Supply outlook mixed as concerns grow for spring wheat: Grain market daily

Tuesday, 22 June 2021

Market commentary

- UK feed wheat futures took small falls yesterday. Nov-21 fell £0.65/t to £172.00/t, whereas May-22 fell £1.05/t to £176.95/t. This was on account of EU supply news (explained below) and US rains.

- Most US regions received rain over the weekend, with hot and dry weather forecasted for the next 10 days only in the Northern Plains and Canadian Prairies. Regions in the Midwest including Iowa received around 1 inch of rain.

- The latest USDA crop progress report was released after EU and UK markets closed last night. Maize condition rated ‘good’ to ‘excellent' fell 3% points to 68%, for soyabeans this was 2% point fall to 60%. Winter wheat harvest was pegged as 17%, up 13% points from last week but behind last year by 10%. Spring wheat condition rated ‘good’ to ‘excellent’ fell 10% points to 27%.

Supply outlook mixed as concerns grow for spring wheat

As we close in on the new season, supply concerns have been easing as global weather improved. With low US stocks, the market is sensitive to any ‘new’ news. Yesterday, two big global grain players had ‘new’ news. EU winter crops and US maize worries have eased, though spring wheat conditions are causing concern.

US

There were small declines in the latest USDA crop progress ratings for maize and soyabeans, as expected by the trade. Some improvements are expected to crop conditions going forward as long as forecast rains arrive.

Though the talking point this week emerged on spring wheat conditions, with ‘good’ to ‘excellent’ ratings falling 10% points to 27%. This is the worst ratings in 33 years. This time last year this rating was 75%.

EU

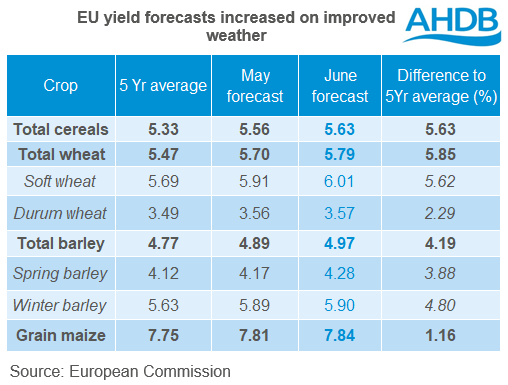

The latest EU crop monitoring (MARS) report increased all EU 2021/22 winter crop yield forecasts, as well as spring barley yield forecasts. This was on account of improved moisture and temperature across the bloc. Forecasts for EU maize continue to be mixed, with cold weather delaying development in some countries. Though overall expected maize yield still above the average.

Using the June MARS yields with Stratégie Grains EU crop area estimates, EU soft wheat production is forecasted as 131.5Mt, up 2.2Mt from last month’s forecast and up 12.1Mt from 2019/20.

Winter crops are looking good, though like the US, concern surrounds spring wheat crops in European Russia. There is worry that dry and warm weather in the spring wheat areas may lead to poorer germination.

What does this mean for new season prices?

Globally, it seems winter crops are looking better than spring crops. Weather will be key in the days ahead as to whether concerns for global spring wheat grow. US northern plains and Canada are forecasted warm and dry for the next 10 days. In Russia, some rain is due over the next week. However, forecasts can change and until quantified, the global wheat picture will stay under review.

Bullish factors

- Spring wheat conditions poor in US and desperate for rain. Rainfall in Russia needs to arrive as forecast.

Bearish factors

- Favourable weather in the US maize belt and EU, global supply looks stronger than a few weeks ago. Higher production year-on-year, especially in the EU, is likely to bring pressure on UK new-crop grain prices.

Wildcard

- Whilst supply is still being formed, long-term demand from China still underpins sentiment.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.