Saudi sorrow supports rapeseed, but for how long? Grain Market Daily

Tuesday, 17 September 2019

Market commentary

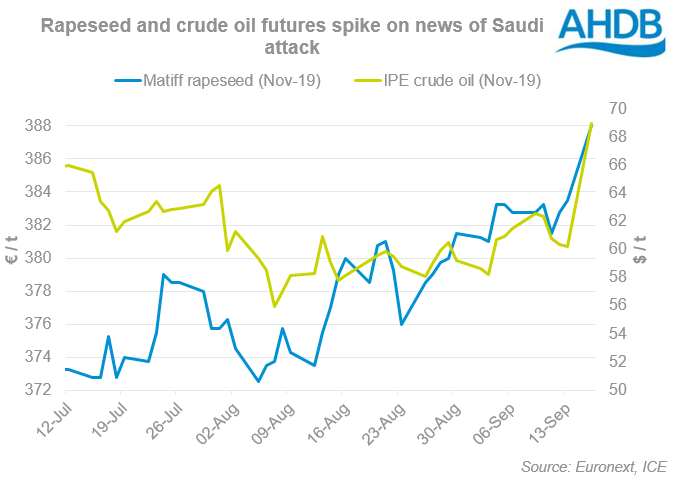

- Oilseed markets moved higher yesterday on the back of the Saudi Arabia oil processing plant attack with Paris rapeseed futures spiking to contract highs (read more below).

- US grain futures (Dec-19) also rose yesterday. Initial sentiment was that reduced crude oil supply could offer support for use of grains in ethanol but both Chicago wheat and maize futures (Dec-19) moved lower this morning.

- Friday saw sterling at its strongest against both the euro and US dollar since early-June and mid-July respectively. And although sterling has weakened against both these this morning, it could counteract any rise in European markets in UK physical prices.

Saudi sorrow supports rapeseed, but for how long?

The attack on Saudi Arabia’s largest oil processing facility on Saturday halted the country’s output by half. This was estimated at 5% of the world’s production of crude oil. In reaction, oil prices spiked from Monday’s opening, closing around 14% higher (IPE Brent crude oil, Nov-19).

Paris oilseed rape futures (Nov-19) closed yesterday €4.50/t higher than Friday on the back of this news. The EU are already facing a deficit of rapeseed and therefore the EU will require imports of oilseeds, oils and/or biofuels in order to fulfil demand.

The reaction to the news is likely to be short-lived as there has been recent concerns of diminishing demand for crude oil and the market still seems relatively well supplied. There are reserve stocks available, of which Donald Trump announced the US would release its strategic petroleum reserve, the largest supply of emergency crude oil, if it was so required.

Although the EU is undoubtedly facing an oilseed deficit, globally there remains strong supply and the events of Saturday will likely weigh on sentiment but relatively short-term. Crude oil already moved lower, closing yesterday below the peak.

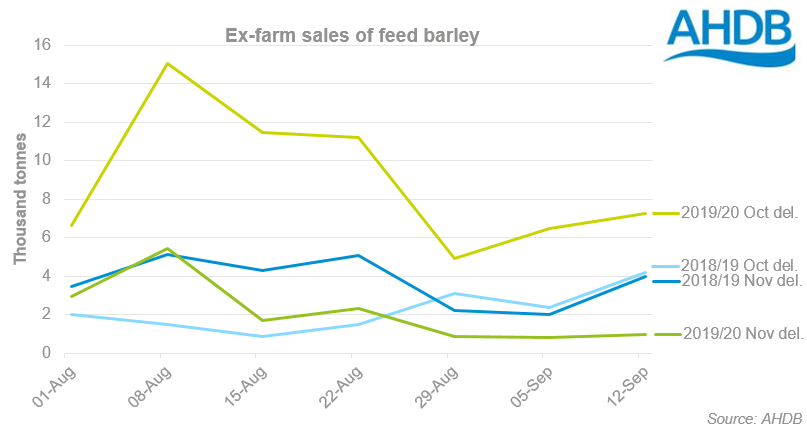

Ex-farm sales drop off post-October

The UK has produced large cereal crops this season which will ultimately mean that we will have an exportable surplus for both wheat and barley. Brexit analysis of both wheat and barley has been covered in some detail in recent analyst insights.

Ex-farm sales of both crops have been at near record, if not record, highs over the past few weeks. Much of the trade has been for movement pre-November. Although there is a larger crop this year, compared to last, it is likely that much of this increased trade is due to concerns around the 31 October Brexit deadline. Due to the TRQ available and the fact 94% of UK feed barley exports have been to EU markets over the last 3 years, barley trade will be heavily affected by a no deal Brexit.

This could be the driver behind increased sales for October and a drop for November movement. October sales (traded in Aug-Sept) are 57Kt ahead of last year, yet November sales (traded in Aug-Sept) are 11Kt behind last year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.