Smaller US cattle herd, 2021 production and trade prospects

Monday, 22 February 2021

According to the USDA’s latest cattle inventory, the number of all cattle and calves in the country on 1 January totalled 93.6 million head, slightly lower (-0.2%) than the same point a year ago.

The total number of cows stood at 40.6 million head, down 0.2% year-on-year. Beef cows slipped by 0.6% in number to 31.2 million head. This was somewhat outweighed by a 1% expansion in the dairy cow herd, which stood at 9.4 million head. Some reports suggest that cow numbers were higher than expected, considering the drought conditions seen across many (particularly western) states in 2020.

The 2020 calf crop was estimated at 35.1 million head, down 1% on the year. This continues a downward trajectory for the US calf crop, and could offer some support to domestic cattle prices in 2021.

Production forecast up in 2021

The effects of the COVID-19 pandemic on the US beef market have been well documented. Early on in the year, the virus caused widespread disruption to meatpacking facilities, as well as a shutdown in global trade. This created bottlenecks at abattoirs and ports, which led to a backup of cattle on farms. Cattle prices were affected as a result.

Cattle slaughter recovered as the year progressed, however remained 2.4% lower than 2019 for the year overall. According to the USDA, total beef production in 2020 was estimated at 27.2 billion lbs, virtually unchanged from the year before.

So far in 2021, weekly beef production has been above 2020 levels, while prices are still suppressed when compared to a year ago. The latest USDA forecast expects US beef production will grow by 1% to 27.5 billion lbs in 2021, boosted by heavier cattle weights. However, extreme cold winter weather across parts of the country at present, and higher feed costs could affect this outlook.

Trade: exports to grow, imports to ease

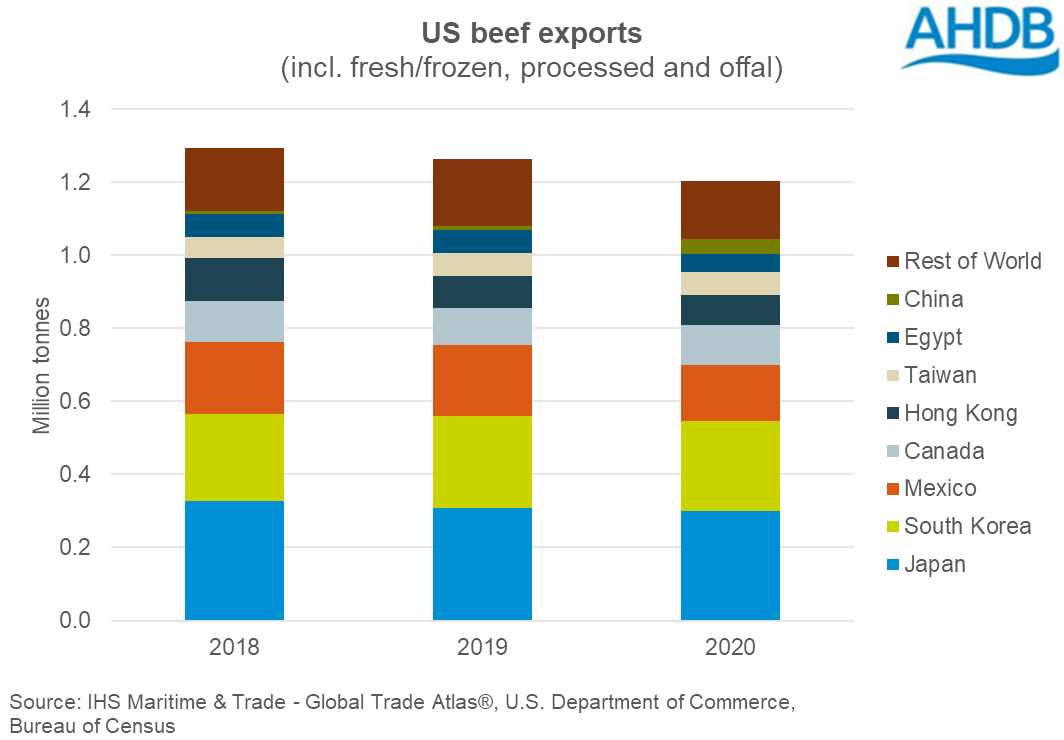

The US exported 1.2 million tonnes of beef (shipped weight of fresh/frozen, processed and offal) in 2020, down 5% (60,900 tonnes) from the year before, according to data from the US Department of Commerce. The majority of the decline was in shipments to Mexico, which fell by 20% year-on-year. Exports declined to other key destinations including Japan (-2%), South Korea (-4%), and Egypt (-23%), but to a lesser extent. Notable growth was seen in shipments to China (+30,900 tonnes; +290%), but this was not enough to outweigh losses elsewhere. The latest forecast for 2021 is that US beef exports will grow by around 6% year-on-year.

Conversely, imports of beef into the US rose, by 9% (95,700 tonnes) during the year. Increased imports from New Zealand (+28%) was a key driver of overall growth, as were increased shipments from Mexico (+12%) and South America. Less beef was bought in from Canada (-2%) and Australia (-8%). The USDA forecasts that US imports will fall by around 10% in 2021, driven by tighter global cattle supplies.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.