September dairy market review

Thursday, 13 October 2022

By Patty Clayton

Milk production

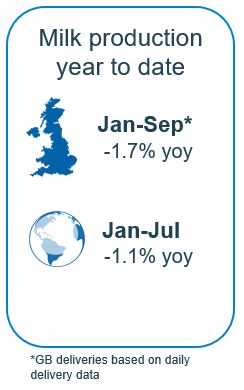

GB milk production so far this year (Jan-Sept) is back 1.7% compared to the same period last year. When compared to the 5-year average, it is running at a deficit of 1.5%, a difference of 146 million litres.

GB milk deliveries in September however, recorded year on year growth, up 0.6% on last year, based on our daily deliveries data. The return to a positive growth was likely due to favourable weather boosting grass growth.

At a global level, total milk production so far this year (Jan-Jul) is 1.1% lower than a year ago. Almost all key dairying regions have been challenged with high input costs, labour shortages and less than favourable weather conditions. The latest EU outlook expects production will remain in deficit for the calendar year, with potential destocking over the winter.

Wholesale markets

A bit of life returned to wholesale markets in September with the end of summer breaks, although trades were still limited. This was in part due to tight availability and in part due to buyers’ reluctance to stock up while prices remain high. Exchange rates also played a role, with a weaker pound increasing sterling prices to those taking part in European markets.

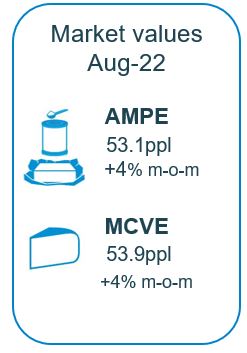

Higher wholesale prices pulled up both AMPE and MCVE by 4% in September. This translates to an equivalent milk market value (MMV) of 53.76ppl. The latest update to processing costs for Q2 2022 had only a marginal impact on net returns. A reduction in the quarterly average for gas prices, combined with modest increases in other costs, meant there was little change in overall processing costs in the quarter. This is likely only short term however, as gas prices have increased again in recent months.

Farmgate prices and input costs

Milk price announcements for October have been roughly balanced between increases and price holds, as have the handful of announcements for November. According to Defra, the UK farmgate price averaged 46.71ppl in August, up 2% from July and 49% higher than the August 2021 price.

While farm costs are unlikely to decrease through the remainder of this year, preventing most farmers from pushing for higher output, it remains to be seen whether lower demand will reduce the tightness in supply. Retail sales of key dairy products down from year earlier levels as higher product prices start to show up on retail shelves. The rising costs of food and drink is changing consumer behaviours, and higher prices of dairy products are negatively impacting sales.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.