Smallest UK oat crop for seven years: Grain market daily

Friday, 20 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £188.30/t yesterday, down £3.00/t from Wednesday’s close. The Nov-24 contract was down £0.90/t over the same period, ending the session at £201.50/t.

- Domestic wheat prices followed European wheat futures down yesterday, following a lack of export news, and a strengthening euro against the US dollar.

- Paris rapeseed futures (Nov-23) closed at €407.25/t yesterday, down €11.75/t over the session. The Nov-24 contract was down €2.50/t over the same period, closing at €457.25/t.

- Falls in European rapeseed prices were largely due to a shift in exchange rates, as well as falls in Canadian canola filtering through.

Smallest UK oat crop for seven years

The 2023 UK oat crop is provisionally the smallest since 2016. Provisional data from Defra (for England) and the Scottish government, plus estimates for Wales and Northern Ireland point to the 2023 crop totalling 841 Kt. This is down by 166 Kt from 2022 harvest and below the five-year average due to both a smaller area and lower yields in parts of England. Prices in 2022 incentivised a switch back to planting oilseed rape (OSR) as a break crop, reducing the oat area for harvest 2023. Get more details here.

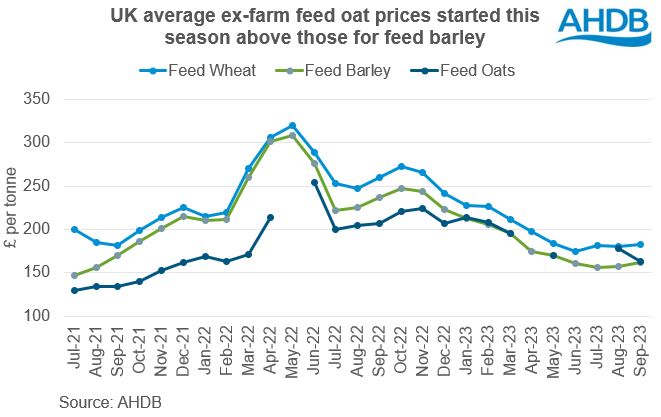

The smaller crop is reflected in UK average ex-farm prices, with feed oat prices so far above those of feed barley. It is likely to have implications for oats used as animal feed this season.

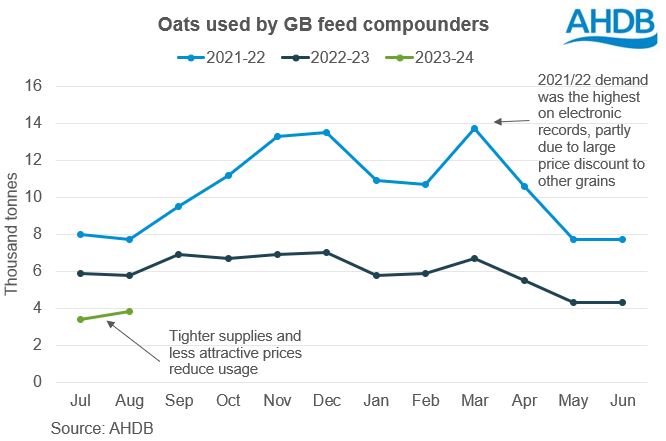

Last season, usage of oats by GB feed compounders reduced as the season progressed. The gap between feed oat and feed barley prices narrowed as the strong pace of oat exports reduced available oat supplies. This priced feed oats out of compound rations. In the last two months of the 2022/23 season (May and June), GB feed compounders used just 4.3 Kt of oats per month. This was the lowest level of oat usage by GB compounders since August 2020. In total (including on farms), 349 Kt of oats were used as animal feed last season, the lowest since 2019/20.

In the first two months of this season, oat usage by GB feed compounders was even lower again. They used 3.4 Kt of oats in July and 3.8 Kt in August 2023, making it the slowest start to a season’s usage since 2017/18.

Given the smaller crop size and current price relationships, it seems unlikely that we’ll see much recovery in compound usage of oats in the months ahead. The last few times the UK oat crop was below 1.0 Mt, around 300 Kt or fewer oats were used as animal feed in those seasons. However, on-farm usage this season remains uncertain.

The first insight into milling demand for oats this season will be from the quarterly usage survey on 02 November. AHDB will release the first estimates of UK oat supply and demand on 28 November.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.