A rocky road for sterling and UK trade: Grain Market Daily

Tuesday, 3 September 2019

Market Commentary

- UK feed wheat futures (Nov-19) continued to slide yesterday to close at £129.75/t, the lowest nearby price since 7 October 2016.

- Paris milling wheat futures (Dec-19) also hit a new contract low yesterday at €166.75/t.

- Paris rapeseed futures (Nov-19) lost €0.25/t from Fridays contract high, to close yesterday at €381.25/t.

- Global wheat markets remain well supplied continuing to weigh on prices. Conversely, Europe is in a rapeseed deficit supporting the prices.

A rocky road for sterling and UK trade

- Sterling loses value against the euro and US dollar.

- Weak sterling can offer some support for UK physical prices and allow the UK to be more export competitive.

- Trade has slowed post-Brexit due to uncertainty surrounding the outcome.

After a period of strengthening, sterling has taken a downwards turn and is once again on a weakening streak. Since last Wednesday sterling has weakened continually against the US dollar. It lost nearly 2% from Tuesday’s close to yesterday’s close when £1 = $1.2066. This morning that has plummeted further, to levels not seen since October 2016.

Sterling also weakened against the euro from last Tuesday, but has been much less consistent.

Last week, the Prime Minister announced plans to close parliament in the run up to the Brexit deadline. This heightened concerns around the likelihood of a no deal Brexit on 31 October. This could lead to further decline in UK trade post-October and will likely further weaken sterling against the euro.

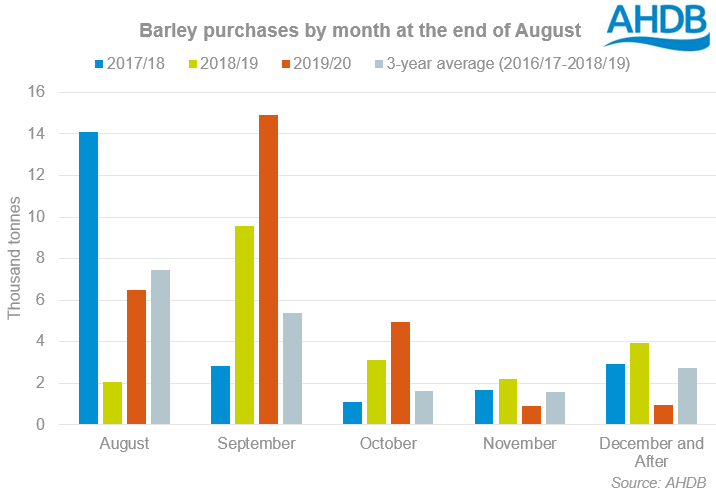

Based on 3-year averages, 94% of UK barley exports and 90% of UK wheat exports move into Europe. Furthermore, our latest corn returns figures show a sharp drop in purchases for post-October movement. As at 29 August, 26.3Kt of feed barley was purchased for movement August to October, with just 1.8Kt purchased for November or after.

The uncertainty around Brexit is slowing trade not just in agriculture. IHS markit announced yesterday that the UK manufacturing purchasing managers index (PMI) has dropped to its lowest level since July 2012.

With an increasing likeliness of a no deal outcome, sterling could continue to weaken against both the euro and US dollar. Although trade is currently slow post-Brexit, weak sterling can allow the UK to price more competitively in an export market. It can also offer support to physical UK prices as seen in physical oilseed rape prices recently.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.