Sheep industry overview of 2018

Friday, 25 January 2019

By Hannah Clarke

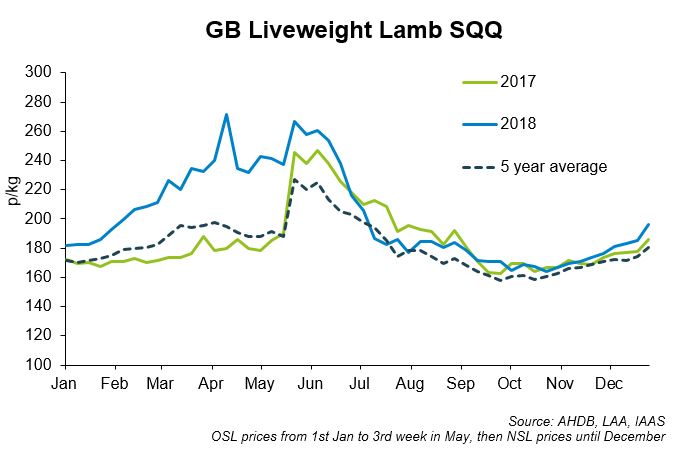

The year began with just under 4.3 million old season lambs carried over from 2017, 4% higher than the carryover figure from the previous year. Despite this, poor weather during winter heavily affected lambing, resulting in a smaller lamb crop for the year, later reported in the Defra June survey as being just under 1 million head smaller than in 2017. This in turn led to 270,000 fewer new season lambs being slaughtered in the first five months of 2018, helping to push farmgate prices to record-breaking highs during the first half of the year. Prices dropped below those of last year in late June, then fell more in line the five-year average for the rest of the year.

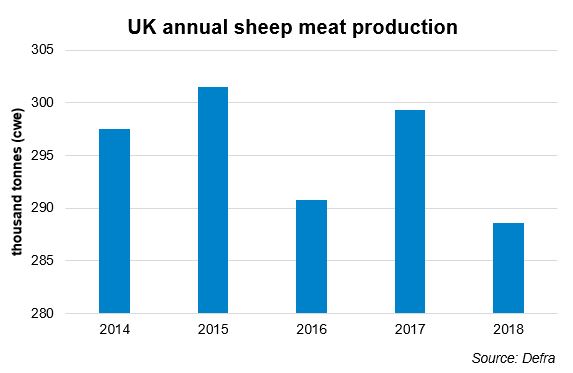

Total sheep meat production for 2018 was 289,000 tonnes, down 4% from 2017 production levels. Clean sheep slaughterings – including both NSL and OSL – reached 12.8 million head in 2018, 3.8% less than in 2017. Cull ewe and ram slaughterings for the year stood at 1.6 million head, a 2.5% rise from 2017.

Domestic retail lamb demand declined for the second year in a row, according to data from Kantar Worldpanel. In the 52 weeks ending 2 December, the volume of fresh and frozen lamb sold to shoppers was 6.9% less than last year, with expenditure slipping by 1.2%. All cuts of lamb showed a decrease in volumes sold, with shoulder roasting joints suffering the largest decline (12%).

Between January-November 2018, UK sheep meat imports stood at just over 70,600 tonnes, a 4% decline from the same period in 2017. Volumes imported from Ireland showed the largest decline year-on-year, falling by almost a quarter. Imports from Australia fell by the second largest amount, 1,800 tonnes (-18%) year-on-year. Based on current trends, it is possible that 2018 will record the lowest levels of sheep meat imports for at least 20 years. Low imports have been attributed to decreased supplies in New Zealand and Australia, coupled with a high global price.

EU-28 sheep meat imports reached 123,600 tonnes product weight between January and October 2018, up just under 2% (2,151 tonnes) year-on-year. Imports from New Zealand to the EU-28 increased by 2% on-the-year for the period, despite the UK taking less.

Although a small consumer, Spanish volume sales were up 1% in the first quarter of the year. In contrast, French volume purchases continued to decline for the first half of 2018, falling almost 6% compared to 2017. Nonetheless, across the EU market as a whole, it seems EU lamb demand has remained fairly robust this year.

UK sheep meat production for 2019 is forecast to decline slightly from 2018 levels to 286,000 tonnes. Within this there is forecast to be a decline in production of meat from clean sheep and an increase in mutton volumes. UK exports for 2019 are forecast to remain steady and in-line with changes in production. However, these forecasts are based on ‘business as usual’ trading conditions after March 2019. Of course, Brexit may be just around the corner, and any Brexit deal or no deal could drastically alter this forecast.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.