Strong global maize prices narrow the discount to wheat: Grain market daily

Wednesday, 12 January 2022

Market commentary

- UK feed wheat futures (May-22) gained £0.95/t yesterday, to close at £219.95/t. Whereas, the November-22 contract gained £2.60/t yesterday, to close at £194.40/t. This follows global wheat futures in position squaring ahead of today’s USDA world agricultural supply and demand estimates (WASDE).

- Brazil’s Conab reduced their 2021/22 forecasts from last month for Brazilian soyabeans and maize yesterday on drought concerns. The soyabean crop was reduced by 2.3Mt to 140.5Mt, and maize crop reduced by 4.2Mt to 112.9Mt. Both estimates remain ahead of 2020/21 crop sizes.

- EU-27 soft wheat exports are understood to be 15.11Mt, as at 9 Jan according to Eurostat customs surveillance data. This is 1.0Mt more than European Commission official data update last week, as missing French data is retrieved.

Strong global maize prices narrow the discount to wheat

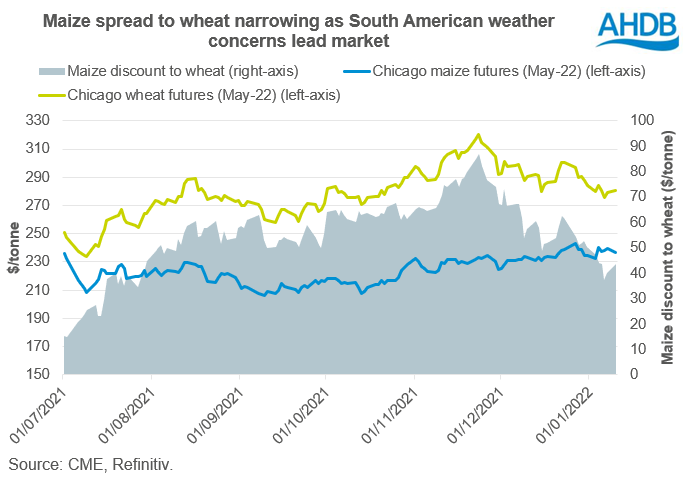

South American weather concerns have been supporting Chicago maize prices over the past few weeks. On 27 December, the May-22 futures reached $242.81/t, the highest price since June 2021 on this contract. From the 1 December to yesterday (11 January), the Chicago maize (May-22) contract gained $11.61/t (+5%) to close yesterday at $237.20/t.

Whereas global wheat futures have drifted slightly lower in recent weeks, capped by strong Southern Hemisphere harvests and current supply and demand news priced in. Over the same period of 1 December 2021 to 11 January 2022, the Chicago wheat (May-22) contract fell by $8.45/t (-3%) to close yesterday at $284.09/t.

As a result, we have seen the spread between Chicago wheat (May-22) and Chicago maize (May-22) futures narrow. On 6 January, the discount of maize to wheat narrowed to $37.47/t. This is the smallest spread since July 2021. Though still a long way from the smallest discount seen in July 2021, at $14.97/t. Since last week the spread has slightly increased again.

Will the spread continue to narrow?

Price direction will be dependent on the latest USDA World Agricultural Supply and Demand estimate (WASDE), which is released this evening (17:00, GMT).

Thinking about global maize and wheat specifically, this spread could narrow further based on two factors.

The first, with wheat prices capped by no ‘new’ news and large Southern Hemisphere harvests, we could see wheat futures continue to plateau. Though, tight supply and demand for the remainder of this season should keep prices relatively elevated, until more information is known on new crop prospects. This is all dependant on there not being any surprises in this evenings WASDE.

The second, is maize prices strengthening further. Yesterday, Conab (Brazilian food supply and statistics public company) reduced their Brazilian maize production forecast for 2021/22 as mentioned above in market commentary. This follows private forecasters also lowering their South American production forecasts. In today’s WASDE, we could see the USDA follow suit and lower their forecasts. However, any cut is thought to be small. As more information emerges on South American yields, there may then be bolder trims to forecasts as the season progresses.

Interesting points for wheat and maize markets to watch for in the WASDE include:

- US ending stocks for wheat and maize.

- US export forecasts for wheat and maize.

- US maize for ethanol usage.

- South American (Brazilian and Argentinian) forecasted maize production.

- Wheat export forecasts for Russia and the EU.

Why is this important to UK feed wheat?

Strong maize prices provide a strong base for the global grains, which in turn lends support to UK feed wheat futures.

The discount of maize to wheat is seen to be narrowing from strengthening global maize prices and slightly lower global wheat prices. UK domestic wheat is currently competitive to imported maize, especially given the high freight costs too.

To follow whether domestic wheat remains competitive to imported maize as the season progresses, check out the UK import parities survey on the AHDB website.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.