Soya oil, the ceiling to the vegetable oil complex? Grain market daily

Tuesday, 8 November 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £279.55/t, down £2.45/t from Friday’s close. New-crop futures (Nov-23) fell £1.75/t over the same period, to close at £262.00/t.

- This movement followed global wheat and US maize contracts down yesterday.

- Paris rapeseed futures (May 23) fell €13.25/t yesterday, to close at €646.75/t. This followed Chicago soyabeans, as well as the wider oil and oilseed complex down.

- Grain and oilseed markets felt general pressure yesterday, on the news China would not be relaxing their no tolerance COVID-19 approach. Economic recession concerns, and the impact on demand, remains an underlying factor across grain and oilseed markets.

- No ‘new’ news is expected on the Ukrainian grain export corridor imminently. All eyes look to the G20 summit in Indonesia next week, will Ukraine and Russia both attend? Will they come to an arrangement to extend the deal? Something to follow.

- US winter wheat was 92% planted as at 6 November, up 2 percentage points (pp) from this time last year and the five-year average. Condition of winter wheat has improved slightly week-on-week, with ‘good’ to ‘excellent’ conditions up 2pp to 30%. This time last year, 45% was rated ‘good’ to ‘excellent’, many US areas are currently suffering from dryness.

Soya oil, the ceiling to the vegetable oil complex?

Rapeseed’s large premium over other oilseeds has reduced, as globally, rapeseeds stocks-to-use ratio this marketing year (2022/23) has increased to 9.0%, up from 6.5% in 2021/22 (USDA).

Despite having plentiful global supply this season, spot rapeseed prices into Erith have increased from £537.50/t at the start of August to £580.50/t last week (as at 4 Nov). Our domestic prices have followed Paris rapeseed futures, which have increased over the same period, but why?

To some degree, what has been keeping the elevated support in the oilseed / vegetable oil complex is demand for soya oil by the US bio-fuel industry. Based on yesterday’s close, since the start of August, Chicago soyabean oil futures (May-23) have increased by nearly 13%. This has added support to soyabean markets too; over the same period, the Chicago soyabean May-23 contract has increased by 4%.

US soya oil demand for biofuel consumption has continued to exponentially grow since April 2022 and the latest data in August shows that 420kt of soya oil was used as a feedstock in biofuels, up 12% from the same point in 2021 (U.S. Energy Information Administration).

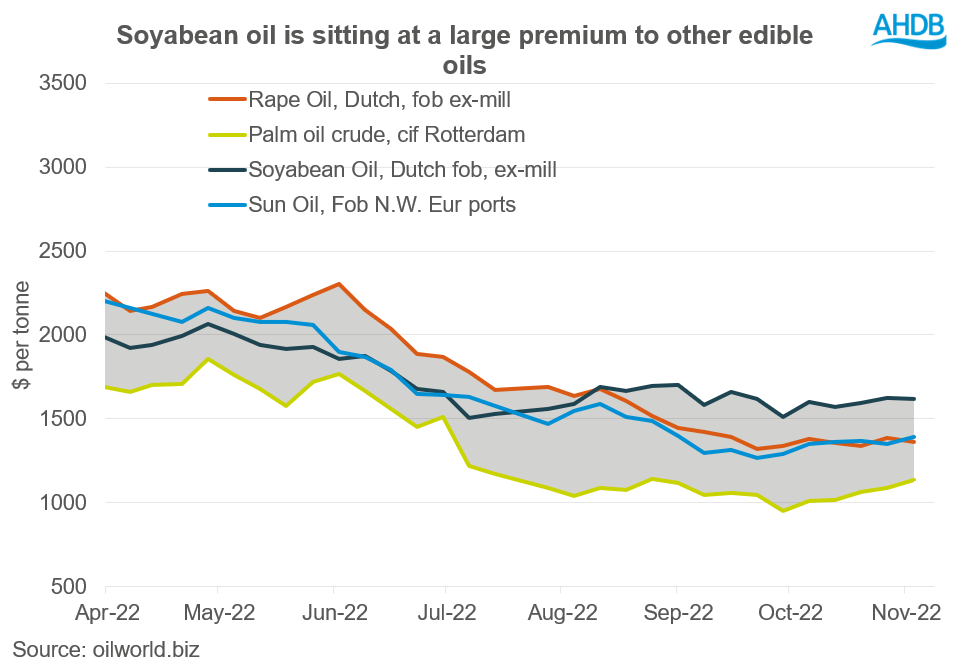

Since the start of the marketing year this demand has changed soya oil’s trading relationship in the vegetable oil complex – as soya oil is currently the ceiling of the complex.

In the EU, rapeseed and sun seed oil are trading in the middle of this complex, whilst soya and palm sit at a healthy premium and discount, respectively, to these oils.

Going forward, this continued demand from the US for soya oil, will keep soyabean markets supported. However, if demand for soya oil was to decrease, then this could weigh on oil and oilseed markets. This will remain a watchpoint going forward.

The longer-term outlook for soyabeans is bearish, with the anticipation of large South American crops. However, this demand for soya oil is adding some support to soyabean markets, which is filtering into rapeseed markets. There are many other key parameters that will drive rapeseed prices as we continue this marketing year, such as the La Niña weather event and questions over Chinese demand. However, if demand reduces for soya oil this could add further pressure to soyabean markets in the longer term, in turn, impacting rapeseed markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.