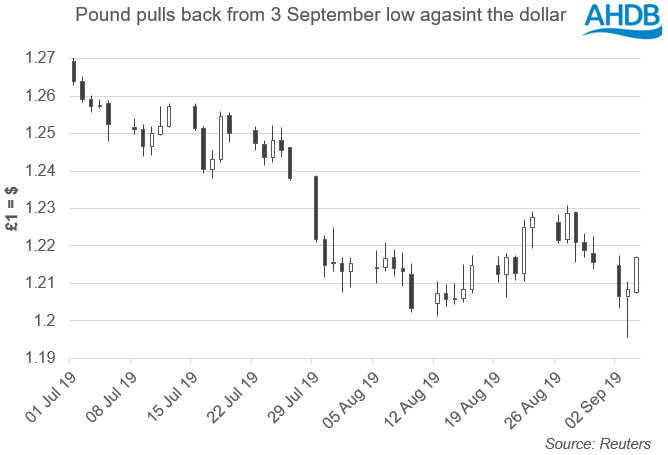

- A fall in the pound during wheat trading hours provided a temporary lift to UK feed wheat futures yesterday, the Nov-19 contract gaining £0.70/t yesterday.

- Following last night’s vote in the House of Commons, the value of the pound has recovered against both the euro and dollar.

- The condition of US spring wheat has slightly deteriorated and the pace of harvest is behind expectations, providing a temporary lift to grain markets today.

- The condition of Maize in the US has again been revised up and forecasts are for beneficial, warmer than average, weather in the US.

The only Brexit certainty is uncertainty

- Following last night’s vote in the House of Commons, a bill will be brought forward later today requesting to avoid a hard Brexit and potentially delay Brexit beyond October 31.

- The outcome of today’s bill will set the political direction of events over the coming weeks, with the possibility of a General Election now on the cards and a Brexit extension.

Where does this leave UK cereals?

For now, there are little, if any concrete changes that will shape the outlook for the UK grain trade.

From a barley market and export stance, trade uncertainty will remain about the market implications post October. From a UK-EU trade point, there will likely remain a lack of demand for shipments in late and post-October. This will continue to pressure UK feed barley markets.

Ex-farm barley sales have been greater than in recent years, and at least 244Kt more has been sold than at the same point last year. However, as Alice highlighted yesterday, forward sales of barley for November and December are now below average.

Additionally, with a crop size likely to be in the region of 7.4-7.6Mt, there is more barley to be sold than at the same point than in the last three seasons.

For wheat, again there are limited actual changes to the fundamentals. Until there are concrete changes to the nature of Brexit, the UK market outlook is for a surplus of feed wheat that could face trade barriers.

With only 8 weeks until the UK is set to leave the EU, and a couple weeks less from an export trade view, there will be limited appetite for fresh export sales of UK cereals to the continent.

Yet, the catch 22 of currency remains a major factor for UK grain pricing. While a softening of stance or avoiding a no deal with the EU would allow access for cereal exports, there would likely be a substantial rally in the value of the pound.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.