US pig prices rallying strongly on tight supplies

Thursday, 6 May 2021

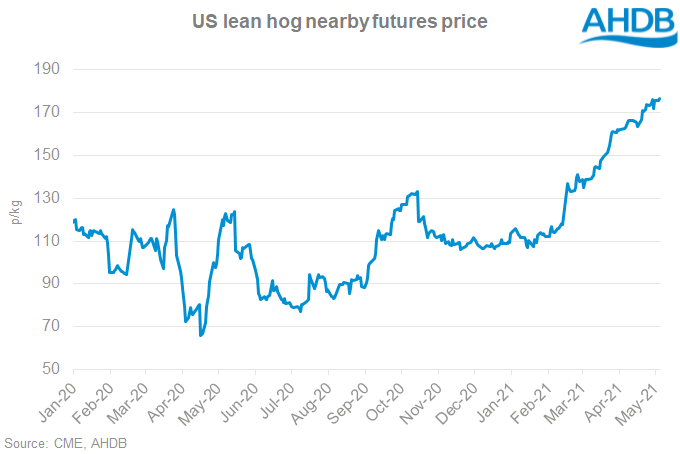

US lean hog futures have been staging a remarkable rally in recent weeks, on the back of both tighter supplies of pigs, but also strong pork prices. More recent losses in the Chinese herd, adding volatility to the pace of its rebuild, will also be adding to the bullish sentiment in the US.

The USDA price for carcases in Iowa/Minnesota was $121.66/cwt (over £1.90/kg) on 5 May, more than double the price at the beginning of the year (£0.80/kg on 4 January). Futures prices have been rallying strongly too. Some market reports point to a lot of speculative interest, but also indicate the market may be increasingly comfortable building in higher feed prices. Prices for cattle going onto feedlots, by comparison, have plummeted.

Lower numbers of market-ready pigs are reducing supplies now, and a reduction in the number of breeding animals and reported farrowing intentions could lead to reduced supplies later in the year. The amount of pork in store is also low, totalling 452 million pounds on 31 March, 27% lower than the year before. Strong demand for frozen inventory is leading to higher pork prices, fuelling the market price for pigs.

US imports of fresh/frozen pork in March were 32,000 tonnes, 35% more than a year ago, but still a little below 2019. They were also 9% higher year on year in February (at 26,000 tonnes). On the other hand, exports were steady on year-earlier levels at around 230,000 tonnes, having fallen 13% year on year in February (to 190,000 tonnes). It is possible that the tight market situation in the US could limit export volumes, at a time when buyers in China and the Philippines, in particular, could be looking for more pork.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.