Market Report - 21 June 2021

Monday, 21 June 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

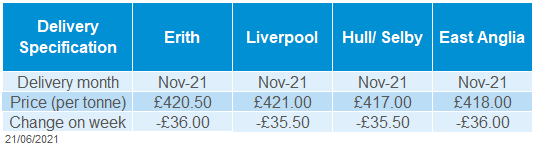

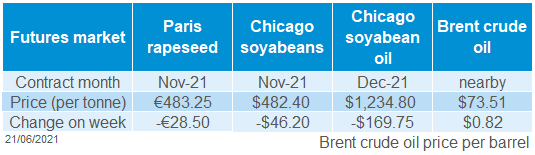

UK delivered prices fell sharply last week. On 18 June, rapeseed delivered to Erith in Nov-21 was reported at £420.50/t, £36.00/t less than on 11 June, and the lowest price since 9 April. It’s still £73.00/t higher than the price of Nov-20 rapeseed on 19 June 2020.

The fall in delivered prices (Friday-Friday) is larger than the Paris futures market, which lost approximately £24.00/t. The AHDB survey is carried out at lunchtime before the world market recovered partially on Friday afternoon due to high US export sales of soyabeans.

The German rapeseed crop is forecast at 3.67Mt by the German association of farm cooperatives. This is up slightly from the May forecast of 3.62Mt and 5% larger than last year. But, in Ukraine, the crop was trimmed from 2.51Mt to 2.46Mt by APK-Inform due to wet weather. This is now 6% smaller than last year.

The global rapeseed crop in 2021/22 is forecast to be slightly bigger than demand currently (USDA). But, a bigger global crop is largely dependent on a bigger Canadian crop. We find out the Canadian planted area on 29 June.

Wheat

Global grain markets

Maize

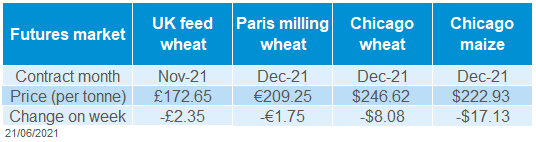

Global grain futures

Barley

Global supply for 2021/22 is shaping up to be plentiful. With the EU-27 and Black Sea having favourable conditions, they are set to produce large crops.

Recent rains have brought relief to the maize crop in the US. With production anticipated to rebound in 2021/22, the US weather in July will be a watch point as maize starts to flower.

UK focus

Expect barley prices to follow the direction of other feed grains, particularly maize, as they compete into feed rations.

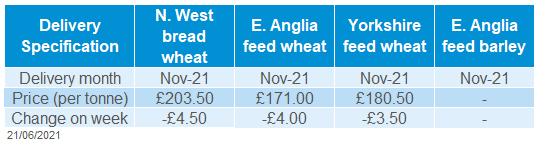

Delivered cereals

Weather remains in the spotlight. Forecast cooler and wetter conditions in the U.S. Midwest weighed on grain markets last week. Chicago new crop futures (Dec-21) for maize and wheat were pressured by 7.1% and 3.2%, respectively.

Further adding to this reduction was the broad-based selling in commodities. This came as the dollar firmed Friday to Friday (+2.1% USD/EUR, +2.2% USD/GBP, Refinitiv) and US Federal Reserve officials projected interest rate increases as soon as 2023.

Although rains in the Northern Midwest and Great Plains will bring relief there is still severe moisture deficits, which suggest yields in the key regions remain at risk. This is especially the case in Iowa, Minnesota, and the Dakotas where there is recently planted maize and spring wheat.

Further to that, about 41% of Iowa was under severe drought as of Tuesday 15 June. This is up from less than 10% a week earlier, according to the weekly U.S. drought Monitor published on Thursday 17 June.

In France as of 14 June 81% of soft wheat was in good or very good condition unchanged from the previous week and well above the year-earlier score of 56%.

Across the EU the wheat harvest is expected to be late. However, recent rains over May have supported yield potential. With EU soft wheat production forecast at 131.1Mt in 2021/22, up from 119.4Mt in 2020/21 (Stratégie Grains).

With plentiful supplies, advanced sales were supporting expectations of brisk early exports in 2021/22 (Refinitiv).

Oilseeds

Favourable weather conditions have bolstered potential production prospects for our domestic new crop. Talk is heading more towards 15Mt for the wheat crop, which would help to offset tight starting stocks and potentially allow for exports from South/East England.

The UK market followed the global market as new crop wheat futures (Nov-21) closed at £172.65/t, down £2.35/t across the week.

The pressure on old crop values was greater as delivered feed wheat (Jun-21, into East Anglia) was quoted at £195.00/t, down £7.50/t across a very thin week of trading. Old-crop prices are converging downwards towards new-crop as we head closer to harvest. Meanwhile, new crop (Nov-21, delivered into East Anglia) was quoted at £171.00/t, down £4.00/t across the week.

Rapeseed

Global oilseed markets

Soyabeans

Global oilseed futures

Global rapeseed supply and demand continues to be tight so rapeseed remains at a premium to other oilseeds. But, the whole oilseed complex is looking less tight than earlier in the year due to better prospects for US soyabeans and threats to vegetable oil demand.

Rain in the US and threats to demand have dented the price outlook for soyabeans. However, the supply and demand situation is still precarious and prices are likely to remain volatile.

Rapeseed focus

UK delivered oilseed prices

Oilseed prices dropped again last week after rain was forecast in the US and vegetable oil prices tumbled. A stronger US dollar and reported selling by speculative traders also pushed US prices lower.

Vegetable oil prices have slumped over the past couple of weeks due to worries about lower demand. US government policy on biofuels is still uncertain as it considers allowing US companies to blend less biodiesel into fuel. This would reduce the amount of soyabean oil needed to make biodiesel. There is also uncertainty about demand levels in Asia.

US soyabean crop conditions are in focus now that the South American harvest is essentially complete. Rain last week likely improved conditions for the crop and more is forecast for this week. But, not all areas received rain and the key yield forming periods are still to come.

However, the US market bounced up on Friday afternoon and recovered some of the week’s losses. US traders reported that Chinese importers bought at least 480Kt of soyabeans (Refintiv). This is the biggest buy by China in nearly 5 months.

There’s likely to be more re-positioning by funds this week ahead of key data next week. On Tuesday 29 June, Canada issues data on the planted area. And on 30 June, the USDA will put out the US planted area and quarterly stock statistics. The market is expecting a bigger soyabean area in the USDA area report on 30 June.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.