Analyst Insight: Deal or no deal, barley exports will be key

Thursday, 29 August 2019

Market Commentary

- Statistics Canada has estimated a year-on-year production drop of 9% for canola (OSR) to 18.5Mt, below average trade estimates.

- With European rapeseed in short-supply we would likely look to Canada to make up some shortfall later in the season.

- Paris rapeseed futures (Nov-19) have been climbing since Friday (+€3.75/t) to close yesterday at €379.75/t.

- UK feed wheat (Nov-19) remained flat from Tuesday at £132.00/t and Paris milling wheat futures (Dec-19) lost €1.00/t to close ta €169.75/t.

- News of a suspended government has also raised concerns around Brexit which has pressured sterling lower against both the euro and US dollar.

Analyst Insight: Deal or no deal, barley exports will be key

Favourable growing conditions for much of the season have resulted in large barley crops this year. This article will look at the barley trade outlook for 2019/20 from a no deal perspective.

This year’s surplus and what normally happens

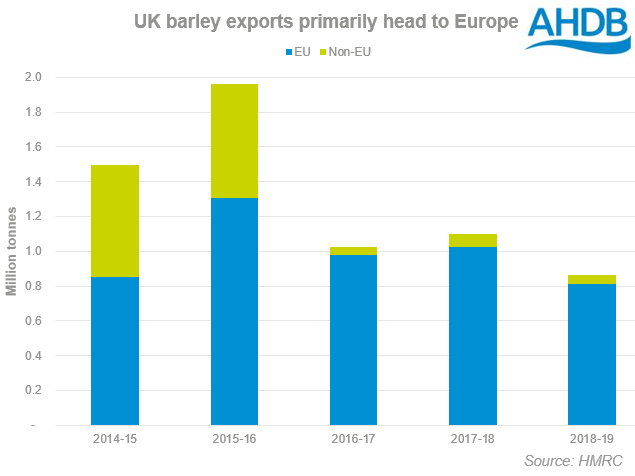

The potential for a 7.3Mt+ crop of barley is looming for the 2019/20 season with harvest almost complete. The average domestic usage is 5.9Mt (3-year average) and, assuming stocks are unchanged, the exportable surplus could be well over 1Mt. Over the past 3 years 94% of UK barley exports have been to Europe and with the 31st October Brexit deadline closing in, this raises concerns for where this season’s crop could go.

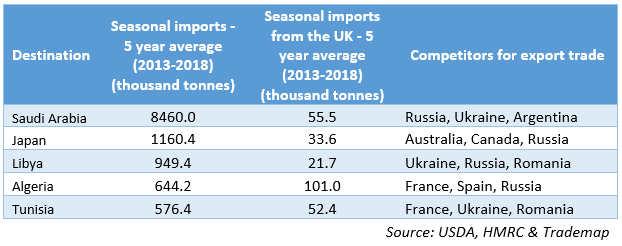

Outside of the EU, demand comes from China, Iran, Japan, Algeria and Brazil primarily. For many of these destinations it would be difficult for the UK to be competitive against other barley producers due to high freight costs and non-tariff barriers such as contract specifications and phytosanitary barriers.

EU trade - tariffs

Barley trade has been at record pace so far this season, with 290.4Kt of accumulated spot purchases reached from beginning of July to 22 August. Some of this movement will be driven by prospects of a no deal Brexit and due to movement limitations this sort of trade will likely come back down as we enter October.

Working on a figure of 450Kt of barley moved pre-31 October based on current purchases to October plus room for more, the UK could be left with c.950Kt to export post-Brexit.

In the first instance, the UK would have access to the EU Tariff Rate Quota (TRQ, explained here) of 307.1Kt per calendar year of any origin barley subject to the reduced tariff of €16/t. As at 26 August 305.9Kt of this TRQ was still available. This will then be renewed on 1 January 2020 to 307.1Kt again.

Based on the five-year average of UK barley exports to the EU, it is unlikely that more than 200Kt will move between 1 November and 31 December 2019 on the current TRQ leaving c.750Kt carry into 2020.

Although the TRQ renews in 2020, if the entirety of the TRQ available is used by the 2019 crop there will be no reduced tariff allowance for 2020 harvest crop. Once the TRQ volume has been met by the EU then the UK will be subject to third country tariffs of €93/t.

Other destinations

If UK barley exports are subject to a €93/t tariff then non-European markets will need to be considered.

The UK is currently priced competitively in coaster vessel export markets with a 4kt FOB price of £130.00/t (October delivery, quoted 27 August). Saudi Arabia’s state grain buyer, SAGO, recently purchased 780Kt of barley at an average CIF price of $206.76/t (basis 60kt vessel).

This equates to £169.27/t, and with freight costs from the UK of c.£23.50/t to Saudi Arabia (Reuters), UK origin barley on larger vessels was in theory competitive. However, the next trade barrier is specification lead, in this case the moisture specification was the limiting factor, set at maximum 14%.

The main non-EU trade partners with the UK for barley markets are generally North African countries as the freight costs are lower than other options. The table below shows some of the options for UK trade. It is useful to note however, that the UK hasn’t exported barley to Saudi Arabia for the past 3 years or Japan for the past 2 years.

Pricing competitively

As discussed, the UK will need to find export homes for barley post-TRQ. The two options will be to either price into European markets inclusive of the €93/t tariff or price competitively to non-EU destinations with higher freight costs.

The first option is unfeasible, as this will push farm-gate prices well below the cost of production. And although the UK can price competitively into non-EU countries, specification and phytosanitary requirements into some countries will remain trade barriers as recently displayed for the Saudi Arabia tender.

So, if the EU is a limited market due to TRQ volumes and Saudi Arabia limited by moisture content, this leaves North Africa as a potential market to exploit. Whilst we’re priced competitively this will need to continue for the rest of the season and potentially into 2020/21.

We will continue to monitor North Africa tenders and trade to review UK export potential.

Useful tools to keep updated

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.