South American weather will impact rapeseed prices: Grain market daily

Tuesday, 4 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £285.00/t, down £6.15/t from Friday’s close. The Nov-23 contract closed at £274.05/t, down £0.95/t over the same period.

- The domestic market followed the Paris and Chicago wheat market down across the day. This drop was due to profit taking after the market surged on Friday from the bullish USDA data, more information can be found in yesterday’s market report.

- Paris rapeseed futures (Nov-22) closed yesterday at €633.25/t, gaining €0.25/t from Friday’s close.

South American weather will impact rapeseed prices

As northern hemisphere harvests progress, focus has started to turn towards cropping intentions, plantings and crop development in South America for this season.

Argentina and Brazil are currently forecast to produce a combined soyabean crop of 198.4Mt, the highest output from these two countries…ever (Buenos Aires Grains Exchange, Conab).

The sentiment of this large crop has the potential to weigh on global soyabean markets. Although to some extent this has been factored into the market, if production is even larger (see below), this could pressure soyabean markets. In contrast, if weather is not favourable and area reduces, this in turn could support soyabean markets. Either of these scenarios would likely influence rapeseed markets too.

South American weather

The south Pacific is currently in the midst of its third successive La Niña. This has the potential to bring hot and dry weather to the continent, in parts, and may impact soyabean plantings at the end of 2022, or crop development going into 2023.

So, what has the weather outlook been for both countries so far?

Brazil

Brazil started soyabean plantings in early September on irrigated lands. In the latest update from Conab (up until 01 Oct) soyabean plantings are estimated at 4.6% complete. This is up from 1.7% the week before and up on the same point last year which was 3.9% complete.

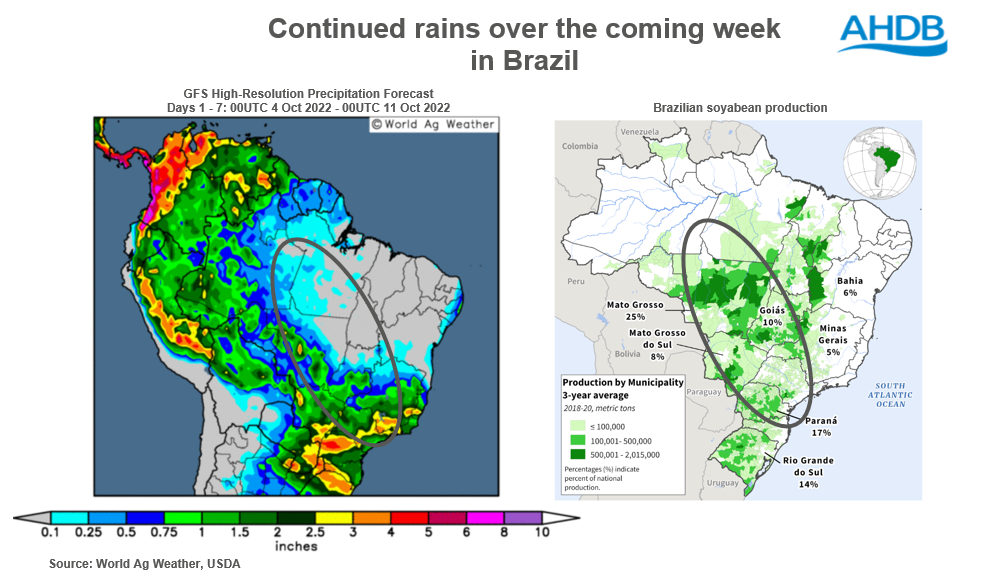

Plantings are progressing in Mato Grosso (8.9%) and Parana (9.0%), where over the last seven days parts of these regions have received up to 8 inches of rain.

Further to that, the outlook over the next seven days is continued rains in Brazil.

As shown in the figure above, rains over the next week in key growing regions will aid Brazilian plantings, as long as they do not continue excessively over the coming weeks. If there was excessive rainfall, then planting intentions could be comprised, if fields are waterlogged or inaccessible.

Argentina

Soyabean plantings in Argentina have not started yet but are expected to in the coming weeks. Last Wednesday, Buenos Aires Grains Exchange estimated the 2022/23 soyabean crop at 48Mt, a 15.5% increase on the year before (43.3Mt). The increase is at the expense of other crops such as maize.

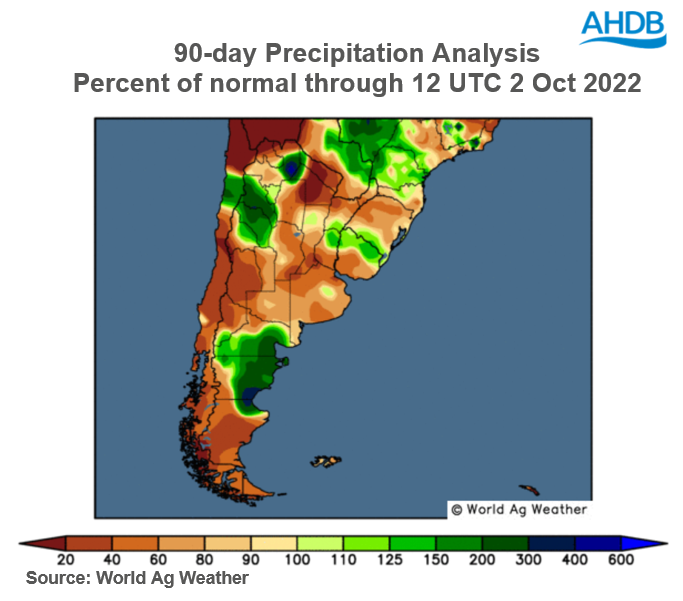

Weather has not been as favourable in Argentina, as they have been plagued with hot and dry conditions, which has impacted soil moisture.

Over the next week scattered rains are expected, but they are minimal, which will only further add to moisture deficits.

Currently, Argentina is focussed on sowing their maize crop, which is currently pegged at 5.8% planted, behind the same point last year of 16.8%. The continued dryness could mean that growers switch their maize intentions to later plant soyabeans (Soybean & Corn Advisor). This is a key watchpoint as an increase in soyabean area could further increase that record production out of South America.

Conclusion

Weather in these two countries over the next four months will be key at driving the potential sentiment of rapeseed markets.

Currently, plantings are looking positive for Brazil soyabeans, with a record crop still expected.

As for Argentina, plantings have not started, but the current dry weather could lead to growers switching their intended maize area to soyabeans, which could further pressure soyabean markets. However, if the La Niña weather event becomes extreme, we could see the later soyabean crop impacted, but this is a key watchpoint.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.