The effect of heavy pigs on the SPP – Feb 2022

Wednesday, 16 February 2022

Many pig producers are struggling with pigs backed up on farm, high costs of production (compounded by those more mouths to feed), and falling finished pig prices.

These factors are leading to severe physical and financial pressures. But what is going on with the pig price?

Demand for pork, and British pork in particular, is relatively strong. Pork imports were lower in 2021 compared with 2020. Rather, it is demand for the pigs that is causing problems, because that demand is limited by processors’ ability to kill and butcher them.

The market value of the pigs in backlog depends on whether they could go into the British market (currently not possible because of processing capacity limits) or not. These pigs have not been slaughtered and so they have not directly fed into the SPP. There is still price pressure however, from an over-supplied European market, and access to the (weaker) Chinese market is still limited.

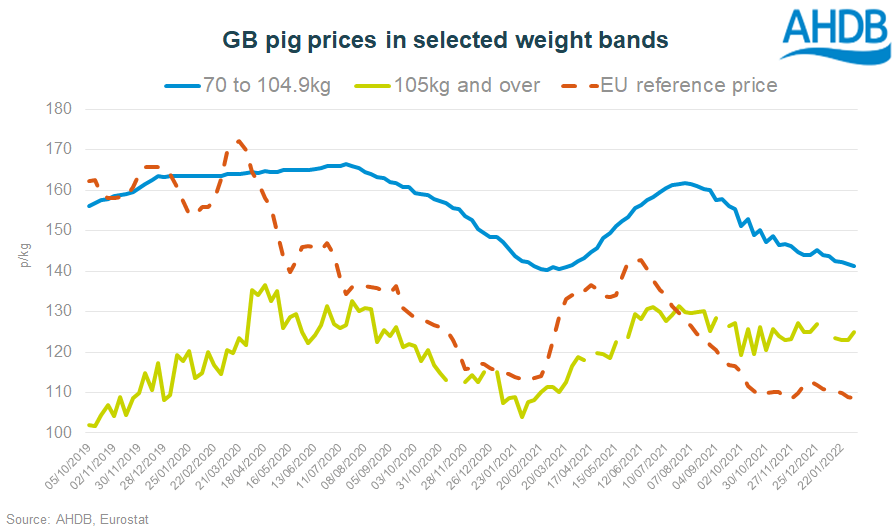

This might explain two things, firstly why GB prices here have sustained a strong premium to the EU price (over 32p/kg in the week ending 6 February 2022) and secondly, why the rate of decline in the price of pigs weighing 70-104.9 kg appears to be slowing. Pork demand probably matches the number of pigs that are being slaughtered, the problem is that this has also been the limit of what can be slaughtered.

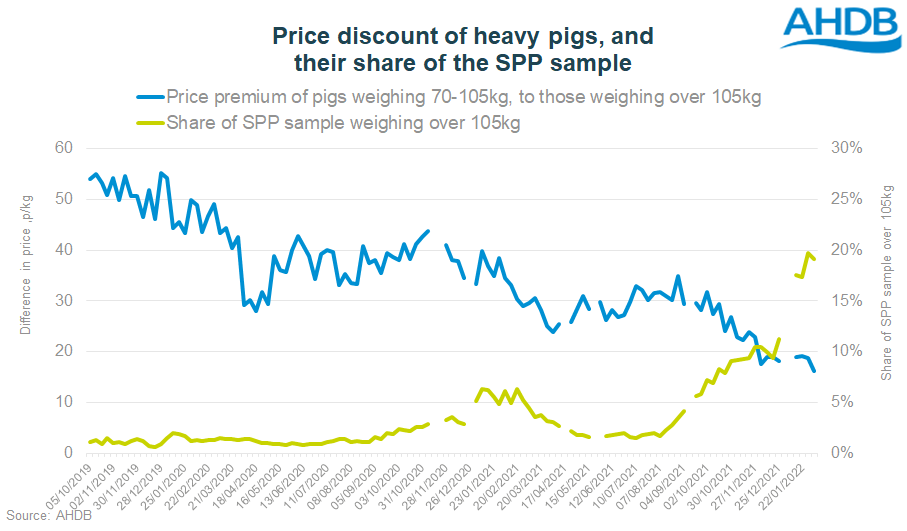

Prices for the heaviest pigs, those weighing more than 105 kg, have, on average, been relatively stable in recent months. As such, their price discount to those pigs in lighter weight bands has been narrowing.

Although the price discount of heavy pigs has been falling, their number has not. In the run up to Christmas, heavy pigs accounted for around 10% of the SPP sample. Since Christmas, this share has nearly doubled, more recently closer to 20%.

However, the price effect of these heavy pigs on the SPP is still relatively limited. What is having far more of an effect on individual producers’ net margins, is the number of heavy pigs that they are individually having to sell.

This, and the absolute price discount compared with what they might have achieved at a lighter finished weight, and of course the dramatic increases in the cost of production for all pigs, whatever their weight.

However, it is probably fair to say that if the capacity had been there to kill the pigs that are backlogged, the overall market price could well have been even lower than it is. Whether that would have been better or worse for individual producers is a moot point, and will depend on their individual circumstances; a lower overall average pig price versus receiving no return for pigs killed on farm and having an increased number of heavy pigs hit by a price discount.

Even if processors are able to increase throughputs in the coming weeks, it is likely that the backlog is going to remain for some time to come, and there will be further contraction in the sow herd.

Listen to our podcast: What effect do heavy pigs have on the SPP?

What moves the SPP?

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.