Analyst Insight: Wheat’s the story, export glory?

Thursday, 5 September 2019

Market Commentary

- Sterling strengthened slightly yesterday as ongoing parliament discussions attempted to block a no deal scenario on October 31. An increase of 1.4% meant sterling closed yesterday at its highest point against the dollar since July 26.

- Despite sterling strengthening, London feed wheat futures (Nov-19) bucked its downward trend of late, increasing to close at £132.50/t, a rise of £2.50/t on the day.

- Paris rapeseed futures (Nov-19) rose to close at €383.25/t yesterday. US export data released yesterday highlighted record volumes for soyabean shipments for June and July. That said, total shipments of soyabeans are well down year-on-year.

Wheat’s the story, export glory?

- Largest UK wheat crop since 2015/16 leaves us with a sizeable exportable surplus.

- Potential to access EU TRQ at €12/t discount, with 2.3Mt of the TRQ still available this season.

- Opportunities to trade outside the EU also available, with UK wheat currently competitive into most markets. Although non-tariff barriers could prove challenging.

The UK wheat harvest is now nearing completion, if yields continue in line with current estimates we tentatively forecast production of wheat at 15.9-16.2Mt (ADAS yield range - 8.8t/ha to 9.0t/ha, AHDB Planting and Variety Survey area – 1,801Kha).

In a “normal” year the surplus wheat would find an export home primarily in the EU. However, this year is far from “normal”.

How much do we have to export?

Based on a UK wheat crop of 15.9Mt to 16.2Mt, the UK could have as much as 2.6Mt to 2.9Mt available for free stock or export this season. This is a significant rise on the past two seasons and assumes that human and industrial demand is 400Kt up year-on-year (Ensus) and animal feed demand is broadly in line with last season.

Even if we take the maximum demand level over the past five years (15.7Mt – 2016/17) the UK has a balance in excess of 3.7Mt, leaving a potential exportable surplus of 2.2Mt.

With uncertainty around UK-EU trade, exporting a large crop becomes more complicated.

Tariffs, but room to trade

The UK will still need to export wheat beyond 31 October, and it is highly likely that this will involve trade with the European Union.

The TRQ (read here to learn more about TRQs) for EU wheat imports is somewhat wider than that of barley. With up to 2.5Mt of low and medium quality wheat (wheat less than 14.6% protein on a 13.5% moisture basis) accepted into the EU at a reduced tariff of €12.00/t each season.

So far this season the EU has only imported 210Kt of wheat under the TRQ system. That leaves an additional 2.3Mt that the UK could potentially access without a trade deal, albeit at a €12.00/t discount.

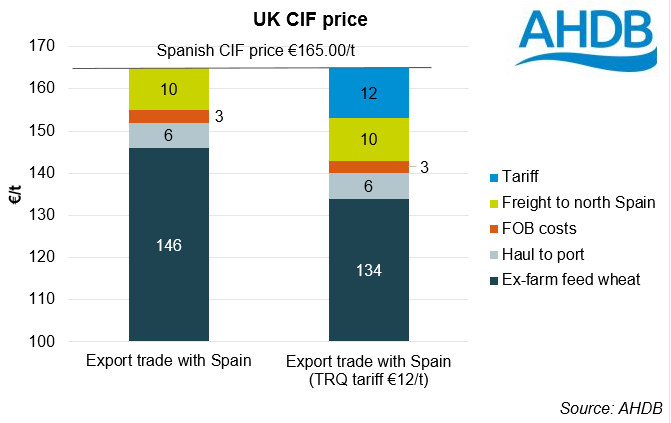

The graph below demonstrates the impact that a tariff would have on determining the ex-farm price. Where the UK is an exporter the price of grain will be determined by the relative import prices of EU nations.

If we assume that Spanish feed wheat (CIF) is worth €165.00/t, then ex-farm wheat would need to price at that level, excluding costs to get wheat to the port, get it on a boat and ship it. Moreover, the price also needs to take into account the tariff.

Will the UK need to access the EU

Whether the UK trades with the EU post-Brexit will depend on the comparative prices of wheat into different homes.

Outside of the EU, UK trade will centre on Asia and North Africa. To assess the degree to which the UK will trade with the EU we need to look at the comparative prices of trading with the EU, North Africa and East Asia.

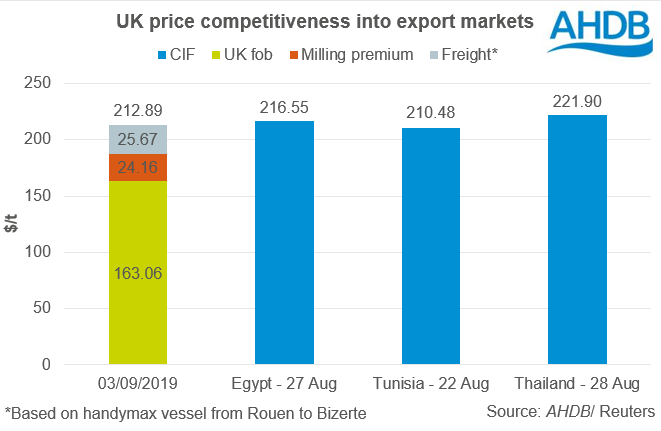

Using recent tender results as a gauge we can see where UK wheat would need to price to access trade.

UK wheat for October delivery is currently worth $163.06/t FOB, assuming a portside milling premium of $24.16/t (£20.00/t) and freight of $25.67/t to North Africa, UK wheat would calculate at around $212.89/t CIF.

Recent North African tenders have been in a similar range to where UK wheat is currently pricing. This limits the volume of UK wheat which needs to price into Europe with a €12.00/t tariff, limiting the Brexit risk for the crop.

Non-tariff barriers for UK wheat trade

While it is possible for the UK to export wheat to non-EU markets, there are a few barriers which could prevent large exports of wheat;

- Specification – The second half of this year’s harvest has been typified by intermittent weather. With most North African wheat traded on a 14% moisture basis, some drying will be required in order to meet specification adding to costs of vessels.

- Admix – historically North African tenders have been very tight on admixture, some operating a zero tolerance approach on ergot alkaloids.

- Volume – The vast majority of international wheat tenders are based on large vessels. This limits the number of ports UK wheat can trade from and could be preventative of access to some tenders.

- UK quality – The AHDB cereal quality survey results will be published on Monday. This will determine whether the UK is trading in milling or feed markets this season.

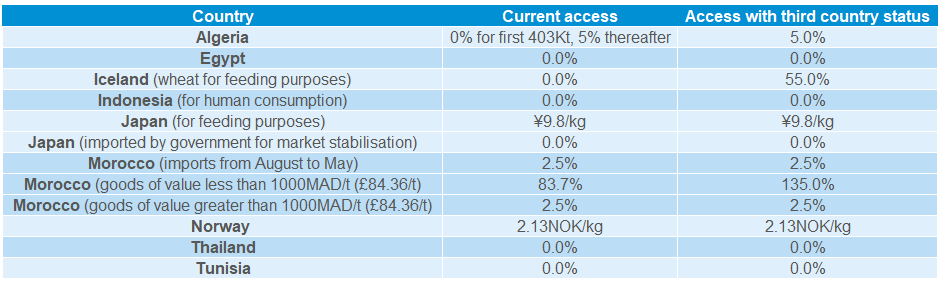

- Trade agreements – There is still some lack of clarity around potential trade agreements with third-countries that could yet prevent access to markets.

As with barley we will continue to monitor trade and tenders throughout the course of the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.