Strong start to 2021 for EU pig meat exports

Wednesday, 12 May 2021

By Bethan Wilkins

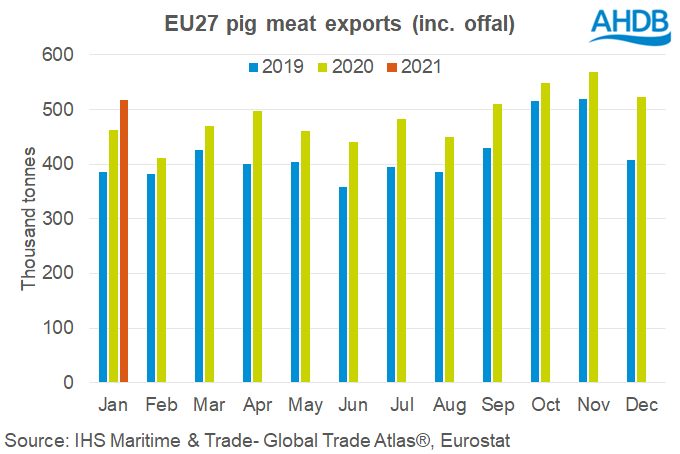

The strong performance of EU exporters in 2020 continued into January, with fresh/frozen pork shipments up by nearly a quarter compared with the year before, totalling 356,000 tonnes. This is by far the largest start to the year on record, despite trade friction with the UK reducing the volume shipped here by 37% (totalling 21,000 tonnes).

China remains the key driver of the growth, with shipments more than 40% higher than the level in January 2020 at 235,000 tonnes. Even though Germany remains excluded from this market, other suppliers have been able to compensate to maintain growth to this region. This indicates that demand remains strong, despite some recovery in the Chinese pig population, and product from the EU remains competitive.

Trade with other Asian markets was mixed; most took more EU pork this January, but Japan and South Korea were notable exceptions.

However, this export growth in export volumes has come with a 19% fall in average prices. The value of exports was stable year-on-year, at €850 million.

The trend was less positive for other products. Offal exports were 6% lower than a year earlier, at 114,600 tonnes. Sales to China were weaker and this was not fully offset by gains elsewhere, such as to the Philippines and Hong Kong. Value was down 13% at €162 million.

Sales of bacon, processed hams and sausages were all well below usual levels as this trade is dominated by trade with the UK. Volumes of these products exported were 12% down year-on-year at 46,500 tonnes. Prices for these products were actually a little higher than last year, so in value terms, the decline was only 9% to €212 million.

A good export performance will be vital for supporting EU pig prices, as the EU is a significant net exporter of pork products. Strong US prices at the moment may help EU competitiveness, though Brazil will remain a significant competitor. The outlook for the year ahead is uncertain, and really depends on how China’s ASF situation develops this year, and what this means for their import demand.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.